- United States

- /

- Machinery

- /

- NYSE:FTV

Fluke’s Solar Fault Locator Could Be a Game Changer for Fortive (FTV)

Reviewed by Sasha Jovanovic

- In early October 2025, Fluke Corporation, a Fortive subsidiary, announced the launch of the Fluke GFL-1500 Ground Fault Locator, a tool that speeds up and improves the safety of troubleshooting ground faults in utility-scale solar power systems.

- This product debut directly addresses a persistent challenge in solar maintenance and may position Fortive to capture new opportunities in the expanding renewable energy service market.

- Let's examine how Fortive's entry into advanced solar diagnostic tools could shape its broader investment thesis and sector positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Fortive Investment Narrative Recap

To be a Fortive shareholder right now, you need to believe in the company's ability to leverage innovation and recurring revenue streams to offset near-term challenges like segment concentration risk and government spending constraints. The Fluke GFL-1500 launch opens the door to growth in renewable services, but it does not materially alter the need for stronger core revenue growth or resolve the biggest risk of reduced diversification post-spin-off.

Among recent announcements, Fortive’s latest earnings report stands out, reflecting year-on-year declines in revenue and net income, which add pressure for new products like the GFL-1500 to drive performance. While the new diagnostic tool may support long-term market expansion, earnings momentum and segment concentration remain central to the stock’s near-term outlook.

By contrast, investors should be aware of how Fortive’s reduced diversification after the Precision Technologies spin-off could amplify volatility and risks if...

Read the full narrative on Fortive (it's free!)

Fortive's outlook anticipates $4.5 billion in revenue and $741.9 million in earnings by 2028. This forecast reflects a 9.8% annual decline in revenue and a $27 million decrease in earnings from the current $768.9 million.

Uncover how Fortive's forecasts yield a $57.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

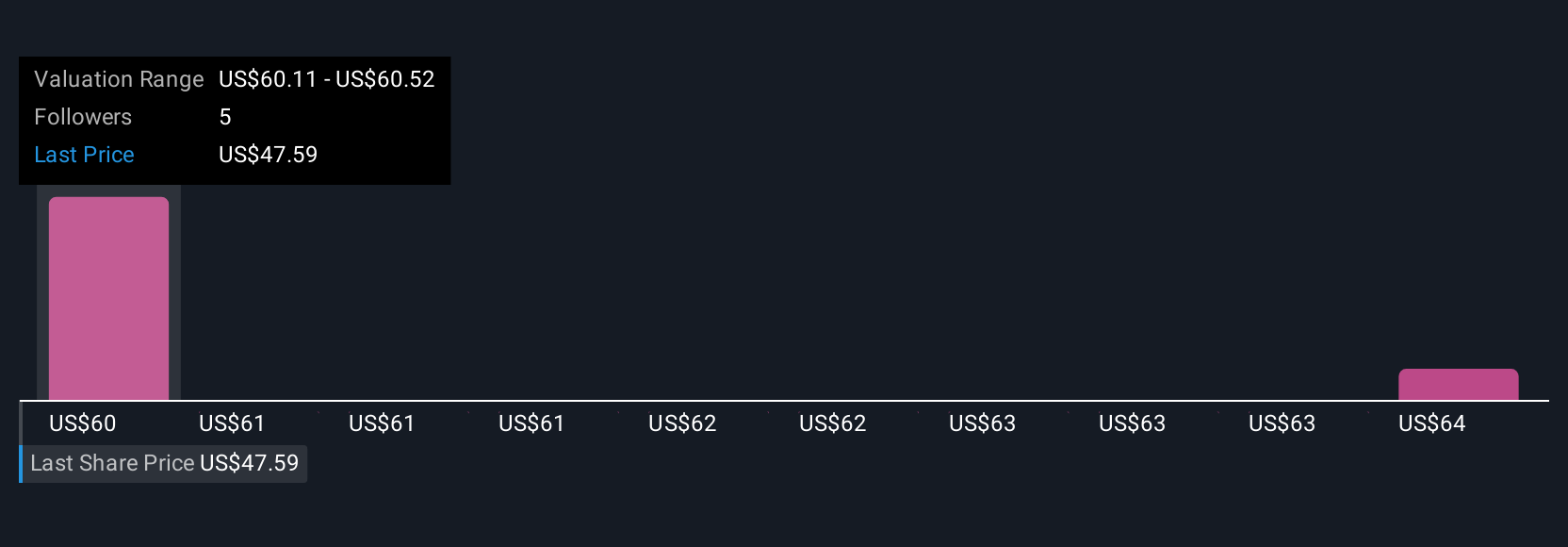

Simply Wall St Community members offered fair value estimates for Fortive ranging from US$57.25 to US$59.88, drawing from two viewpoints. These contrasting assessments come as concentration risk after the recent business spin-off remains a leading concern for future stability.

Explore 2 other fair value estimates on Fortive - why the stock might be worth as much as 19% more than the current price!

Build Your Own Fortive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortive research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Fortive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortive's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTV

Fortive

Designs, develops, manufactures, and markets products, software, and services in the United States, China, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives