- United States

- /

- Trade Distributors

- /

- NYSE:HRI

A Fresh Look at Herc Holdings’s Valuation After Strong Q3 Revenue and Updated Guidance

Reviewed by Simply Wall St

Herc Holdings (NYSE:HRI) grabbed the spotlight after reporting strong third-quarter revenue growth that exceeded analyst expectations. The company reaffirmed its full-year revenue guidance, even as it navigated integration challenges from acquiring H&E Equipment Services.

See our latest analysis for Herc Holdings.

Shares of Herc Holdings have staged a dramatic short-term rebound, with a 16.6% one-month share price return and an 18.2% gain over the last 90 days following the upbeat Q3 revenue and guidance update. That recent momentum only partially offsets this year’s market reset, leaving the total shareholder return down 33% over the past twelve months. However, the shares are still showing a strong 211% gain over five years, a reminder of the company’s longer-term potential once headwinds stabilize.

If recent industry consolidation or Herc’s resurgence has you looking wider, now is a smart time to broaden your radar and discover fast growing stocks with high insider ownership

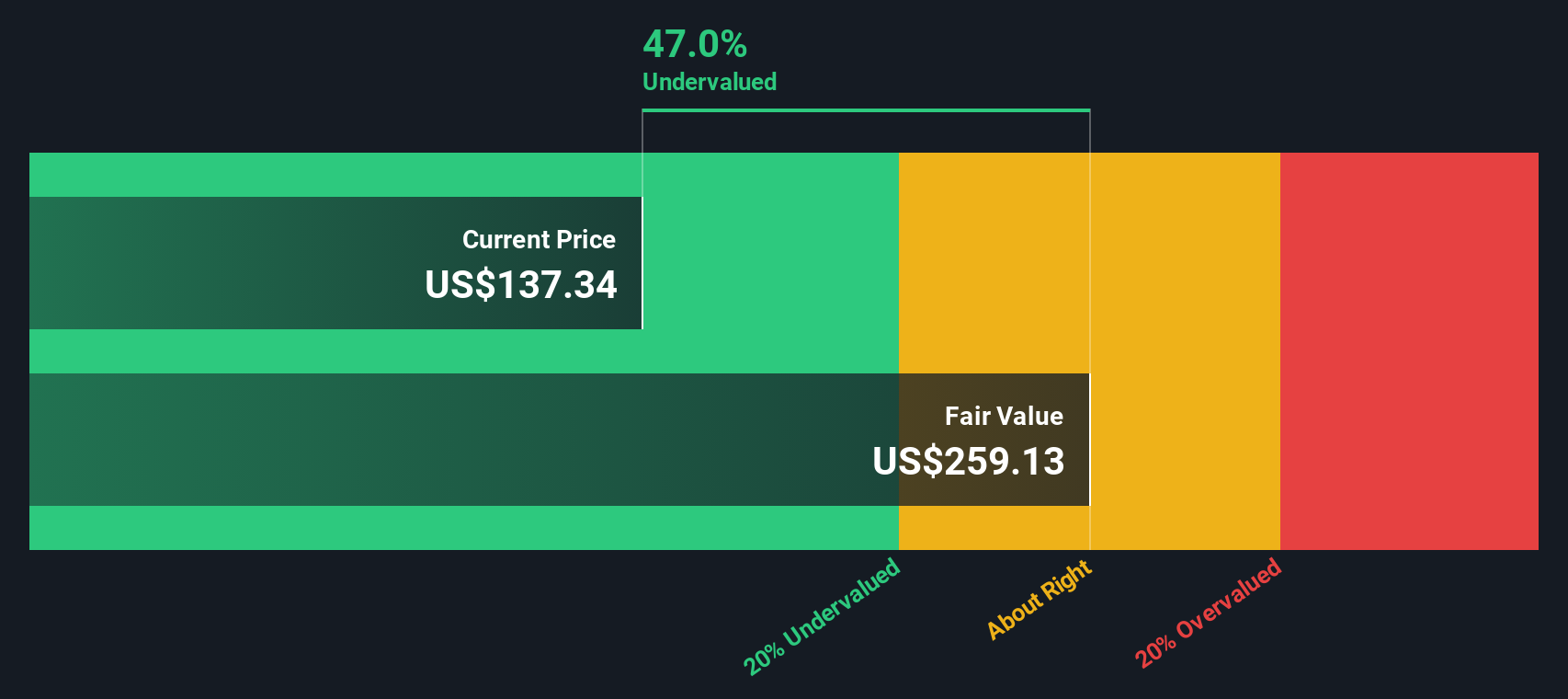

With Herc Holdings shares rebounding sharply but guidance remaining cautious, the key question for investors is whether the current price reflects a real bargain or if the market has already accounted for future growth potential.

Most Popular Narrative: 15.2% Undervalued

With a fair value of $163.56 set against the last close price of $138.64, the prevailing narrative currently assigns Herc Holdings a substantial discount, signaling further upside for patient investors. The story behind this estimate highlights both the company’s improving fundamentals and the unique factors shaping its market position.

Ongoing investments in technology (digital platforms, systems integration, fleet telematics) and operational scale are expected to optimize fleet utilization, lower operating costs, and support pricing discipline. This provides a pathway to improved net margins over time.

What is the playbook behind this fair value? One crucial assumption is a notable transformation in profit margins powered by efficiency gains and innovation. Want to see what other aggressive financial targets and model upgrades are fueling such bullish expectations? Don’t miss the full narrative as it breaks down exactly what is driving this high conviction outlook.

Result: Fair Value of $163.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges and ongoing weakness in select end-markets remain key risks that could undermine the recovery narrative for Herc Holdings.

Find out about the key risks to this Herc Holdings narrative.

Another View: Discounted Cash Flow Model

Taking a different approach, our DCF model places Herc Holdings' fair value at $275.39. This is nearly double the recent trading price. This stark undervaluation suggests there may be more upside than what multiples indicate. But is the market missing something, or is there hidden risk in these forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Herc Holdings Narrative

If you want to dig deeper or believe there is more to the story, it’s simple to build your own view in a matter of minutes. Do it your way

A great starting point for your Herc Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for just one great stock when you could uncover powerful themes shaping the next wave of winners? Give yourself an edge with these hand-picked screens and see what smart investors are watching now.

- Boost your search for big returns by checking out these 3575 penny stocks with strong financials that combine strong balance sheets with real growth stories.

- Secure your income stream and build confidence with these 21 dividend stocks with yields > 3% offering yields above 3% and financial resilience.

- Be early to tomorrow’s breakthroughs by targeting the trailblazers behind medical innovation with these 34 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Herc Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRI

Herc Holdings

Operates as an equipment rental supplier in the United States and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives