Last Update15 Jul 25Fair value Increased 24%

GE Vernova's fair value outlook has improved notably, with the consensus price target rising from $396.99 to $491.27, driven by higher projected earnings multiples and a modestly increased discount rate.

What's in the News

- GE Vernova was dropped from multiple Russell Value indices and benchmarks, including the Russell 1000, 2000, and 3000 series.

- The company was added to several Russell Growth indices and benchmarks, such as the Russell 1000, 2000, and 3000 Growth indices.

- GE Vernova is exploring the sale of its Proficy industrial software business, with shares rising 3.3% after the news.

- Selected by Power Grid Corporation of India to supply over 70 extra high-voltage transformers and shunt reactors, supporting India's renewable infrastructure; deliveries to begin in 2026.

- Announced a major partnership with Duke Energy for up to 11 advanced gas turbines to support infrastructure and growth in power demand.

Valuation Changes

Summary of Valuation Changes for GE Vernova

- The Consensus Analyst Price Target has significantly risen from $396.99 to $491.27.

- The Future P/E for GE Vernova has significantly risen from 29.19x to 34.64x.

- The Discount Rate for GE Vernova has risen from 7.60% to 8.00%.

Key Takeaways

- Accelerated electrification and increased service revenues are driving substantial growth and enhancing net margins and earnings stability for GE Vernova.

- Strategic investments in R&D, capex, and manufacturing bolster operational efficiency and improve earnings visibility, supporting long-term shareholder value.

- Policy uncertainties and market challenges in the wind segment may hinder revenue growth and affect profitability, impacting long-term growth prospects.

Catalysts

About GE Vernova- An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

- GE Vernova is experiencing accelerated electrification across markets driven by manufacturing growth, electrification in industries, electric vehicles, and emerging data center needs, which is expected to drive substantial growth in revenue from investments in baseload power, grid infrastructure, and decarbonization solutions.

- The increased utilization of GE Vernova’s installed base creates opportunities for additional service revenues, with over 60% of the services backlog positioned at strong margins, which is likely to enhance net margins and earnings stability over the years.

- Investments in supply chain resiliency, with a $600 million commitment in U.S. manufacturing and a $9 billion global investment in R&D and CapEx through 2028, are expected to bolster operational efficiency and expand net margins over time.

- The substantial increase in gas turbine orders and slot reservations, particularly in the U.S., alongside a heavy mix of combined cycle orders expected in the second half of the year, could significantly boost future revenues and improve earnings visibility through sustained dispatchable power generation.

- GE Vernova’s strong free cash flow, expanding backlog, and strategic buybacks provide flexibility for further shareholder returns and capital investments, supporting earnings per share growth and enhanced shareholder value in the long term.

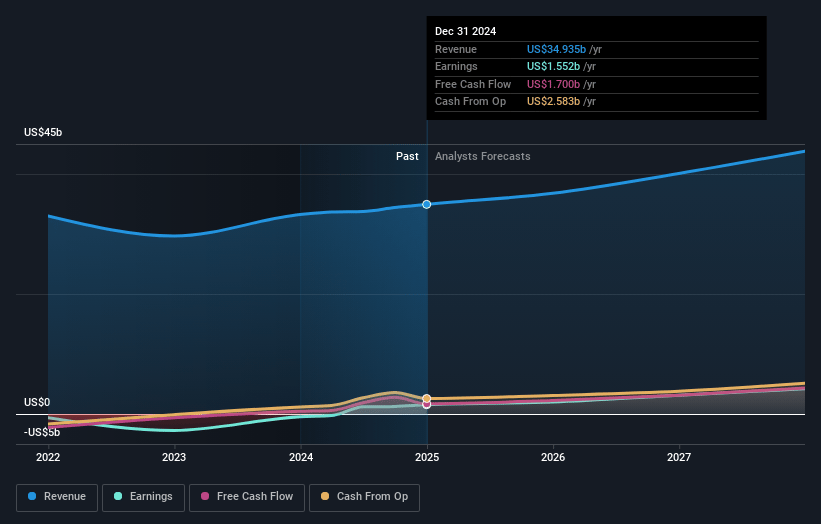

GE Vernova Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GE Vernova's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 10.2% in 3 years time.

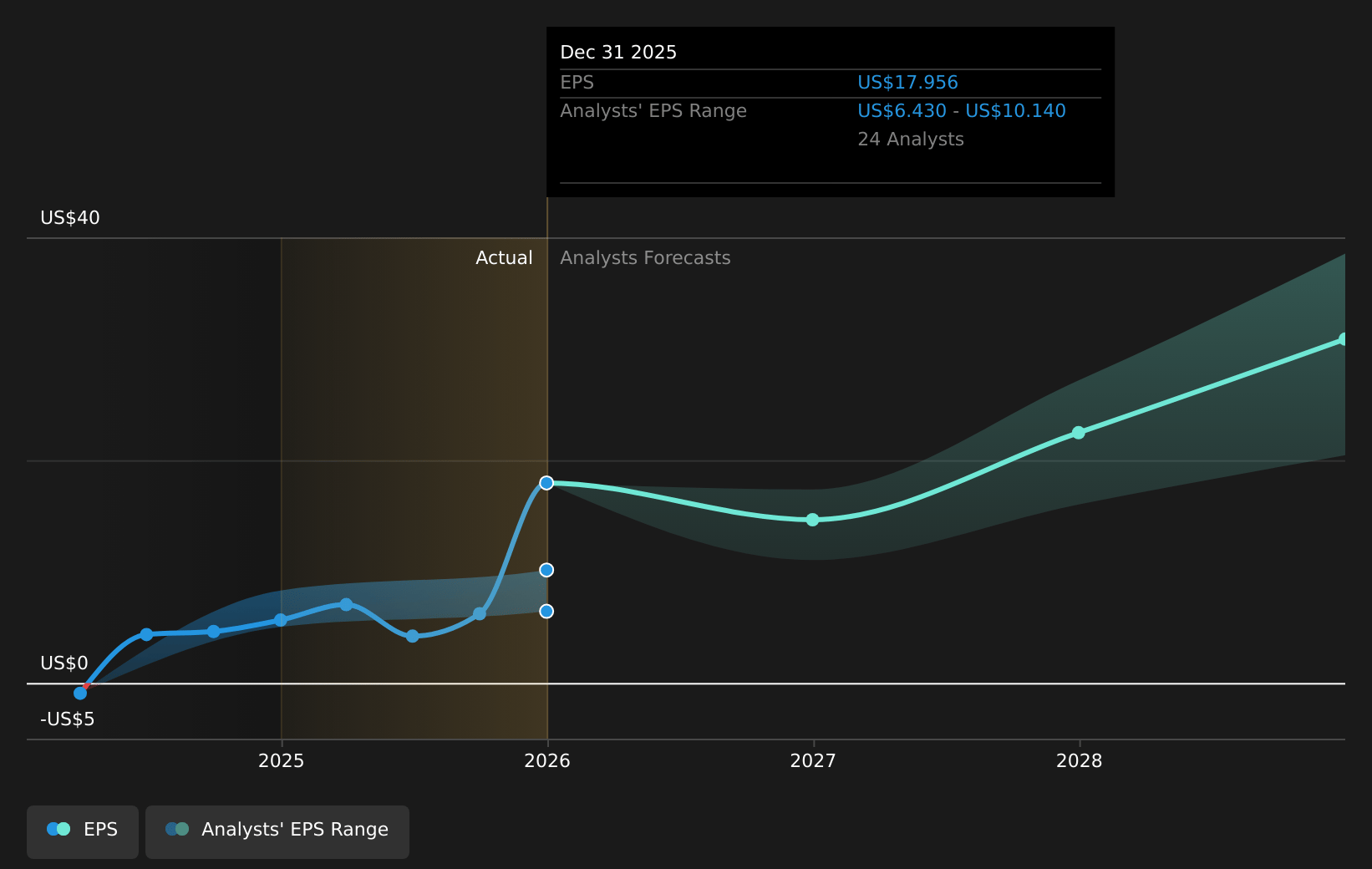

- Analysts expect earnings to reach $4.6 billion (and earnings per share of $16.45) by about May 2028, up from $1.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.3 billion in earnings, and the most bearish expecting $2.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 56.6x today. This future PE is greater than the current PE for the US Electrical industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

GE Vernova Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Due to ongoing U.S. policy uncertainties and permitting delays, onshore wind orders have decreased significantly, which may impact future revenue growth in this segment.

- Offshore wind continues to face challenges with a focus on executing an existing backlog that is not profitable, which could negatively affect net margins.

- The impact of tariffs and resulting inflation is expected to increase costs by $300 million to $400 million in 2025, potentially impacting overall net margins if not fully mitigated.

- There is a risk of delays in converting slot reservation agreements for gas turbines into firm orders, which could affect future earnings and revenue realization timelines.

- The slowdown in onshore wind equipment orders due to market conditions and policy uncertainties could lead to decreased future backlog and revenue, impeding long-term growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $397.747 for GE Vernova based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $500.0, and the most bearish reporting a price target of just $279.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $44.8 billion, earnings will come to $4.6 billion, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $401.23, the analyst price target of $397.75 is 0.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.