- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

General Electric (NYSE:GE) Added to S&P Aerospace & Defense Index, Dividend Affirmed, Strategic Alliances Boost

Reviewed by Simply Wall St

General Electric (NYSE:GE) is navigating a dynamic period characterized by both significant achievements and pressing challenges. Recent developments include a 60% year-over-year increase in adjusted EPS and strategic investments in pioneering technologies, contrasted with a 20% sequential drop in new engine output due to supply chain constraints. In the discussion that follows, we will explore GE's core strengths, critical weaknesses, growth opportunities, and potential threats to provide a comprehensive overview of the company's current business situation.

Dive into the specifics of General Electric here with our thorough analysis report.

Strengths: Core Advantages Driving Sustained Success for General Electric

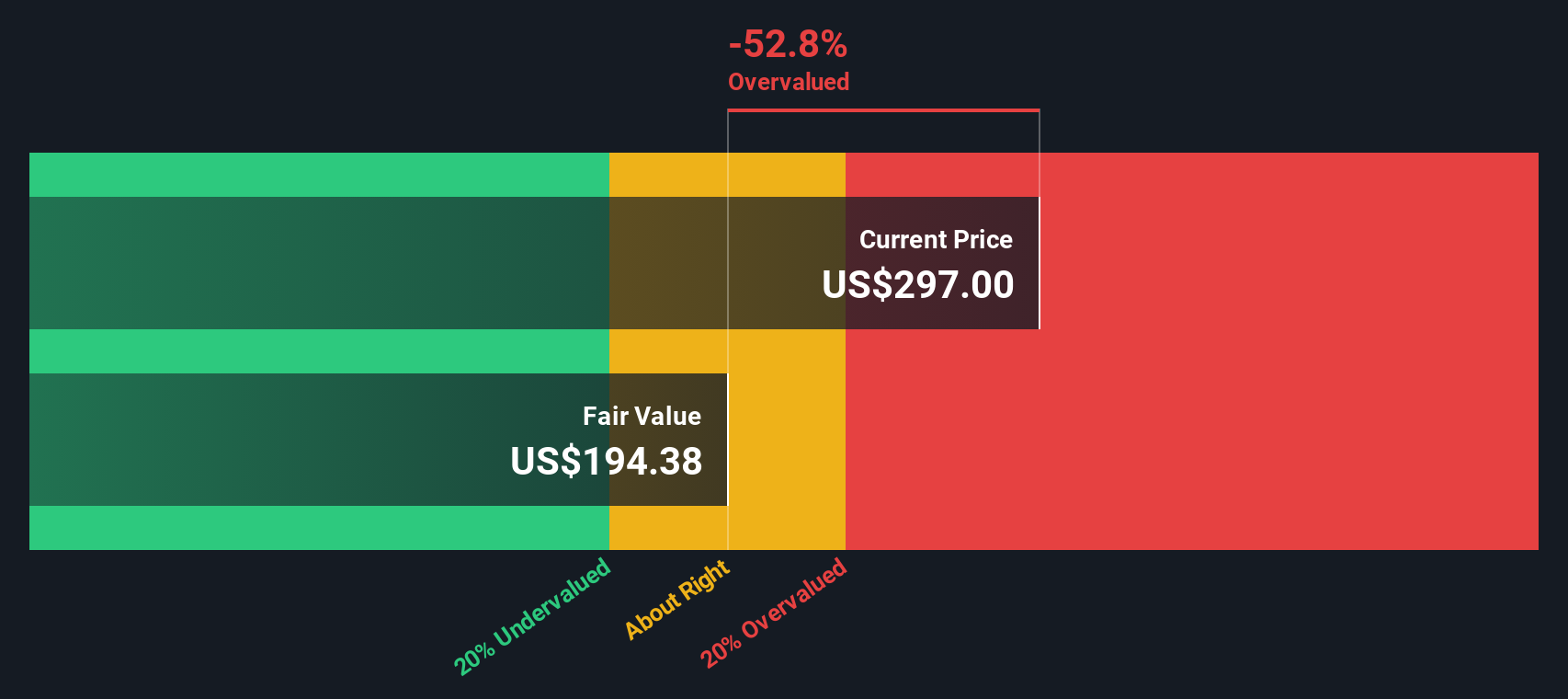

General Electric (GE) has demonstrated strong financial health and profitability, highlighted by a significant year-over-year increase in adjusted EPS, which rose by more than 60% to $1.20. The company's strategic initiatives, such as the RISE program, emphasize innovation through pioneering technologies like open fan and hybrid electric systems. Additionally, GE's strong customer base, with 70,000 commercial and defense engines, supports a resilient aftermarket services business, contributing to 70% of its recurring revenues. This stability is further reinforced by the company's raised corporate guidance, projecting an operating profit range of $6.5 billion to $6.8 billion for 2024. Despite trading below its estimated fair value of $222.1, GE is considered expensive with a Price-To-Earnings Ratio of 51.1x compared to the peer average of 37.1x and the US Aerospace & Defense industry average of 35x.

Weaknesses: Critical Issues Affecting General Electric's Performance and Areas For Growth

GE faces several critical challenges, notably in its new engine output, which was down 20% sequentially. Supply chain constraints are a significant issue, with 80% of material input shortages tied to nine suppliers across 15 supply sites. Additionally, GE's revenue growth is impacted by a lower outlook, contributing to a negative earnings growth of 56% over the past year, making it difficult to compare to the Aerospace & Defense industry average of 24.5%. The company's high Price-To-Earnings Ratio (51.1x) compared to industry peers (37.1x) and the US Aerospace & Defense industry average (35x) further underscores its financial challenges. GE's Return on Equity (21.92%) is also skewed due to high debt levels, impacting overall financial stability.

To gain deeper insights into General Electric's historical performance, explore our detailed analysis of past performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

GE has several strategic opportunities to enhance its market position, including investing over $1 billion in its Maintenance, Repair, and Overhaul (MRO) facilities worldwide. This investment aims to meet the growing demand for CFM LEAP engines, with more than 10,000 additional engines currently in backlog. The company's strategic alliances, such as the partnership with Kratos Turbine Technologies, focus on developing small affordable engines for unmanned aerial systems, potentially expanding GE's market reach. Regulatory changes, like the introduction of the 320XLR aircraft powered by LEAP engines, also present opportunities for growth. GE's earnings are forecast to grow 17.1% per year, faster than the US market average of 15.2%, indicating a positive outlook for future profitability.

See what the latest analyst reports say about General Electric's future prospects and potential market movements.

Threats: Key Risks and Challenges That Could Impact General Electric's Success

GE faces several external threats, including intense competition in both commercial and defense sectors. Despite its deep domain expertise and commitment to innovation, the company must navigate competitive pressures to maintain its market share. Economic factors, although not currently impacting GE's business, pose potential risks in the broader market environment. Operational risks, such as the constrained material supply affecting growth across services and new engines, remain a significant challenge. Additionally, GE's profit margins have declined from 19.1% last year to 5.8%, indicating potential vulnerabilities in maintaining profitability. The presence of large one-off items, like the $1.9 billion loss impacting financial results, further complicates the company's financial landscape.

Conclusion

General Electric's strong financial health, driven by a significant increase in adjusted EPS and a resilient aftermarket services business, positions the company well for sustained success. However, critical challenges such as supply chain constraints and declining new engine output present significant hurdles. Strategic investments in MRO facilities and partnerships to develop new technologies offer promising growth opportunities. The company's high Price-To-Earnings Ratio of 51.1x compared to peers and industry averages indicates that GE is considered expensive, which may impact investor sentiment and future performance. Navigating these complexities will be crucial for GE's continued profitability and market position.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Undervalued with excellent balance sheet.