- United States

- /

- Electrical

- /

- NYSE:GEV

The Bull Case For GE Vernova (GEV) Could Change Following $100M Investment in Pennsylvania Expansion – Learn Why

Reviewed by Simply Wall St

- Earlier this week, GE Vernova announced plans to invest up to US$100 million in Pennsylvania over two years, creating around 700 new jobs and expanding manufacturing activities to support grid modernization and the growing need for high-capacity switchgear products.

- This expansion includes a significant order to upgrade the Homer City Energy Campus with advanced natural gas turbines, aimed at powering a large-scale data center dedicated to artificial intelligence and high-performance computing, reflecting rising demand for reliable electricity infrastructure.

- We'll explore how these manufacturing investments and new turbine contracts reshaped GE Vernova's investment narrative and future growth prospects.

GE Vernova Investment Narrative Recap

To be a shareholder in GE Vernova, you generally believe in the long-term demand for grid modernization and electricity infrastructure, especially as data centers and electrification drive the need for reliable power. This week’s US$100 million Pennsylvania investment and major gas turbine contract support growth in these areas, but they do not materially affect the company’s most important short-term catalyst, converting gas turbine reservations to firm orders, and have little immediate impact on the main risk of margin pressure in wind due to policy and inflation concerns. Among recent developments, the full order to supply seven 7HA.02 natural gas turbines to the Homer City Energy Campus stands out. This contract demonstrates GE Vernova’s ability to win large-scale projects in the data center power market, a demand catalyst supported by surging AI and high-performance computing needs, which should help offset volatility in wind and further build the company’s high-margin service backlog. In contrast, investors should not overlook the risk of onshore wind order delays and the potential impact on future backlog and revenue growth if policy and market uncertainties persist...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's outlook anticipates $44.8 billion in revenue and $4.6 billion in earnings by 2028. This is based on a 7.9% annual revenue growth rate and a $2.7 billion increase in earnings from the current $1.9 billion.

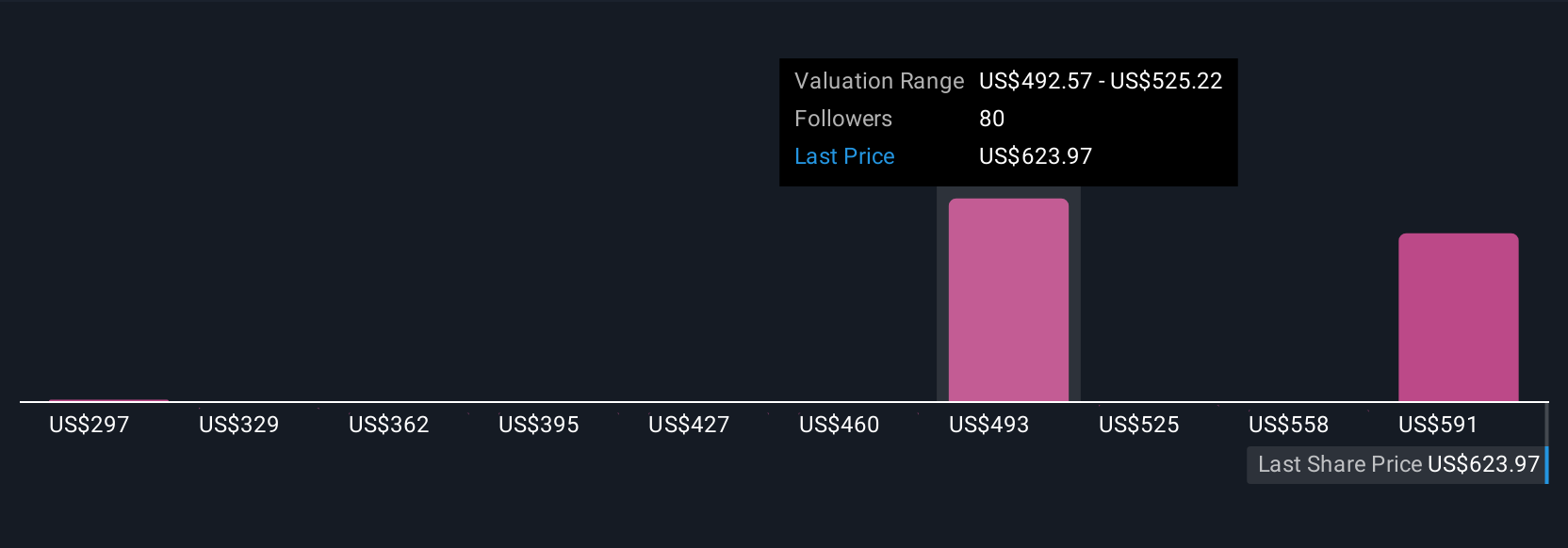

Uncover how GE Vernova's forecasts yield a $491.27 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community range from US$286.69 to US$533.86 per share, highlighting wide variations in outlooks. With turbine contract wins boosting confidence for many, keep in mind that onshore wind demand and policy uncertainty remain key factors affecting future returns.

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives