- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

Should You Reassess General Dynamics After Pentagon Pushes for Missile Production Surge?

Reviewed by Bailey Pemberton

Thinking about General Dynamics? You are certainly not alone. Many investors are eyeing this stock, trying to decide whether now is the right moment to buy, hold, or just keep watching. The defense giant has been making headlines, both for its sturdy customer contracts and for how broader geopolitical tensions might boost demand. As you weigh your options, let's first take stock (no pun intended) of GD's performance and what's driving its price.

Over the past year, General Dynamics has delivered a solid 18.1% return, with an impressive 31.6% gain so far this year. Even zooming out to the last five years, the stock has climbed a remarkable 167%. In just the past month, shares are up 6.4%, as investors anticipate steady growth fueled by contract wins and ramped-up production needs. The Pentagon is actively urging suppliers like General Dynamics to ramp up missile output, underscoring a shift in risk perception that is supporting the stock price. Even so, the headlines about China limiting critical minerals supply have injected a note of caution, reminding investors that global supply chains can still throw a curveball.

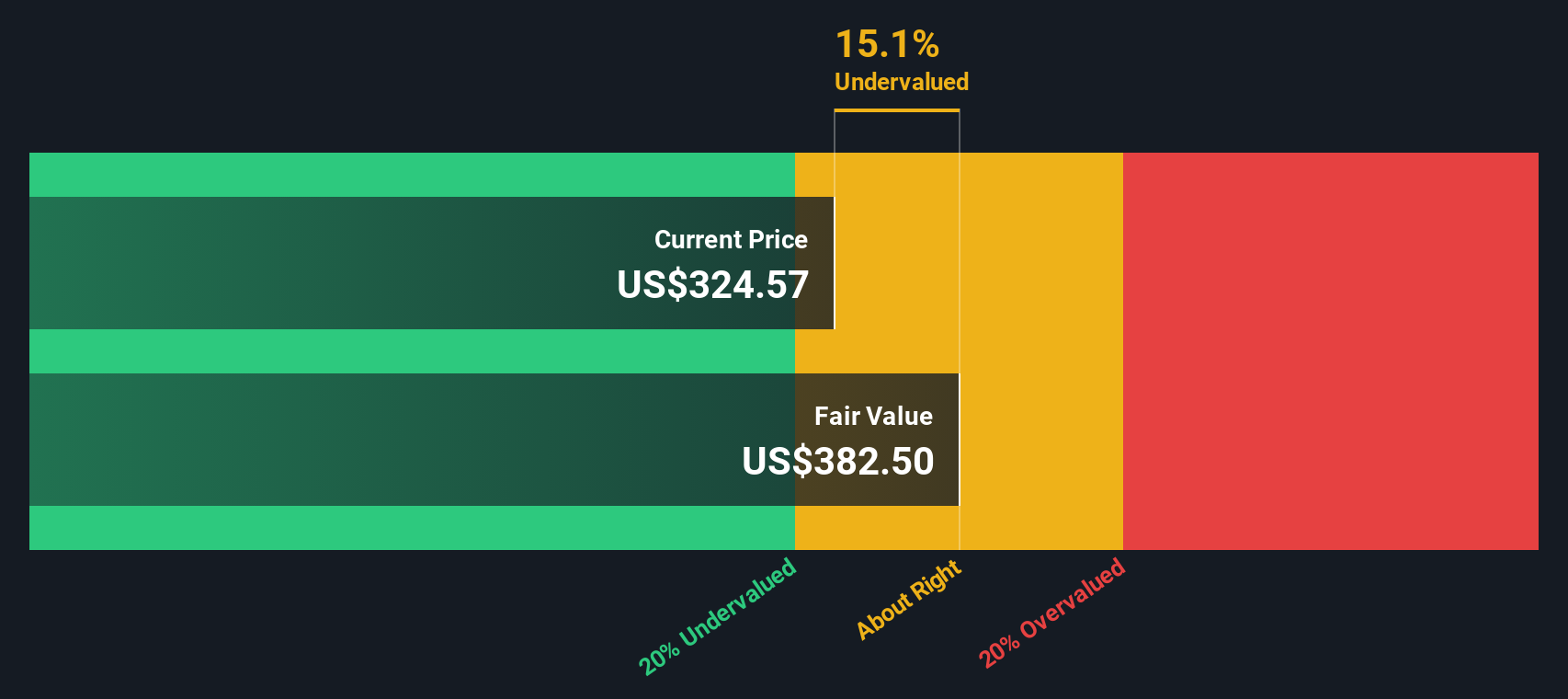

Against that backdrop, valuation matters more than ever. Based on six commonly used checks of a company's intrinsic value, General Dynamics scores a 4, meaning it appears undervalued in four out of six ways we measure. Is that enough to tip the scales in favor of buying, or is there more beneath the surface? Let's walk through how the valuation checks stack up. Stick around, because there's an even sharper approach to value that we'll reveal by the end.

Why General Dynamics is lagging behind its peers

Approach 1: General Dynamics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts those amounts back to today's value, aiming to estimate what the entire business is really worth. In the case of General Dynamics, analysts and forecast models have mapped out expected cash generation well into the 2030s using this approach.

General Dynamics currently generates about $3.94 billion in Free Cash Flow (FCF). Analyst projections indicate FCF will exceed $5.2 billion by 2029, and, based on extrapolations, could reach $6.5 billion by 2035. It is important to note that after five years the projections become more model-driven and less reliant on direct analyst estimates.

Using a two-stage Free Cash Flow to Equity model, the DCF assessment values General Dynamics shares at $378.06 each. This result is based on robust cash flow growth assumptions and discounting future dollars back to today's terms at a risk-appropriate rate. Compared to the current price, this calculation implies an intrinsic discount of 9.2 percent, suggesting the stock appears just about in line with its fair value according to this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out General Dynamics's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: General Dynamics Price vs Earnings

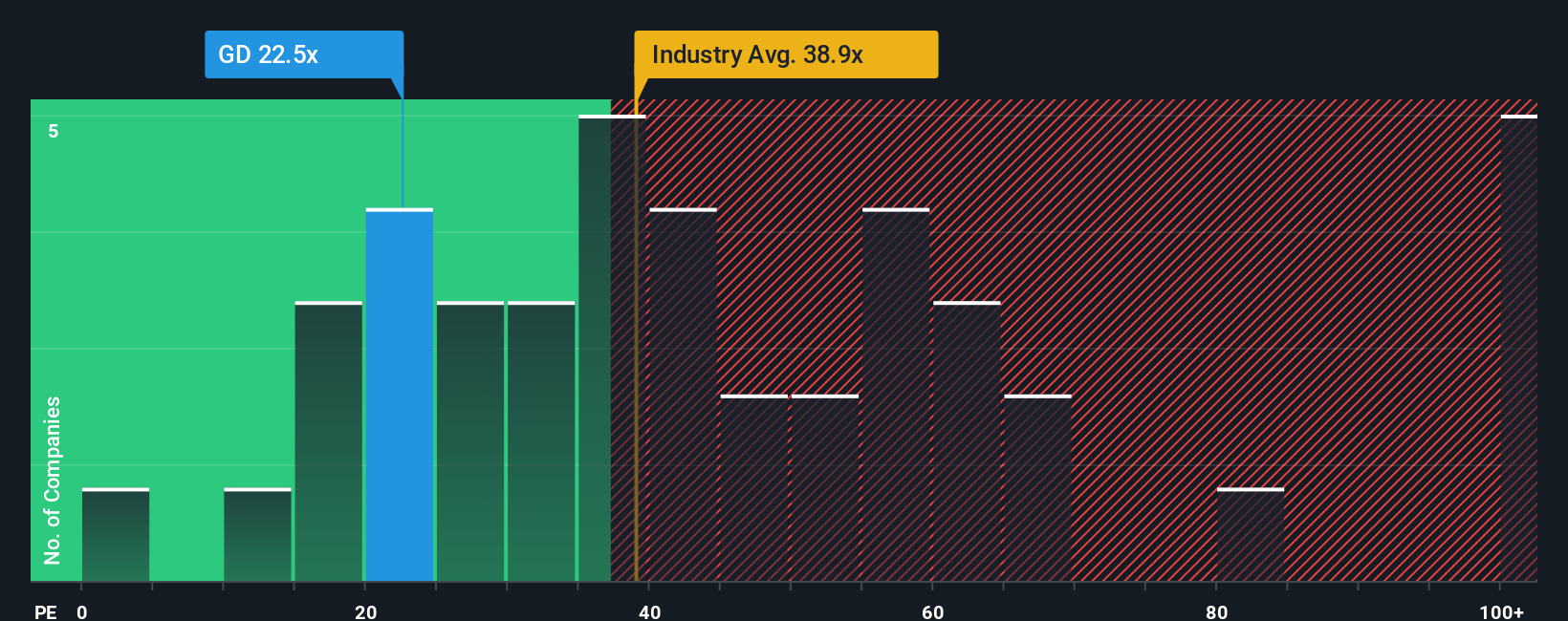

The price-to-earnings (PE) ratio is widely used for valuing profitable companies because it reflects how much investors are willing to pay for each dollar of earnings. For businesses like General Dynamics that have stable profits and a long history of generating earnings, the PE ratio offers an accessible and reliable snapshot of valuation. Generally, faster-growing and lower-risk companies command higher PE multiples, while volatile or slow-growing businesses tend to trade at more modest levels.

Currently, General Dynamics trades at a PE ratio of 22.6x. This is well below the Aerospace & Defense industry average of 39.4x and is also cheaper than the average for its peer group at 36.9x. On the surface, this might make General Dynamics look like a bargain compared to its sector. However, there is more to the story than simply comparing headline ratios.

Simply Wall St's proprietary “Fair Ratio” comes into play here. This tailored metric assesses what an appropriate PE should be for General Dynamics by factoring in fundamentals like its earnings growth, risk profile, profit margins, industry dynamics and even its market cap. This approach is more nuanced and investor-focused than a straightforward industry or peer comparison since those figures can be skewed by outliers or irrelevant business models.

For General Dynamics, the Fair Ratio is calculated at 26.1x. Since the current PE is 22.6x, the stock is trading slightly below what is considered its fair multiple. The difference is not large, and the PE is well within a reasonable range, suggesting the stock is fairly valued at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Dynamics Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind a company, your perspective that connects what you believe about General Dynamics’ future (like expected revenue, earnings, and margins) to the numbers you use for fair value. This transforms cold data into a personal investment thesis.

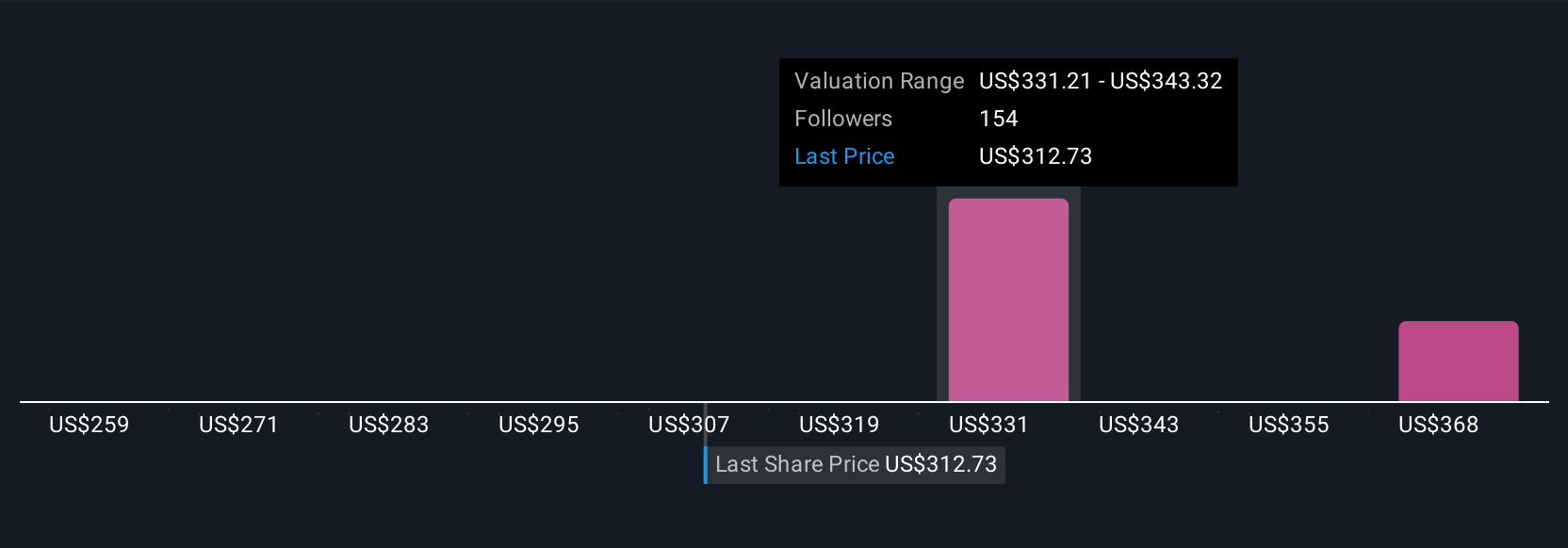

Narratives make investing more approachable by letting you anchor your forecast to actual events and outlooks, then compare your calculated fair value to the market price to guide your next move. Narratives are easy to create and view on Simply Wall St’s Community page, where millions of investors share their own views. They update automatically as the latest news or earnings come in, so your story and numbers always reflect fresh information.

For example, using General Dynamics: one investor might believe that strong defense spending and IT modernization will drive revenue to $55.8 billion and earnings to $5.1 billion by 2028, resulting in a fair value of $370. In contrast, another investor with a more cautious view might expect just $4.5 billion in earnings, setting fair value at $280. Your Narrative helps you define your numbers and conviction, making your investment decision both dynamic and uniquely yours.

Do you think there's more to the story for General Dynamics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives