- United States

- /

- Electrical

- /

- OTCPK:HLGN

Investors one-year losses grow to 74% as the stock sheds US$65m this past week

Heliogen, Inc. (NYSE:HLGN) shareholders should be happy to see the share price up 30% in the last month. But that isn't much consolation for the painful drop we've seen in the last year. Indeed, the share price is down a whopping 74% in the last year. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes.

Since Heliogen has shed US$65m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Heliogen

Heliogen wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Heliogen grew its revenue by 810% over the last year. That's a strong result which is better than most other loss making companies. So the hefty 74% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

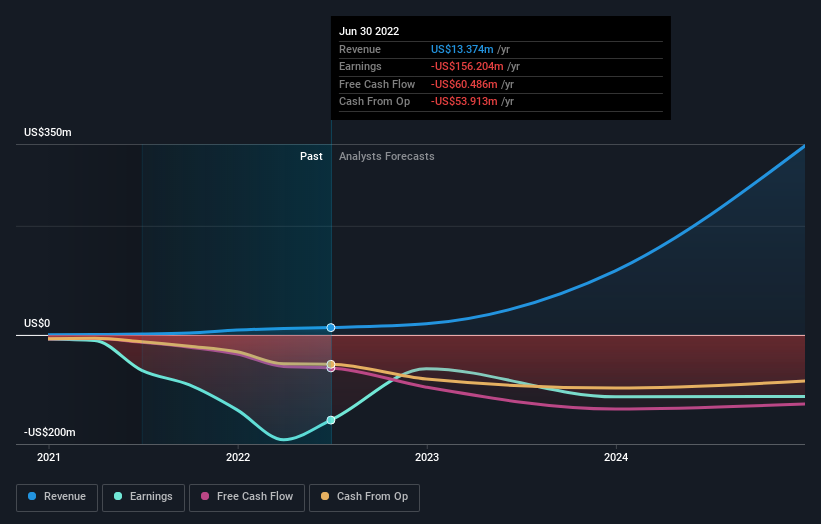

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt Heliogen shareholders are happy with the loss of 74% over twelve months. That falls short of the market, which lost 7.6%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 25% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Heliogen (2 are potentially serious) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Heliogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:HLGN

Heliogen

Develops and commercializes concentrated solar energy in the United States.

Medium-low and slightly overvalued.

Market Insights

Community Narratives