- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (GEV): Evaluating Valuation After RBC Downgrade and Cautious Wind Business Outlook

Reviewed by Kshitija Bhandaru

RBC Capital Markets recently downgraded GE Vernova (NYSE:GEV), citing concerns about the stock’s current valuation and challenges in its wind business. This shift is catching the attention of investors watching sector momentum.

See our latest analysis for GE Vernova.

Despite this slightly more cautious outlook from analysts and a recent dip in sector sentiment, GE Vernova’s recent news cycle has included a new quarterly dividend, ongoing electrification initiatives, and a spotlight appearance at the AI for the Electric Sector Summit. The stock’s total shareholder return over the last year sits just above 1%, reflecting a period where momentum has cooled and the market weighs long-term growth against challenges in the wind segment.

If shifting trends in power and renewables have you curious about where growth might come next, consider broadening your search and uncovering fast growing stocks with high insider ownership.

With the market weighing both solid fundamentals and emerging sector headwinds, the critical question is whether GE Vernova’s stock is undervalued at these levels or if investors have already priced in the company’s future growth potential.

Most Popular Narrative: 8.2% Undervalued

With GE Vernova's last close at $606.23 and the narrative's fair value estimate at $660.45, analysts suggest the shares are trading at a notable discount given expected growth. The latest fair value hinges on forward-looking financial catalysts and an improving profit outlook.

Strategic investments in expanding capacity (e.g., Pennsylvania Electrification plant), robotics, automation, and AI, alongside ongoing productivity initiatives, position GE Vernova to capture accelerating demand and improve operating leverage, boosting future net margins.

What's really driving this projected upside? There are key financial bets behind the scenes, especially around margin expansion and aggressive investment payoffs. Want to know what growth assumptions and margin targets must click into place for this price to make sense? The full narrative reveals the bold blueprint powering that valuation.

Result: Fair Value of $660.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regional slowdowns or continued wind business losses could threaten these optimistic forecasts. This gives investors reason to watch for any signs of decelerating growth.

Find out about the key risks to this GE Vernova narrative.

Another View: Comparing Valuations Against Industry Benchmarks

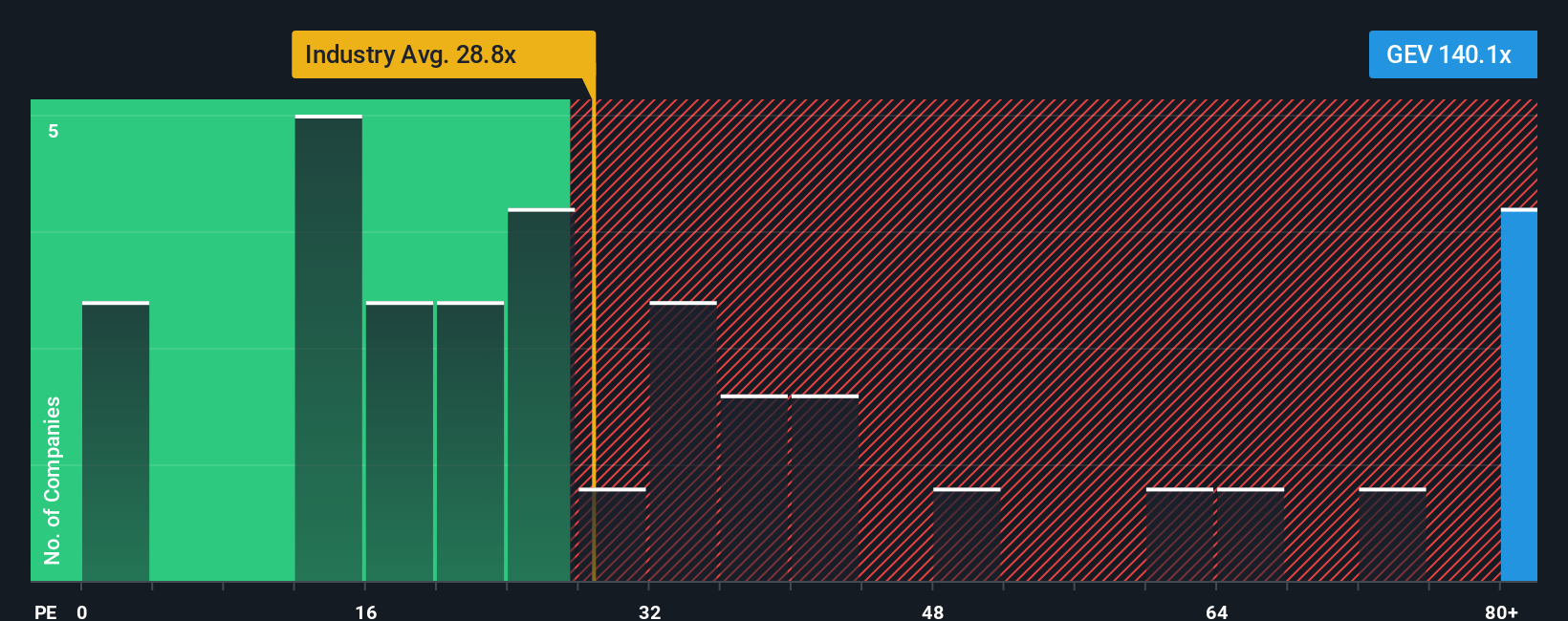

While fair value estimates point to GE Vernova being undervalued, the company's current price-to-earnings ratio stands at 142.8x, which is significantly higher than both the electrical industry average of 29.1x and its peer average of 28.7x. Even the fair ratio the market could eventually move towards is much lower, at 78.8x. This large gap raises real questions about valuation risk and whether the market might eventually adjust expectations down.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If you want a different perspective or enjoy diving into your own research, you can assemble a personalized take on GE Vernova’s outlook in just a few minutes using Do it your way.

A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the curve and grow your portfolio with smarter choices, don’t wait for the crowd. Now's the time to use powerful tools that help you spot fresh opportunities others might miss.

- Unlock consistent income potential by reviewing these 19 dividend stocks with yields > 3% offering yields greater than 3% and stable fundamentals.

- Find tomorrow’s winners at a bargain; target value with these 909 undervalued stocks based on cash flows based on strong cash flow analysis.

- Tap into the next wave of technological breakthroughs and see which innovators lead the future with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives