- United States

- /

- Machinery

- /

- NYSE:GRC

Does Surging Municipal Sales and Infrastructure Demand Shift the Bull Case for Gorman-Rupp (GRC)?

Reviewed by Sasha Jovanovic

- Earlier this year, Gorman-Rupp announced record second-quarter earnings that exceeded analyst expectations, supported by strong sales in the municipal sector and higher infrastructure spending.

- This performance highlights how targeted growth in municipal markets and infrastructure-related demand have reinforced Gorman-Rupp’s operational momentum and market positioning.

- We’ll explore how surging municipal sector sales are influencing Gorman-Rupp’s investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Gorman-Rupp's Investment Narrative?

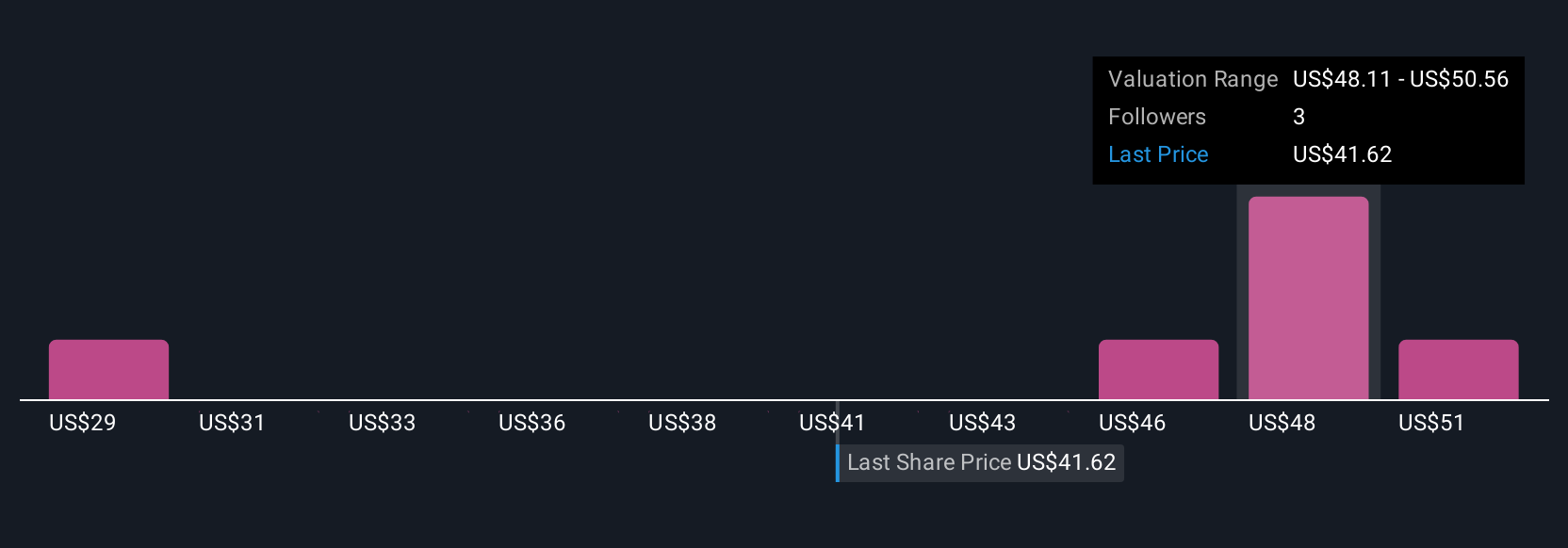

To have conviction in Gorman-Rupp as a long-term investment, you’d likely need to be comfortable with measured revenue and earnings growth, steady dividends, and a history of shareholder returns that outpace market averages. The recent record second-quarter earnings, buoyed by municipal sector sales and infrastructure demand, appear to have acted as a short-term catalyst by pushing the stock to fresh 52-week highs and potentially shifting sentiment more positively. This outperformance may prompt a reassessment of near-term growth risks, especially given prior analyst expectations of slower revenue growth compared to broader markets. Still, the company’s relatively high debt load, premium to estimated fair value, and sensitivity to municipal and infrastructure spending cycles remain live considerations. As the market absorbs these stronger results, attention may shift to how sustainable this latest surge in demand will be, especially with the next earnings announcement on the horizon.

However, despite the strong share price move, Gorman-Rupp’s debt level remains a key risk investors should not overlook.

Exploring Other Perspectives

Explore 4 other fair value estimates on Gorman-Rupp - why the stock might be worth as much as 14% more than the current price!

Build Your Own Gorman-Rupp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gorman-Rupp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gorman-Rupp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gorman-Rupp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRC

Gorman-Rupp

Designs, manufactures, and sells pumps and pump systems in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives