- United States

- /

- Electrical

- /

- NYSE:GEV

Has GE Vernova’s 85% Rally Priced In All the Energy Infrastructure Optimism for 2025?

Reviewed by Simply Wall St

If you have GE Vernova on your radar, you are not alone. The stock has been on quite a journey lately, and investors are weighing whether now is the moment to get in, hold tight, or consider locking in recent gains. Over just the past week, GE Vernova rallied 4.2%, and its one-year return sits at an eye-catching 172.6%. Even more striking is the year-to-date surge of 84.6%, suggesting something more than just short-term momentum is at play.

Much of this movement can be traced to shifting sentiment around the market’s appetite for industrial electrification and energy infrastructure. These are themes that place GE Vernova front and center. While the broader market digests whispers of regulatory tailwinds and new energy policies, the company continues to catch investors’ attention as a strong contender in this transformative sector. However, market optimism and real value do not always line up. Recent price action hints at both rising growth expectations and perhaps a reassessment of risk, pushing shares higher and also raising tougher questions about what the shares are truly worth now.

To put a finer point on it, our initial valuation checks tell an interesting story: out of six rigorous benchmarks for fair value, GE Vernova only comes up as undervalued in one. That gives it a value score of 1, a useful datapoint but only a piece of the puzzle.

If you are wondering how these different valuation methods stack up and whether any of them reflect the true opportunity here, you are in the right place. Let’s take a closer look at the numbers and the frameworks behind them, and later on, we will explore an even smarter way to make sense of valuation in today’s market.

GE Vernova scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: GE Vernova Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a foundational approach for valuing businesses. It works by projecting a company’s future cash flows, then discounting those amounts back to today's dollars to estimate what those future earnings are actually worth now. This lets investors judge how much the company’s income stream is really worth based on time and risk.

For GE Vernova, the analysis starts with current Free Cash Flow at $2.74 billion. Analyst estimates keep the momentum strong, projecting FCF to reach $7.85 billion by the end of 2029. After five years of analyst forecasts, further cash flow growth is extrapolated out to 2035, with projections rising to approximately $14.55 billion. All these figures are based in US dollars.

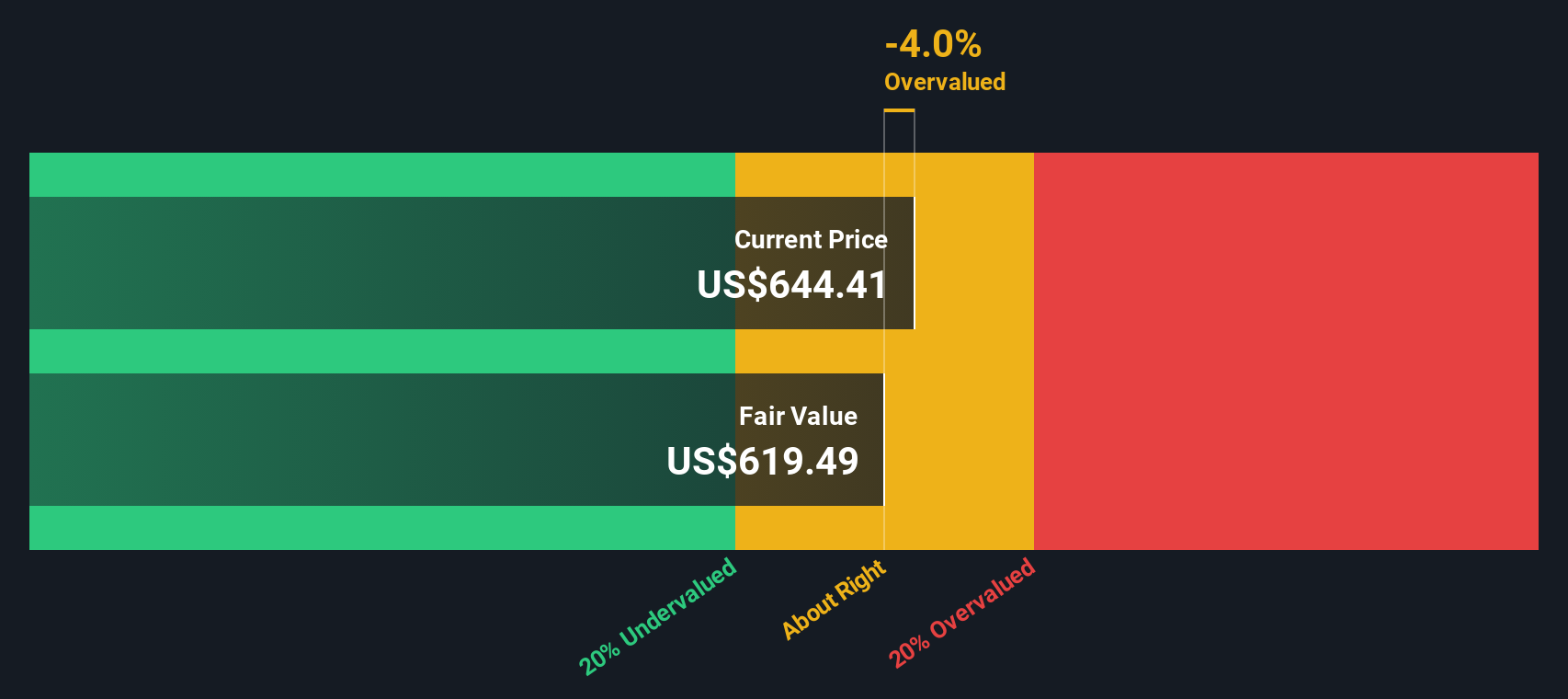

Bringing those future billions back to today's value, the DCF model yields an intrinsic value of $639.21 per share for GE Vernova. With the current share price reflecting only a 2.1% discount to this calculated value, the numbers signal that shares are trading very close to their fair value.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for GE Vernova.

Approach 2: GE Vernova Price vs Earnings (PE) Ratio

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies because it connects a company’s current share price to its per-share earnings. It is especially useful for investors looking at businesses with consistent profits, as it captures investor expectations for future growth and the risks of achieving those results.

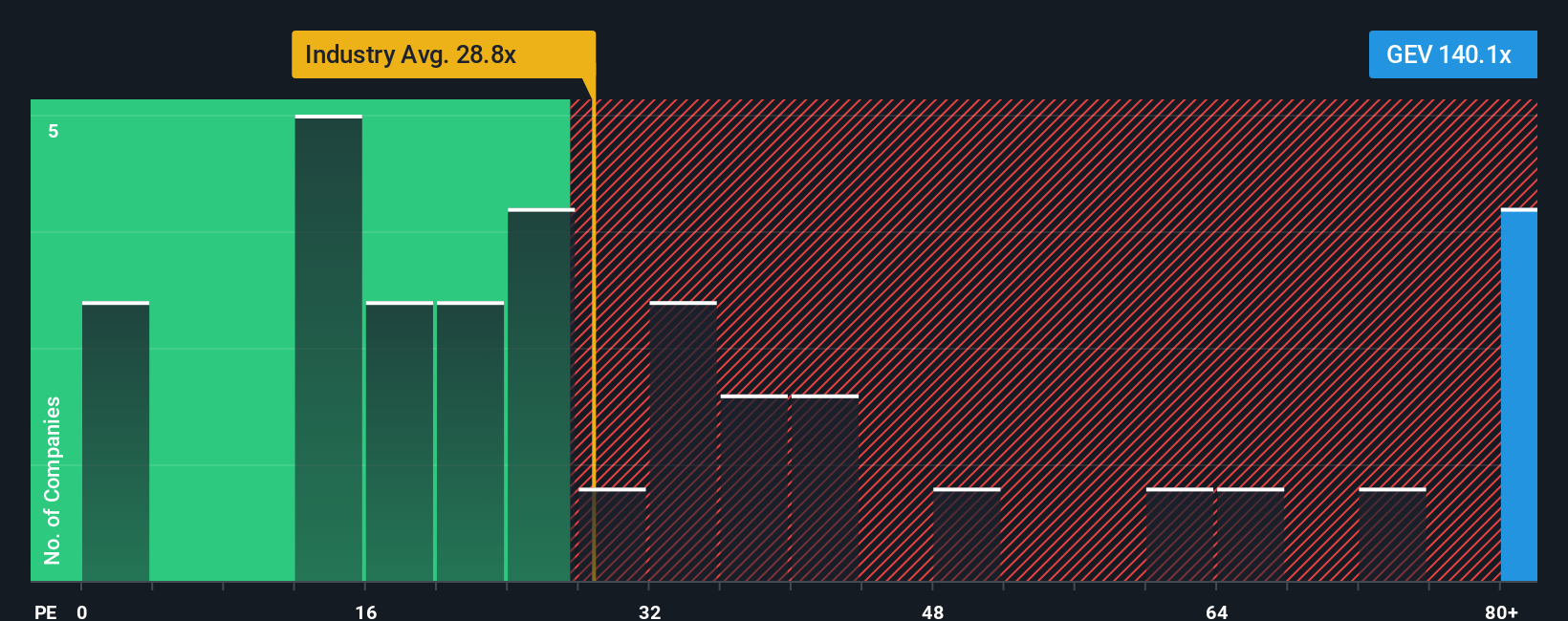

When deciding what makes a “normal” PE ratio, the key drivers are growth outlook and risk profile. Companies expected to grow faster or with less risk usually justify higher PE multiples, while slower growth or higher risk typically call for a lower ratio. With that in mind, GE Vernova currently trades on a hefty 147.3x PE ratio. That is well ahead of its industry average of 30.5x and a peer group average of 27.9x, underlining the market’s optimism on future prospects.

Rather than compare only with industry or peers, Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark. It considers not just sector membership, but also GE Vernova’s growth rate, profit margin, market capitalization, and risk profile, painting a more complete picture of where the PE ratio should realistically stand. According to this model, GE Vernova’s fair PE is 72.3x, which is less than half its current multiple.

Given the company trades at a much higher PE than justified by its own fundamentals, even factoring in strong growth, the shares look meaningfully overvalued by this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your GE Vernova Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story, your perspective on a company, anchored to numbers that reflect your assumptions about its future revenue, earnings, and margins, ultimately shaping your fair value for the stock.

Narratives work by connecting what’s happening at the company and in its industry to concrete financial forecasts, helping you see how a company’s story flows into an actual price target. They make valuation easy and accessible for everyone, and millions of investors already use Narratives on Simply Wall St’s Community page to share their reasoning and forecasts.

By crafting a Narrative, you can compare your fair value against the current share price and quickly see whether it may be time to buy or sell, all as new earnings or news dynamically update the forecasts in real time. This helps you invest with confidence, not just hope.

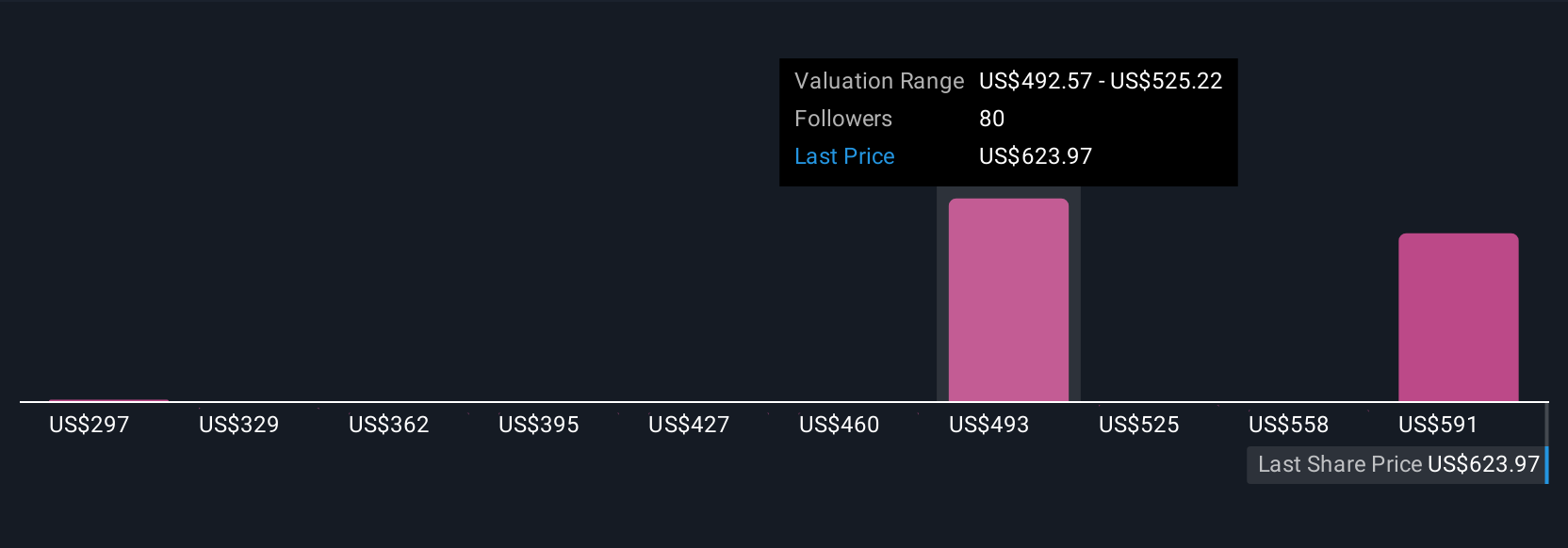

For example, some GE Vernova Narratives project a bullish fair value of $760, reflecting high confidence in electrification tailwinds, while others point to a much lower fair value of $280, emphasizing risks from margin volatility. This is a reminder that your own Narrative shapes your investment decision.

Do you think there's more to the story for GE Vernova? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives