- United States

- /

- Trade Distributors

- /

- NYSE:HRI

Does Analyst Optimism on HRI Revenue Signal a Turning Point After Recent Guidance Miss?

Reviewed by Sasha Jovanovic

- Herc Holdings recently announced that it will release its earnings results before the market opens this Tuesday, following a previous quarter in which it beat analysts’ revenue expectations but missed full-year revenue and EBITDA guidance.

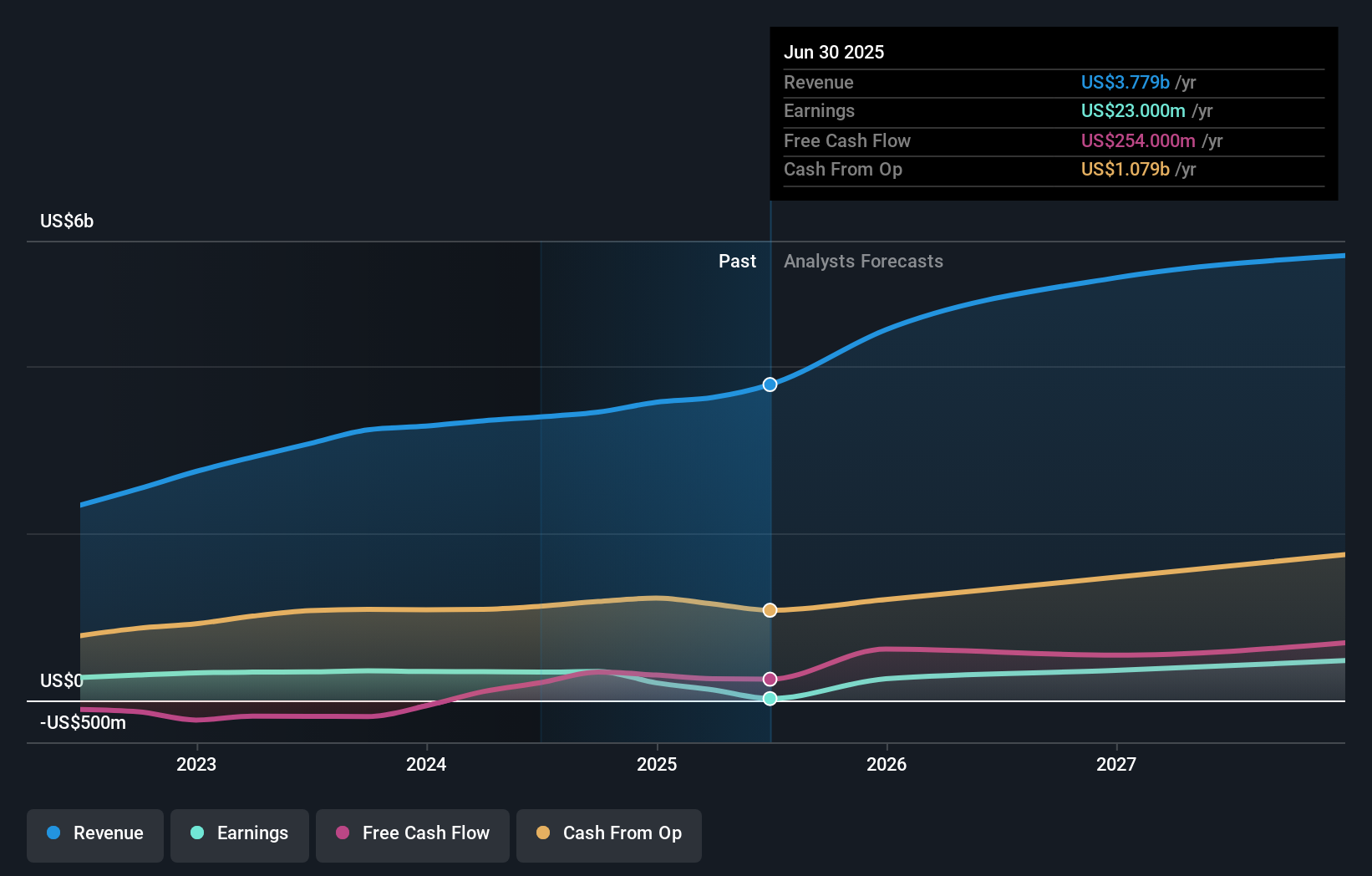

- Analysts are expecting a 33.3% year-over-year revenue increase this quarter, which is a significant improvement compared to the prior year’s results.

- We’ll consider how analyst forecasts for strong revenue growth amid last quarter’s guidance miss could reshape Herc Holdings’ investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Herc Holdings Investment Narrative Recap

To be a shareholder in Herc Holdings, you generally need to believe in steady rental equipment demand fueled by large-scale infrastructure and nonresidential construction, along with the company's ability to integrate acquisitions and scale its specialty fleet. The upcoming earnings report could serve as a short-term catalyst, mainly if results show the company is regaining operational momentum after missing its guidance last quarter, but integration and margin risks remain front of mind and the news does not materially change that risk-reward balance.

Among recent announcements, Herc's June 2025 debt refinancing stands out as particularly relevant: issuance of more than US$2.7 billion in senior notes raises questions about interest costs and leverage at a time when market focus is on short-term profitability and guidance. The extra financial burden and ongoing integration costs could impact margins and future results, especially if revenue doesn't accelerate as much as analysts hope.

At the same time, investors should not overlook the potential drag of rising debt costs on earnings capacity if rate conditions persist, particularly since...

Read the full narrative on Herc Holdings (it's free!)

Herc Holdings' narrative projects $5.9 billion in revenue and $622.5 million in earnings by 2028. This requires 15.7% yearly revenue growth and an increase in earnings of $599.5 million from the current $23.0 million.

Uncover how Herc Holdings' forecasts yield a $156.10 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Community estimates for Herc’s fair value range from US$156.10 to US$275.39, based on two distinct perspectives from the Simply Wall St Community. While market participants differ markedly, concerns about integration risk and workforce turnover continue to influence expectations for the company’s ability to improve earnings and margins.

Explore 2 other fair value estimates on Herc Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Herc Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Herc Holdings research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Herc Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Herc Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Herc Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRI

Herc Holdings

Operates as an equipment rental supplier in the United States and internationally.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives