- United States

- /

- Electrical

- /

- NYSE:GEV

How Vattenfall’s SMR Shortlist Has Shifted the Investment Narrative for GE Vernova (GEV)

Reviewed by Simply Wall St

- Earlier in August 2025, Vattenfall shortlisted GE Vernova and Rolls-Royce SMR as final contenders to supply modular nuclear reactors for a new project at Sweden's Varo Peninsula, aiming for 1,500 MW of output with either five BWRX-300 units or three Rolls-Royce SMRs.

- This selection positions GE Vernova as a leading candidate for a significant nuclear contract in Sweden, reflecting confidence in its modular reactor technology and established fuel supply chain.

- We’ll explore what GE Vernova’s advancement in the Swedish SMR project means for its future role in European nuclear power.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GE Vernova Investment Narrative Recap

To be a GE Vernova shareholder, you need to believe in the company’s ability to translate momentum in energy infrastructure into sustainable earnings growth, despite volatility in large project orders and ongoing margin pressures. The recent news from Vattenfall, while highlighting progress for GE Vernova’s nuclear business, does not materially alter the most immediate catalyst, stronger order flow in power generation and grid modernization, or address the core risk of order delays and cancellations affecting near-term revenue recognition.

One relevant announcement is GE Vernova’s April 2025 UK subsea link contract win, supporting renewable energy transmission through grid infrastructure, a key driver behind the current order book strength that underpins near-term growth opportunities. This is closely linked to the ongoing catalyst of expanding grid infrastructure orders and recurring service revenues, even as nuclear prospects in Sweden develop more gradually.

However, despite these promising project wins, investors should note that order timing and project execution create volatility that...

Read the full narrative on GE Vernova (it's free!)

GE Vernova is projected to reach $48.0 billion in revenue and $5.8 billion in earnings by 2028. This outlook assumes annual revenue growth of 9.4% and an earnings increase of $4.6 billion from the current earnings of $1.2 billion.

Uncover how GE Vernova's forecasts yield a $644.26 fair value, a 3% upside to its current price.

Exploring Other Perspectives

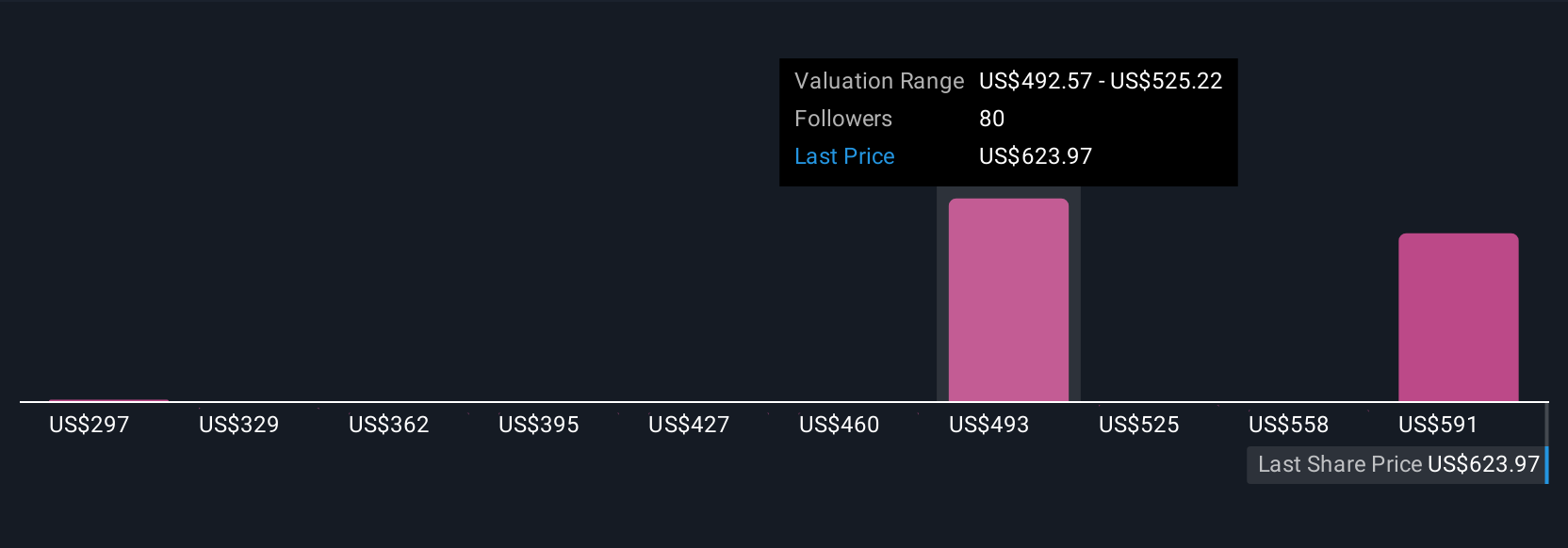

Sixteen Simply Wall St Community members provided fair value estimates for GE Vernova, ranging from US$310.26 to US$714.65. While power infrastructure orders are a positive catalyst, the risk of lumpy project revenue and unpredictable earnings remains top of mind for many participants, highlighting the value of considering several different viewpoints.

Explore 16 other fair value estimates on GE Vernova - why the stock might be worth as much as 14% more than the current price!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives