- United States

- /

- Machinery

- /

- NYSE:GBX

Is Greenbrier Companies (GBX) Undervalued? Revisiting the Stock’s Fundamentals After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Greenbrier Companies (GBX) shares have seen some movement this week, prompting investors to revisit the company’s fundamentals and recent performance. This follows a gradual decline in the stock’s price over the past month.

See our latest analysis for Greenbrier Companies.

Greenbrier Companies’ share price has lost momentum lately, with a 28.2% decline year-to-date and noticeable drops over the last quarter. However, the bigger picture shows a three-year total shareholder return of 92.7%, which is an impressive performance despite recent headwinds. Investors seem to be weighing growth potential against shifting perceptions of risk and valuation as the stock rebalances after its earlier surge.

If you’re watching the market for promising opportunities beyond railcar manufacturing, consider broadening your view and discover fast growing stocks with high insider ownership

With shares currently trading well below analyst targets, but with recent earnings growth lagging, the question for investors is whether Greenbrier Companies is now undervalued or if the market has already factored in what lies ahead.

Most Popular Narrative: 17.9% Undervalued

The current narrative places Greenbrier Companies’ fair value at $53.5 per share, a notable premium to the last close at $43.90. This potential upside is driving debate about whether the market is missing something crucial as the company recalibrates in a complex operating environment.

The continued investment in capacity rationalization and facility optimization, as seen with the rationalization in Europe, could lead to long-term cost reductions and improved competitive positioning. This may positively impact net margins and operating income.

Curious why a traditional rail company could command a premium that rivals the highest fliers? The forecast behind this valuation hinges on bold projections for profit margins, shifting revenue trends, and aggressive assumptions about future earnings multiples. Ready to uncover the figures that drive analysts to such an optimistic target? The numbers might surprise you.

Result: Fair Value of $53.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fluctuating trade policies or slower order rates could limit Greenbrier’s revenue recovery and challenge the optimistic narrative around future growth.

Find out about the key risks to this Greenbrier Companies narrative.

Another View: Value Ratios Tell a Different Story

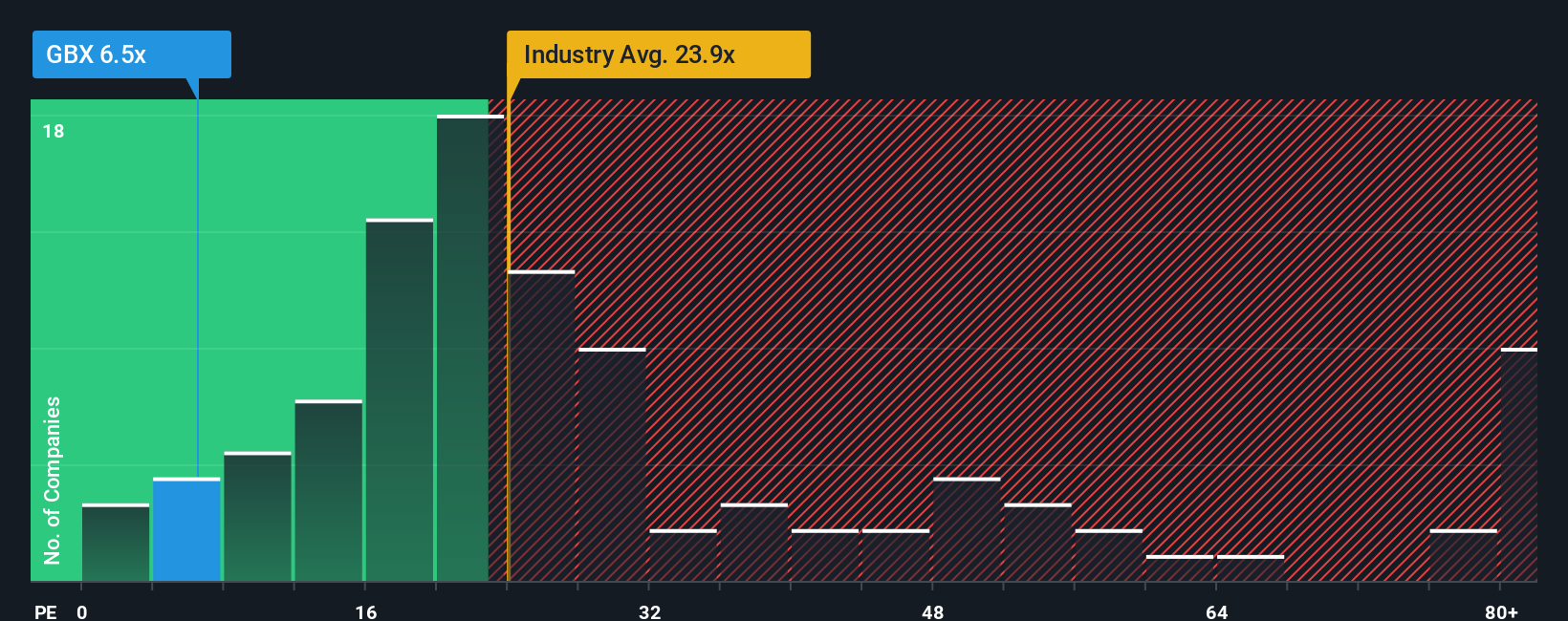

Stepping back from future growth assumptions, Greenbrier Companies currently trades at a price-to-earnings ratio of 5.9x. This is well below the US Machinery industry average of 23.4x and beneath peers at 30.4x. Even compared to its fair ratio of 7.3x, the stock looks attractively priced, suggesting an opportunity if the market adjusts its expectations. But does this deep discount mean hidden value, or is there more risk under the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greenbrier Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greenbrier Companies Narrative

If you see things differently or want to dig into the details yourself, it’s quick and easy to build your own perspective based on the latest figures. Do it your way

A great starting point for your Greenbrier Companies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next great opportunity pass you by. Take the lead and spot emerging winners across different markets using tailored screening tools powered by real data.

- Capitalize on the momentum of high-yield investments by checking out these 19 dividend stocks with yields > 3% for solid returns and long-term stability.

- Tap into technologies transforming healthcare by reviewing these 33 healthcare AI stocks which is paving the way for breakthroughs in patient care and diagnostics.

- Catch early growth stories by evaluating these 3586 penny stocks with strong financials that are positioned for outsized upside and market surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBX

Greenbrier Companies

Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives