- United States

- /

- Construction

- /

- NYSE:VATE

How Much Did HC2 Holdings'(NYSE:HCHC) Shareholders Earn From Share Price Movements Over The Last Five Years?

HC2 Holdings, Inc. (NYSE:HCHC) shareholders should be happy to see the share price up 25% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 54% in that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

View our latest analysis for HC2 Holdings

HC2 Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, HC2 Holdings saw its revenue increase by 10% per year. That's a pretty good rate for a long time period. The share price, meanwhile, has fallen 9% compounded, over five years. It seems probably that the business has failed to live up to initial expectations. A pessimistic market can create opportunities.

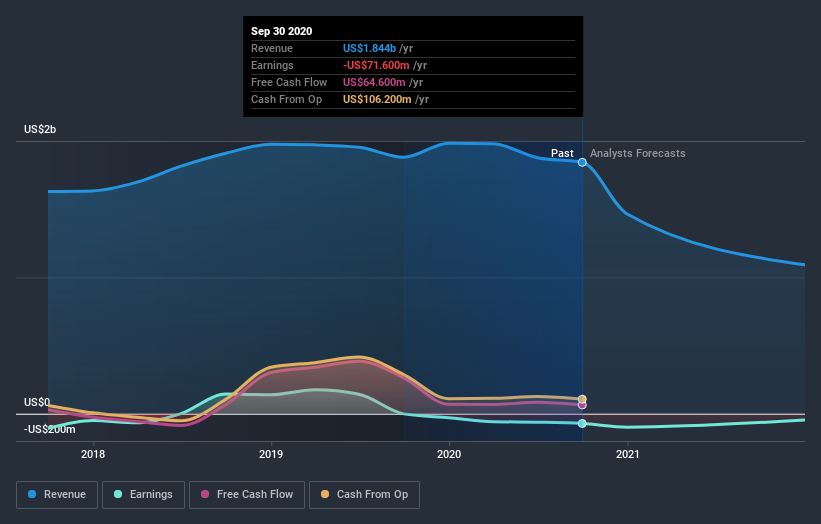

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on HC2 Holdings

A Different Perspective

It's good to see that HC2 Holdings has rewarded shareholders with a total shareholder return of 44% in the last twelve months. That certainly beats the loss of about 9% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for HC2 Holdings that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading HC2 Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:VATE

INNOVATE

Through its subsidiaries, operates in infrastructure, life sciences, and spectrum areas in the United States.

Good value slight.