- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (GEV) Is Up 7.9% After Securing First International Wind Repowering Deal in Taiwan

Reviewed by Sasha Jovanovic

- GE Vernova Inc. recently announced its first onshore wind repowering upgrade agreement outside the United States, partnering with Taiwan Power Company to supply 25 repower upgrade kits and provide five years of operations and maintenance services in Taiwan.

- This milestone marks a significant expansion of GE Vernova’s international presence and supports the modernization of Taiwan’s renewable energy infrastructure.

- We’ll explore how this first international wind repowering contract could influence GE Vernova’s investment narrative in the context of rising global energy demand.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GE Vernova Investment Narrative Recap

To be a GE Vernova shareholder, one should believe in the long-term growth of global energy demand, especially in renewable infrastructure and power grid modernization. The Taiwan wind repowering contract is a milestone for GE Vernova’s international wind services, but it does not materially alter the short-term catalysts or the primary risk: lumpy infrastructure orders and uncertain offshore wind profitability still weigh most heavily on near-term performance.

Among recent announcements, GE Vernova’s selection by the Power Grid Corporation of India in May 2025 to supply high-voltage transformers also highlights the company’s efforts to expand its global footprint in energy infrastructure solutions. The expansion into international repowering projects, when considered alongside continued grid equipment contracts, reinforces how recurring long-term service agreements remain a core revenue and margin catalyst.

By contrast, investors should be aware that heavy dependence on large, lumpy projects may lead to revenue and profit volatility if order cycles or project timelines shift...

Read the full narrative on GE Vernova (it's free!)

GE Vernova's outlook anticipates $48.0 billion in revenue and $5.8 billion in earnings by 2028. This scenario requires a 9.5% annual revenue growth rate and a $4.6 billion increase in earnings from the current $1.2 billion.

Uncover how GE Vernova's forecasts yield a $678.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

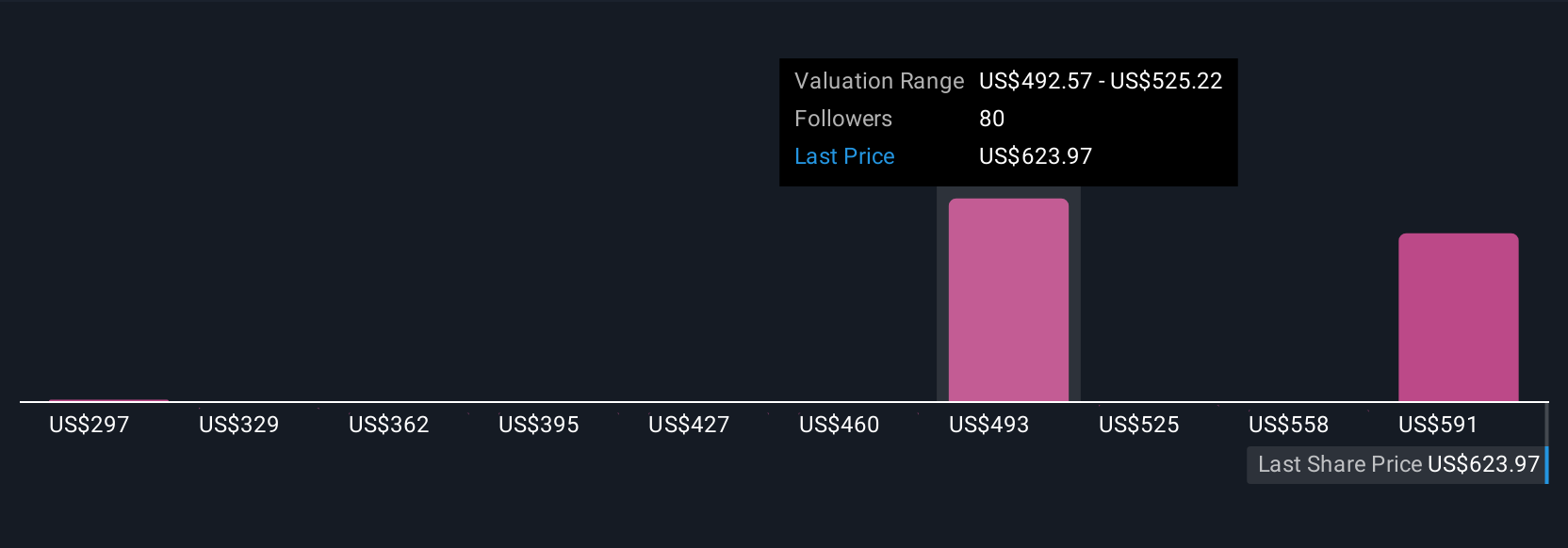

The Simply Wall St Community shared 17 individual fair value opinions on GE Vernova, ranging widely from US$359.90 to US$760 per share. While project wins may boost confidence for some, uneven order flow and infrastructure reliance could keep company performance unpredictable, explore these varied perspectives to sharpen your view.

Explore 17 other fair value estimates on GE Vernova - why the stock might be worth as much as 27% more than the current price!

Build Your Own GE Vernova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE Vernova research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free GE Vernova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE Vernova's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.