- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (GEV): Assessing Valuation as Grid Modernization and AI Strategy Drive Fresh Attention

Reviewed by Kshitija Bhandaru

GE Vernova, freshly in the spotlight, is teaming up with Verizon to launch an advanced industrial wireless platform aimed at modernizing utility networks. Investors are watching closely because the partnership highlights GE Vernova’s strategic push into grid innovation.

See our latest analysis for GE Vernova.

GE Vernova’s share price has been on a winning streak, jumping 87% year-to-date and delivering a remarkable 140% total shareholder return over the past twelve months. Recent grid modernization initiatives, robust quarterly results, and upbeat earnings expectations have fueled bullish momentum. More investors are taking notice as the company deepens its push into energy transition and digital grid technologies.

If you’re curious what other fast-moving companies are capturing momentum, this is a perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

The rally in GE Vernova shares has been extraordinary. With its valuation now approaching analysts’ targets and optimism seemingly high, is the market leaving room for further upside, or is future growth already priced in?

Most Popular Narrative: 4% Undervalued

The most widely followed narrative values GE Vernova at $660.45, which is slightly above the last close price of $634.27. This suggests that current market enthusiasm is well-supported, but further upside rests on pivotal business catalysts playing out.

Strong momentum in power generation and grid infrastructure orders, driven by rising demand for electrification and global decarbonization initiatives, is expanding GE Vernova's backlog at higher margins. This supports sustained revenue growth and future earnings visibility.

Want to know how surging grid orders and electrification demand fuel this bold forecast? The underlying blueprint includes rising profit margins and an aggressive path for future earnings. Which numbers do analysts think will rewrite the company’s future? Find out what truly drives this fair value calculation.

Result: Fair Value of $660.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses in the Wind segment and volatile infrastructure project cycles could quickly challenge the current bullish view on GE Vernova.

Find out about the key risks to this GE Vernova narrative.

Another View: Market Ratios Tell a Different Story

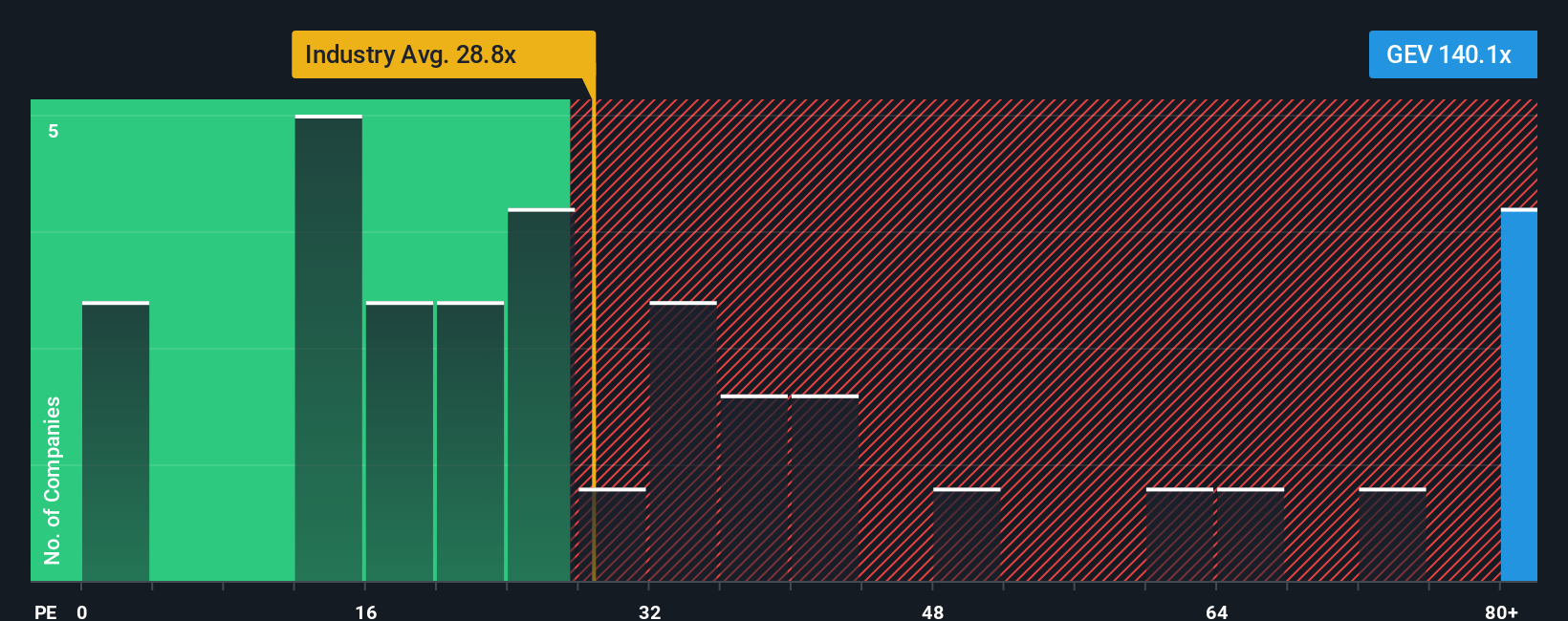

While the leading narrative pegs GE Vernova as slightly undervalued, a closer look at its price-to-earnings ratio challenges this view. GE Vernova trades at a lofty 149.4x earnings, far above the industry average of 28.7x and a peer average of 42.3x. The fair ratio—the level the market could rationally move toward—is 79.2x. This signals investors may be paying a hefty premium for future growth that might not materialize as quickly as hoped. Does this rich valuation hint at too much optimism, or is it justified by the company’s bold transformation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

Curious to carve your own path or challenge the market view? You can dive into the data and build your own analysis in just a few minutes with Do it your way.

A great starting point for your GE Vernova research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Refusing to broaden your search means missing out on stocks making real moves in the market. Take action with these unique opportunities you can’t afford to overlook:

- Find untapped value plays that may be poised for a turnaround by checking out these 897 undervalued stocks based on cash flows before the rest of the market catches on.

- Uncover companies that could benefit as healthcare and artificial intelligence converge by exploring these 32 healthcare AI stocks for tomorrow’s breakthrough leaders.

- Capitalize on high-yielding opportunities and secure your portfolio’s passive income through these 18 dividend stocks with yields > 3%, which highlights options with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives