- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

AI Partnerships And A Higher Dividend Might Change The Case For Investing In General Dynamics (GD)

Reviewed by Sasha Jovanovic

- General Dynamics’ board has declared a regular quarterly dividend of US$1.50 per share, payable on February 6, 2026, to shareholders of record as of January 16, 2026.

- This payout comes as the company reports consecutive quarters of double-digit earnings growth, record defense backlogs, and expanding AI and cloud partnerships that could reshape its long-term revenue streams.

- We’ll now examine how General Dynamics’ recent AI and cloud collaboration with Google Public Sector influences the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

General Dynamics Investment Narrative Recap

To own General Dynamics, you need to be comfortable with a defense and aerospace story anchored in long-cycle U.S. government programs, record backlogs, and steady dividend payments. The latest dividend affirmation largely reinforces this longer term thesis and does not materially alter the nearer term focus on contract execution in Marine Systems or the key risk around legal, supply chain, and wage related challenges that could pressure margins.

The most relevant recent development to set alongside this dividend is GDIT’s expanded AI and cloud collaboration with Google Public Sector, which sits squarely within the Technologies segment. That partnership ties directly into one of General Dynamics’ main potential growth drivers: rising demand for secure IT modernization and mission software, which could become an increasingly important counterbalance to any earnings volatility in more capital intensive platforms.

Yet despite these apparent strengths, investors still need to weigh the emerging class action wage fixing lawsuit and its potential impact on...

Read the full narrative on General Dynamics (it's free!)

General Dynamics' narrative projects $55.8 billion revenue and $5.1 billion earnings by 2028. This requires 3.6% yearly revenue growth and about a $1.0 billion earnings increase from $4.1 billion today.

Uncover how General Dynamics' forecasts yield a $380.80 fair value, a 13% upside to its current price.

Exploring Other Perspectives

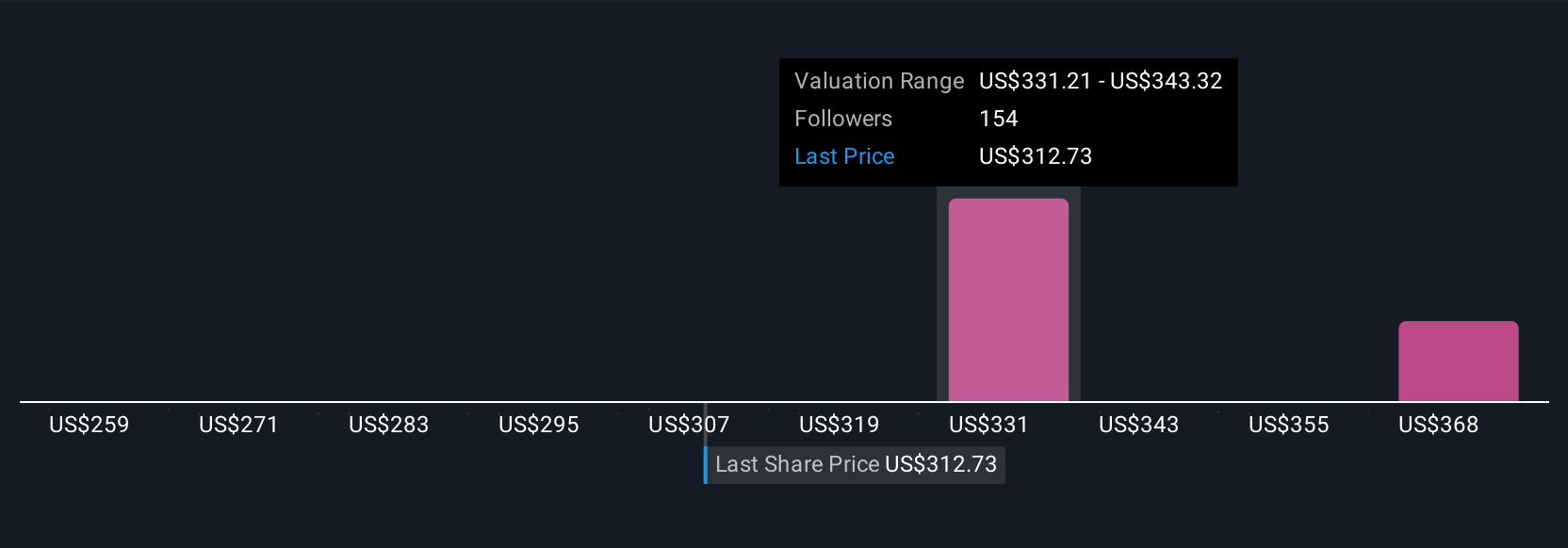

Six fair value estimates from the Simply Wall St Community span roughly US$317 to US$381 per share, underscoring how differently individual investors view General Dynamics. You may want to compare those views with the company’s dependence on record defense backlogs as a key earnings driver over the coming years.

Explore 6 other fair value estimates on General Dynamics - why the stock might be worth 6% less than the current price!

Build Your Own General Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Dynamics research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free General Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Dynamics' overall financial health at a glance.

No Opportunity In General Dynamics?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026