- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics Corporation's (NYSE:GD) Shareholders Might Be Looking For Exit

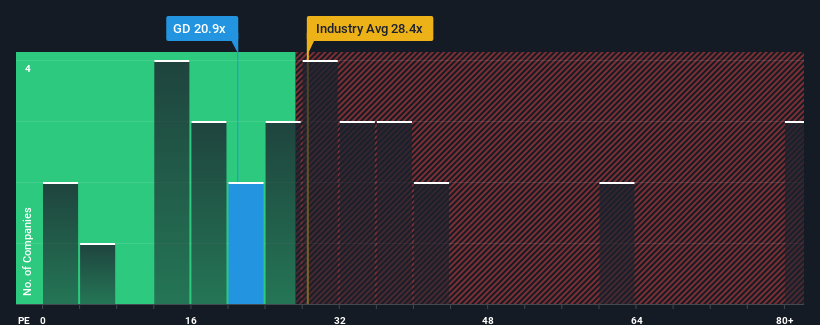

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider General Dynamics Corporation (NYSE:GD) as a stock to potentially avoid with its 20.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for General Dynamics have been in line with the market. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for General Dynamics

How Is General Dynamics' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like General Dynamics' to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow EPS by 9.4% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 13% per annum over the next three years. That's shaping up to be similar to the 12% per annum growth forecast for the broader market.

With this information, we find it interesting that General Dynamics is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From General Dynamics' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that General Dynamics currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for General Dynamics with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than General Dynamics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GD

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives