- United States

- /

- Construction

- /

- NYSE:FLR

How Investors Are Reacting To Fluor (FLR) Facing Class Action Lawsuits Over Project Cost Disclosures

Reviewed by Sasha Jovanovic

- Several class action lawsuits were filed in recent months against Fluor Corporation, alleging the company made false and misleading statements regarding project costs, delays, and the effects of economic uncertainty on its operations between February 18, 2025 and July 31, 2025.

- This legal wave follows the release of disappointing second quarter financial results and comes at a time when investor scrutiny is focused on Fluor's handling of major infrastructure projects and risk management disclosures.

- We'll now assess how these lawsuits and allegations about project challenges may shape Fluor's current investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Fluor Investment Narrative Recap

Fluor’s investment case centers on belief in its ability to convert a US$28.2 billion order backlog into consistent earnings growth, supported by exposure to infrastructure and nuclear power projects. The wave of class action lawsuits and scrutiny around project disclosures may weigh on near-term confidence, but the primary catalyst remains execution on major projects, while litigation and its effects on investor trust stand as the biggest current risk.

The most relevant recent event is Fluor’s disappointing Q2 results, which coincided with these lawsuits and led to a sharp drop in share price. This underscores how cost overruns, project delays, and transparency concerns are moving from background risks to the forefront of shareholder attention, especially as investors await the upcoming Q3 results for signs of operational improvement or continuing turbulence.

However, investors should also be aware that, while a strong project backlog can drive optimism, ongoing legal and project-related uncertainties could...

Read the full narrative on Fluor (it's free!)

Fluor's outlook anticipates $19.6 billion in revenue and $511.6 million in earnings by 2028. This is based on a 6.2% annual revenue growth rate and a significant decline in earnings, down $3.6 billion from current earnings of $4.1 billion.

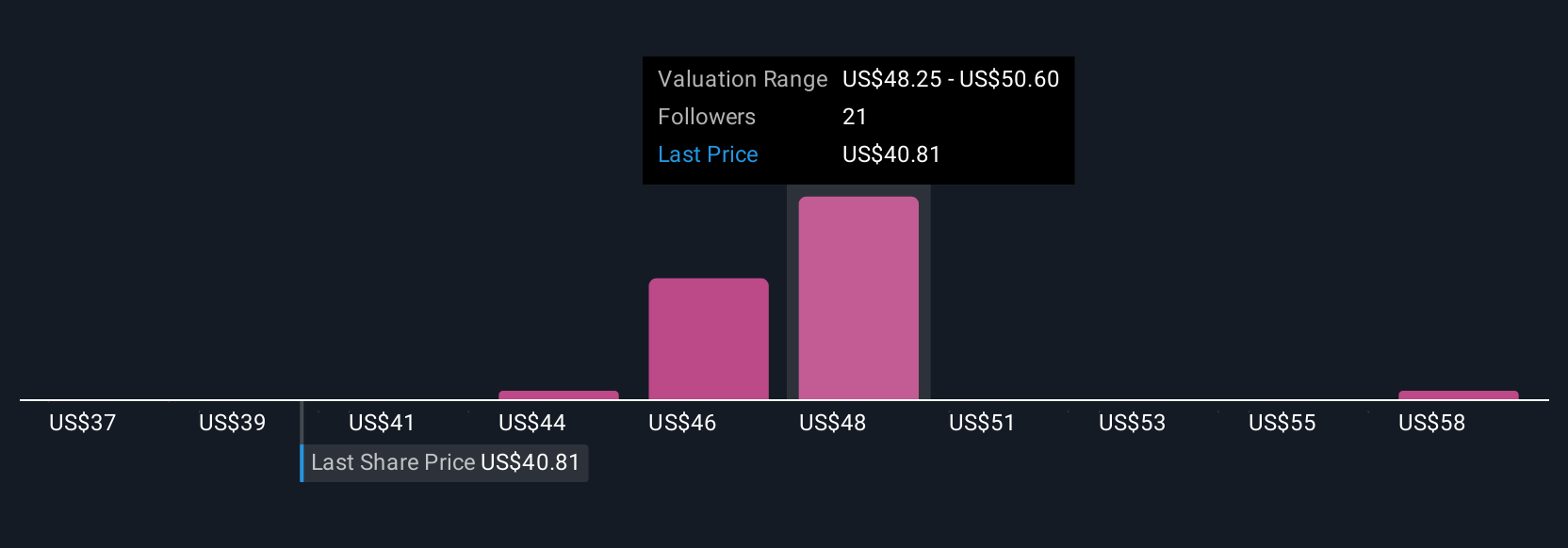

Uncover how Fluor's forecasts yield a $49.89 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimate Fluor’s fair value between US$45.61 and US$60, showing varied individual forecasts. As increasing legal and project risks come into focus, you might want to explore these diverse views on how such issues could influence Fluor’s future performance.

Explore 6 other fair value estimates on Fluor - why the stock might be worth as much as 38% more than the current price!

Build Your Own Fluor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fluor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluor's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives