- United States

- /

- Construction

- /

- NYSE:FIX

What Comfort Systems USA (FIX)'s New Acquisitions and Project Backlog Mean For Shareholders

Reviewed by Simply Wall St

- Earlier this week, Comfort Systems USA announced a series of acquisitions and reported robust demand across technology, industrial, and healthcare sectors, supported by a record project backlog and positive industry trends.

- An interesting detail from the announcement is the company's rising returns on capital employed, indicating effective reinvestment, but also a heavier reliance on current liabilities, which could carry risks if not carefully managed.

- We'll explore how the company's strong project backlog and capital reinvestment are influencing its overall investment narrative and outlook.

Comfort Systems USA Investment Narrative Recap

To be a shareholder in Comfort Systems USA, you likely need to believe in the company’s ability to convert its record project backlog and consistent demand in technology and industrial markets into sustainable growth, while balancing the operational risks of rapid expansion. This week’s news of further acquisitions reinforces the existing short-term growth catalyst, the robust backlog, yet does not materially alter the current key risk, which remains the company’s exposure to rising construction costs due to tariffs and policy shifts.

Among the latest company announcements, the acquisition of Century Contractors, expected to add approximately US$90 million in revenue, stands out. This aligns squarely with the ongoing demand pipeline, supporting the narrative that strategic deal-making may help strengthen near-term revenue streams and address backlog conversion.

However, contrasting this positive momentum, investors should be mindful that a heavier reliance on current liabilities to fund operations introduces potential risks if...

Read the full narrative on Comfort Systems USA (it's free!)

Comfort Systems USA's outlook anticipates $9.1 billion in revenue and $824.9 million in earnings by 2028. This scenario assumes a 7.4% annual revenue growth rate and an increase in earnings of $229.5 million from the current $595.4 million.

Exploring Other Perspectives

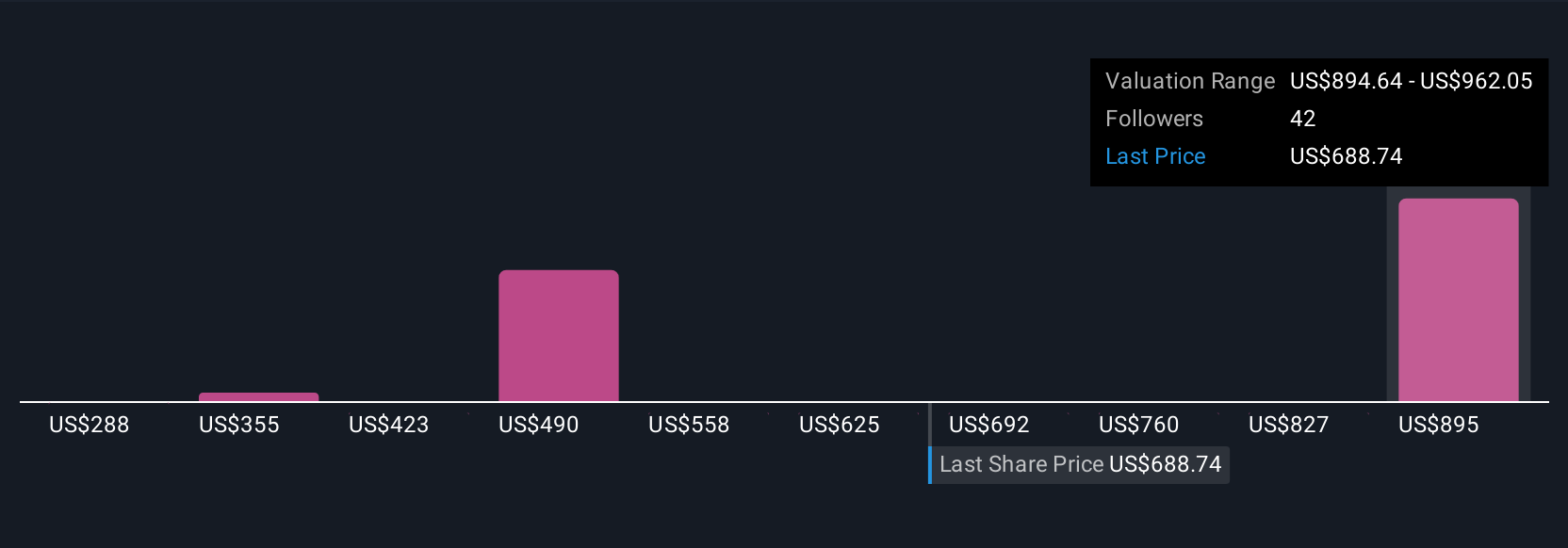

Nine fair value estimates from the Simply Wall St Community span US$287.88 to US$961.57 per share, highlighting sharply different views. With ongoing margin pressures from rising supply chain costs, it’s clear opinions can vary widely, explore how others are seeing the outlook today.

Build Your Own Comfort Systems USA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comfort Systems USA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comfort Systems USA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comfort Systems USA's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives