- United States

- /

- Electrical

- /

- NYSE:GEV

Is Now the Right Time to Consider GE Vernova After a 112% Rally?

Reviewed by Bailey Pemberton

If you have been watching GE Vernova, you are probably wondering whether now is the right time to jump in or if it is best to wait things out. After all, few stocks have had a year as eye-catching as this one. GE Vernova’s share price has blasted upwards a whopping 112.3% over the past year and is still up 72.7% year-to-date, despite pulling back about 9.2% in just the last week. While that dip might look unsettling, it could also be creating a new entry point, especially if you think the company’s potential for long-term growth remains strong.

Part of what has been fueling investor interest is GE Vernova’s growing presence in the energy sector, buoyed by headlines about its innovation in grid modernization and expansion into cleaner energy markets. This momentum has not gone unnoticed by analysts. Many are weighing the risks and rewards differently after such a brisk run-up in the share price. Of course, recent moves have shifted perceptions of risk, but for valuation-minded investors, the question is whether that surge means shares are now too expensive compared to business fundamentals.

On a scoring basis that looks at six different undervaluation checks, GE Vernova is currently undervalued in just one, giving it a total valuation score of 1. That is not exactly screaming bargain territory, but numbers alone never tell the whole story.

So, how do these valuation checks stack up? Is there a better way to figure out what GE Vernova is really worth? Let us dig into the different approaches and then look beyond the numbers for a deeper take.

GE Vernova scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GE Vernova Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates what a company is truly worth by projecting its future free cash flows, then discounting those estimates to today’s value. Essentially, it asks how much all the money a business will generate in the years to come is worth right now.

For GE Vernova, the DCF model is built on its current Free Cash Flow, which stands at about $2.74 Billion. Analysts have provided estimates for the next five years, showing strong projected growth. By 2029, Free Cash Flow is forecasted to reach approximately $7.82 Billion. For years beyond this, projections are extrapolated to give a full ten-year outlook, reflecting expectations that GE Vernova’s investments in energy and technological innovation will pay off.

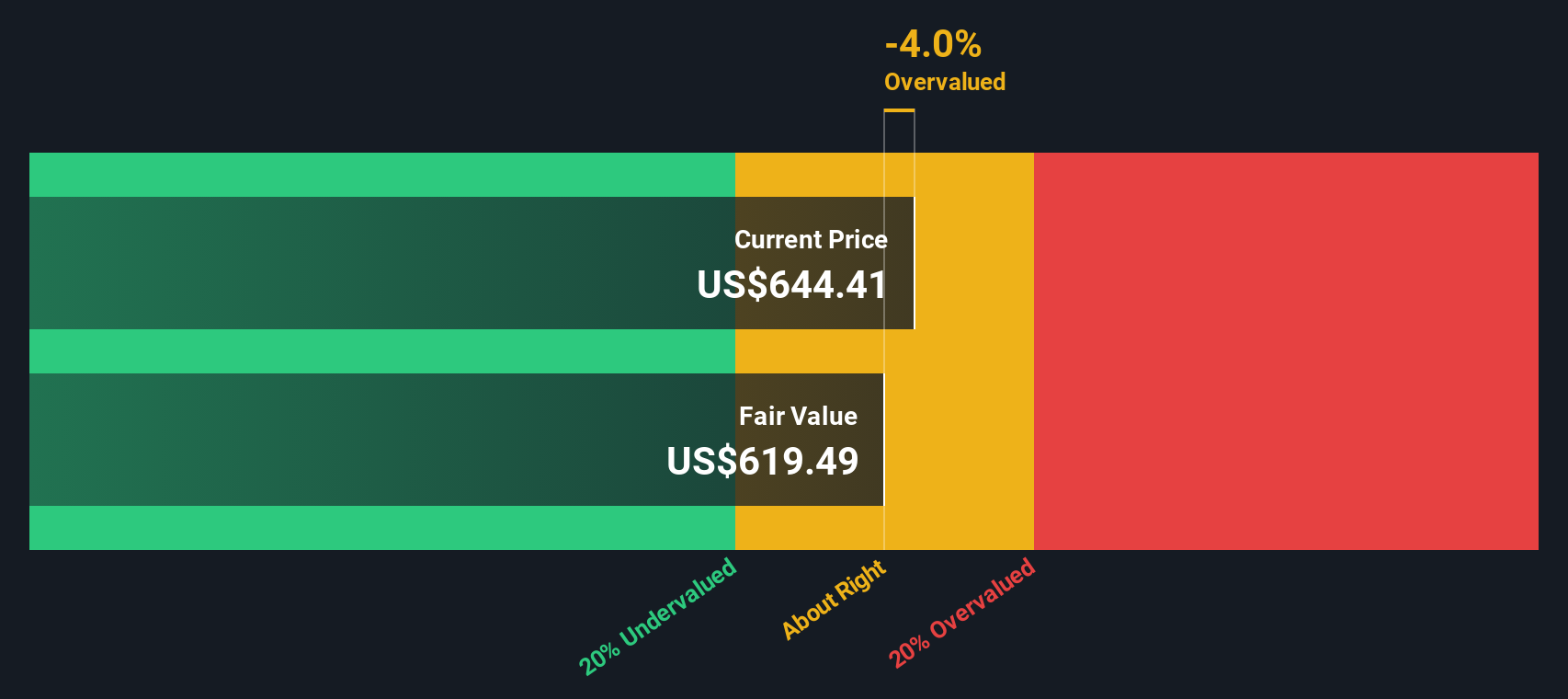

Based on this approach, GE Vernova’s intrinsic value is estimated at $597.35 per share. Compared with today’s market price, this DCF implies the shares are 2.0% undervalued. The margin is slim, suggesting that while there may still be a little upside, the stock is trading very close to its fair value according to this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out GE Vernova's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: GE Vernova Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a popular metric for valuing profitable companies, since it directly links investor expectations for future growth and profitability with the company’s actual earnings. A higher P/E can be justified when a business is growing quickly or carries lower risk. In contrast, a lower P/E may signal slower prospects or more uncertainty ahead.

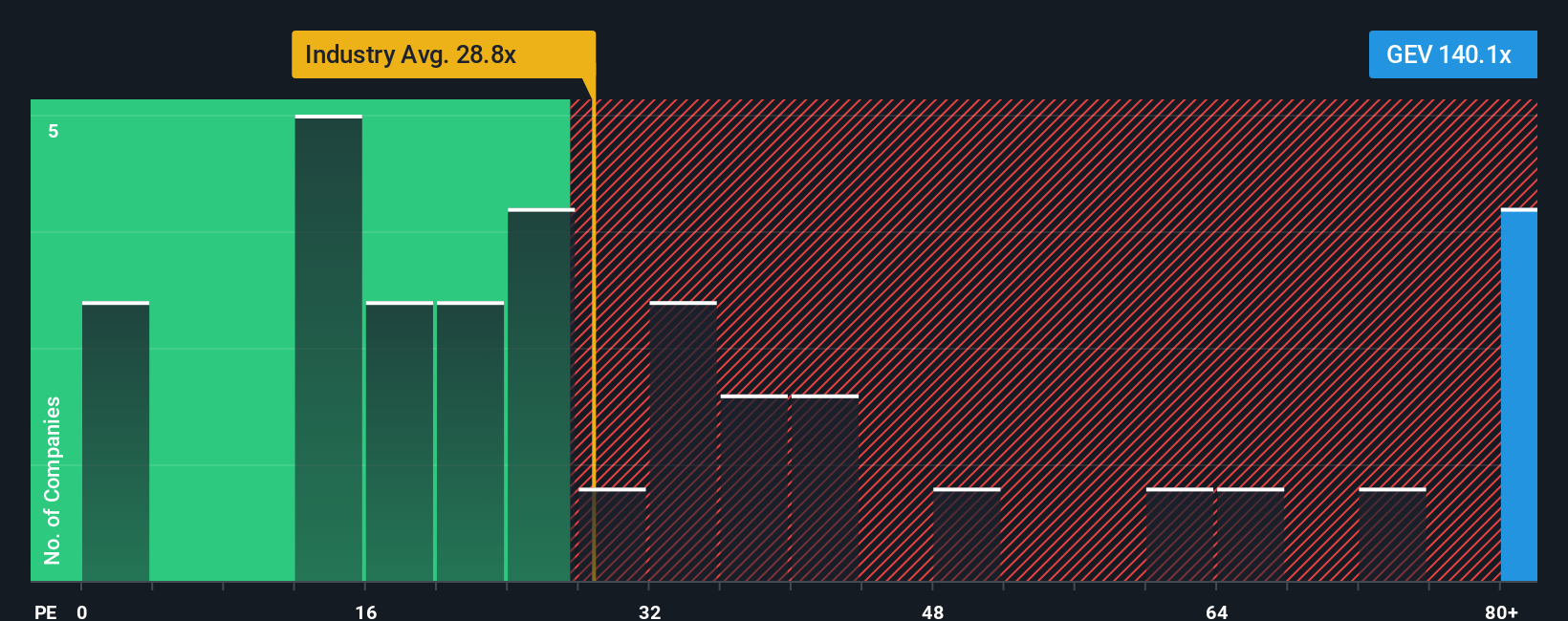

Looking at the numbers, GE Vernova currently trades at a P/E ratio of 137.8x. That is far above the industry average of 30.8x and also well beyond the average of its peer group at 42.4x. At first glance, this might make the stock look expensive relative to others in the electrical industry.

However, the “Fair Ratio,” developed by Simply Wall St, adds essential context by taking into account GE Vernova's actual growth prospects, profitability, risks, and competitive position, rather than relying solely on basic comparisons. For GE Vernova, the Fair Ratio is calculated to be 79.0x. A P/E at this level would fairly balance its advantages and risks. Since GE Vernova’s actual P/E is 137.8x, which is significantly higher than the Fair Ratio, it suggests the market is pricing in even more optimism than what the fundamentals might support. The Fair Ratio offers a much more tailored view than simply stacking up against industry averages or peer multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GE Vernova Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, yet powerful, way to invest by connecting your personal view on a company's story to concrete financial forecasts and an expected fair value. Instead of getting stuck on static numbers, Narratives let you consider how business trends, industry changes, and company strategies might play out financially over time.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an accessible tool that helps you bring together your own assumptions about things like future revenues, margins, or risks and see how they directly affect what a stock might be worth. Narratives make it easier to decide when to buy or sell, since you can always compare a dynamic Fair Value with the real-time share price.

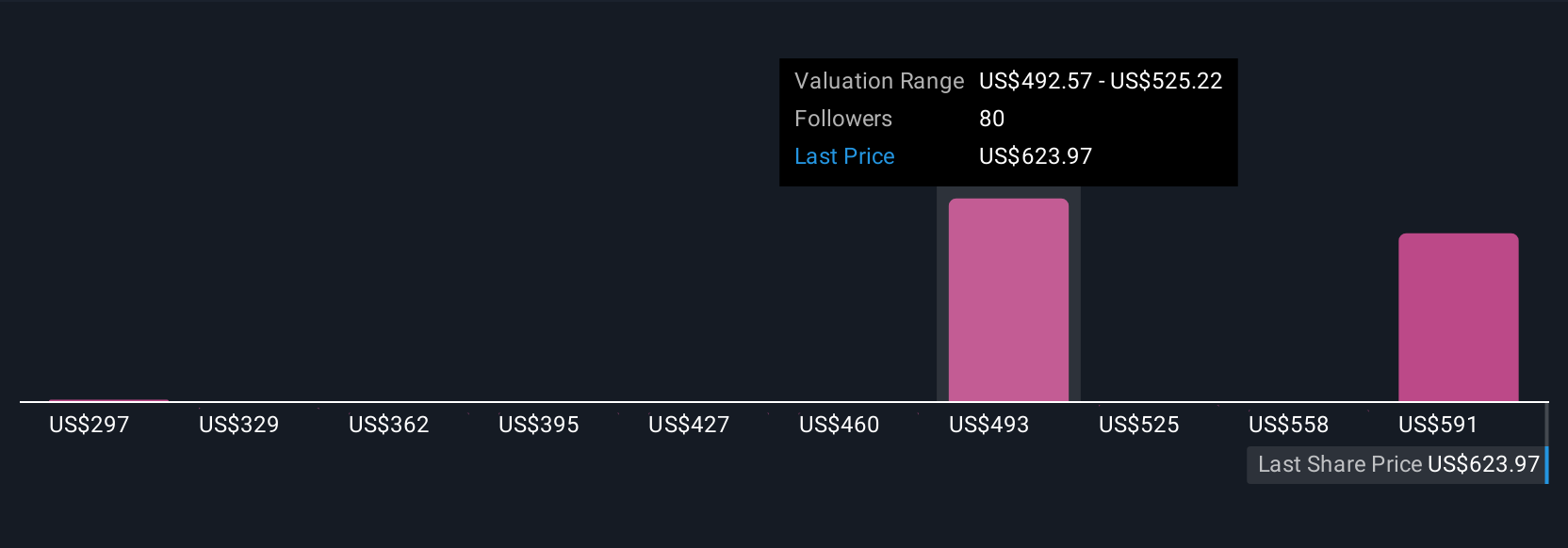

What’s more, Narratives automatically update when new information hits the news or when earnings numbers change, keeping your estimates relevant and actionable. For GE Vernova, this might mean some investors forecast optimistic earnings and set a Fair Value above $760, while others think risks outweigh rewards and see a Fair Value closer to $280. Putting your own Narrative side by side with others helps you invest with much more insight and confidence.

Do you think there's more to the story for GE Vernova? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives