- United States

- /

- Construction

- /

- NYSE:FIX

Is It Too Late to Consider Comfort Systems USA After Its Massive 2025 Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Comfort Systems USA is still a smart buy after its massive run up, or if you are arriving just as the party is ending, this breakdown will help you cut through the noise and focus on what the stock is really worth.

- The share price has climbed to around $989.48, delivering about 2.9% over the last week, 3.6% over the past month, and an eye catching 130.9% year to date, with multi year gains of 114.6% over 1 year, 732.0% over 3 years, and 1873.1% over 5 years that have clearly reset market expectations.

- Behind those moves, investors have been reacting to a steady stream of contract wins and ongoing demand for mechanical, electrical, and plumbing services in large commercial and industrial projects. This has reinforced the narrative that Comfort Systems USA is tied into long term infrastructure and reshoring trends. At the same time, broader interest in companies leveraged to data centers, healthcare, and mission critical facilities has pushed more attention, and capital, toward names like this.

- On our checklist of 6 valuation tests, Comfort Systems USA scores a 4 out of 6, suggesting the market may not be fully pricing in all the positives just yet. However, the headline number never tells the whole story. Next, we will unpack the main valuation approaches you are used to seeing and then finish with a more powerful way of thinking about what this business is truly worth.

Approach 1: Comfort Systems USA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Comfort Systems USA, the model uses a 2 Stage Free Cash Flow to Equity approach, starting with current trailing twelve month free cash flow of about $798.7 Million and building up from there.

Analysts expect free cash flow to grow rapidly in the near term, with projections reaching around $2.415 Billion by 2029. Beyond the explicit analyst horizon, Simply Wall St extrapolates further cash flow growth, gradually slowing over the following years as the business matures.

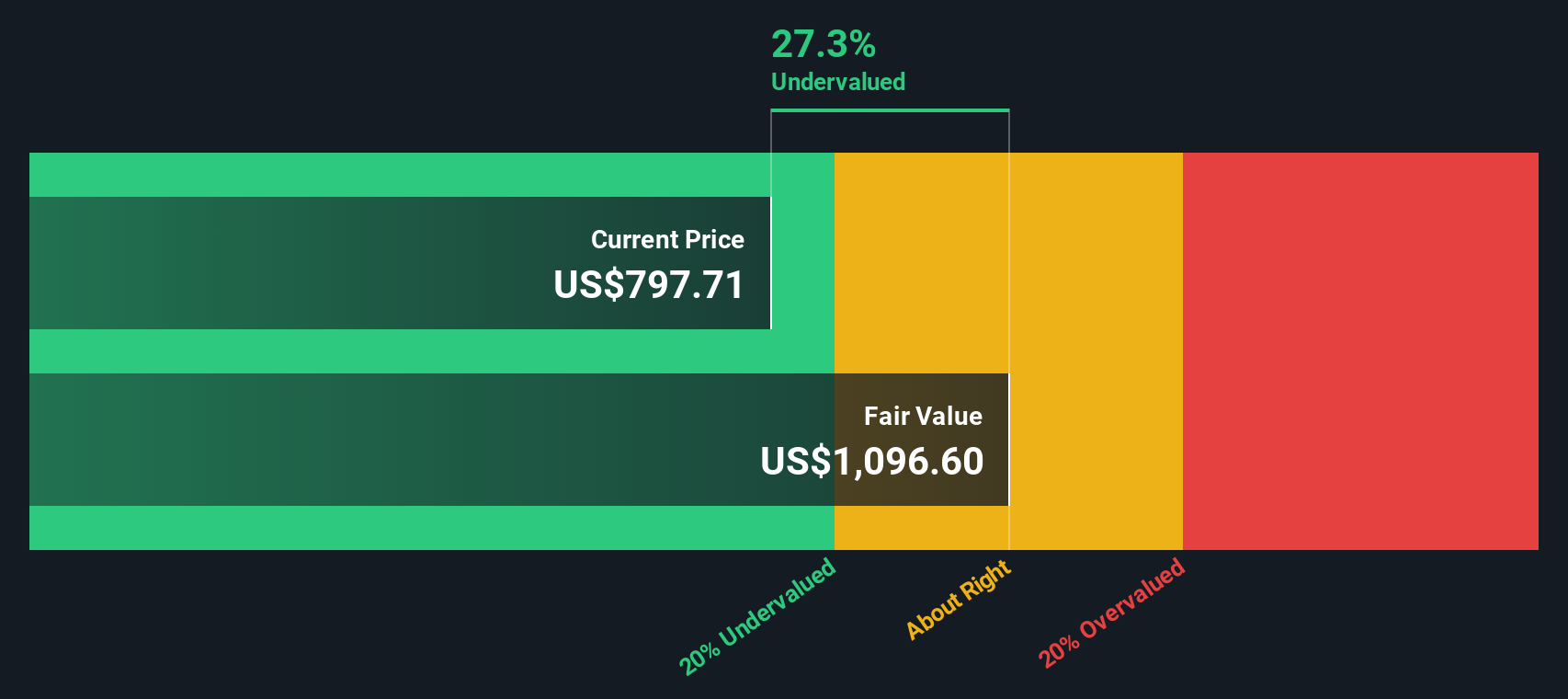

When all those projected cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $1,476 per share. Compared with the recent share price near $989, the DCF suggests the stock is about 33.0% undervalued. This indicates the market may still be underestimating the cash generation potential of the business.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comfort Systems USA is undervalued by 33.0%. Track this in your watchlist or portfolio, or discover 902 more undervalued stocks based on cash flows.

Approach 2: Comfort Systems USA Price vs Earnings

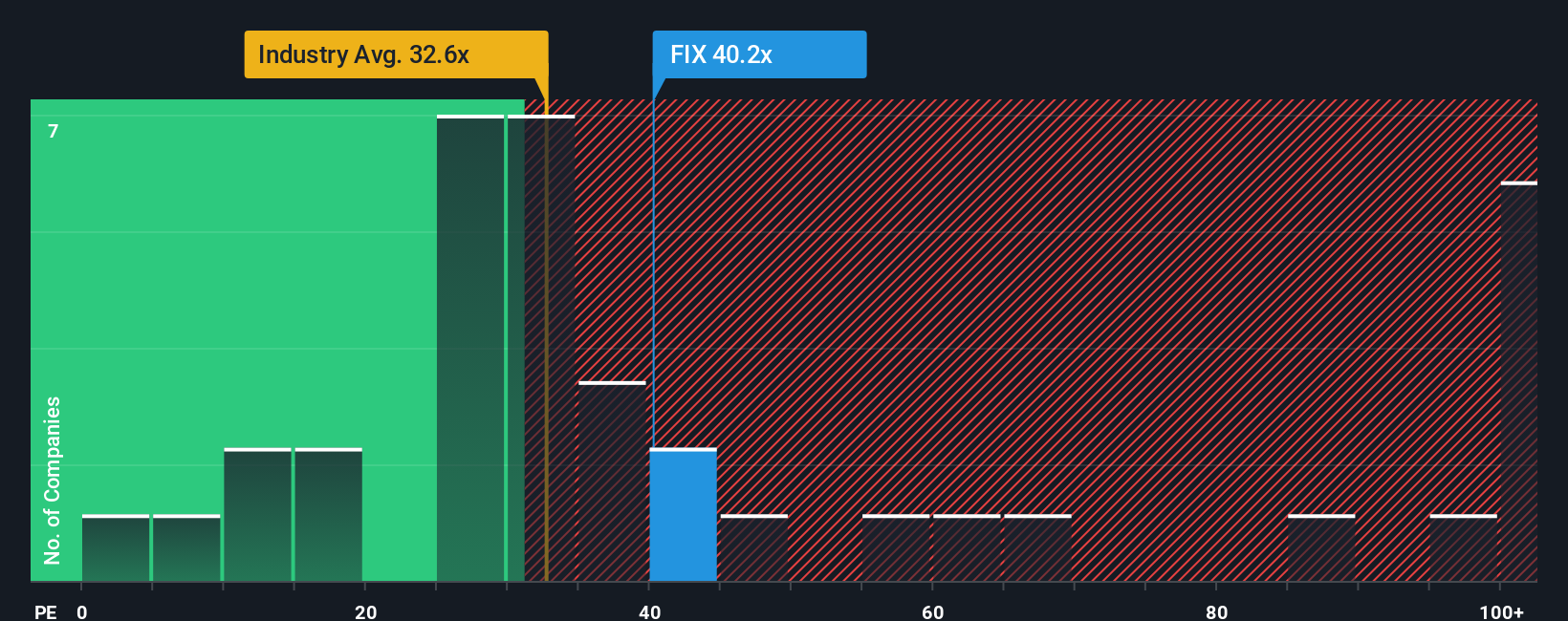

For profitable companies like Comfort Systems USA, the price to earnings ratio is often the clearest shorthand for how much investors are willing to pay for each dollar of current profits. A higher PE can be justified when a business has strong, durable growth prospects and relatively low risk, while a lower PE is typical for slower growing or more cyclical names.

Comfort Systems USA currently trades on about 41.6x earnings, which is above the broader Construction industry average of roughly 34.2x, but below the peer group average near 62.0x. That puts it in a premium, but not extreme, territory. To refine this view, Simply Wall St uses a Fair Ratio, here at around 43.7x, which estimates the multiple the company should trade on after accounting for its earnings growth outlook, margins, risk profile, industry positioning, and market cap.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for how Comfort Systems USA actually operates and grows, rather than assuming all companies deserve the same multiple. With the current PE of 41.6x sitting slightly below the Fair Ratio of 43.7x, the stock appears modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

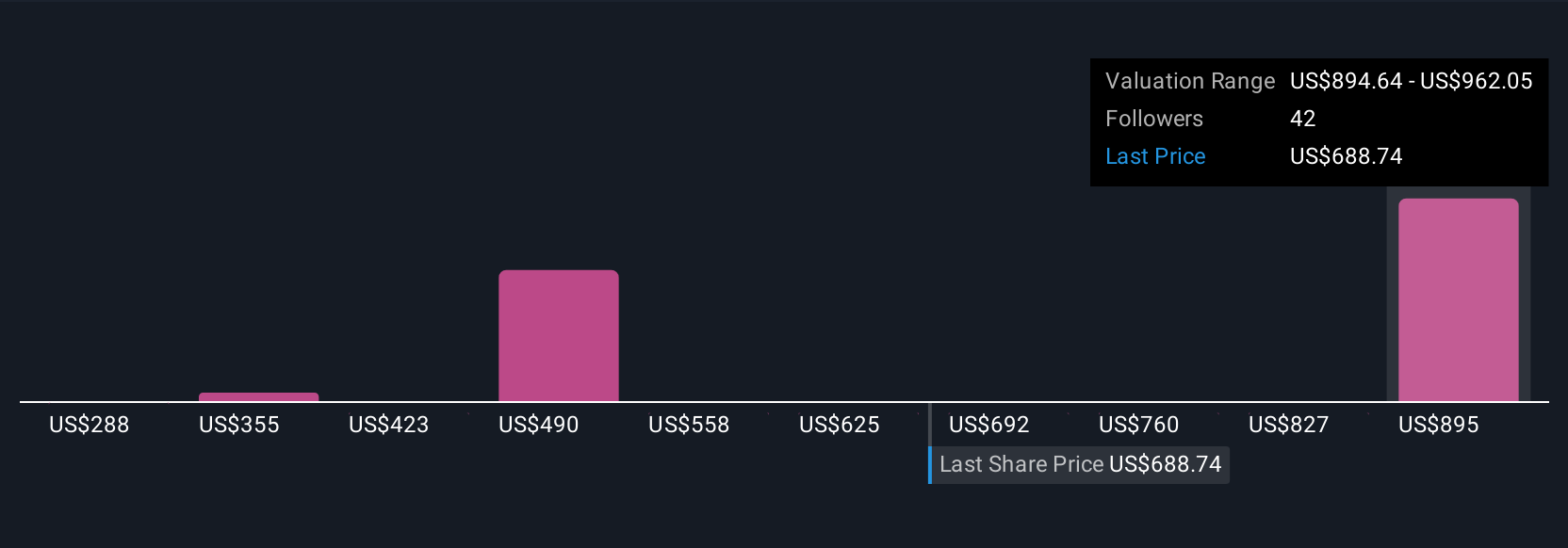

Upgrade Your Decision Making: Choose your Comfort Systems USA Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework that lets you write the story behind your numbers by linking your view of Comfort Systems USA’s future revenues, earnings, and margins to a concrete financial forecast and fair value estimate. All of this is available within an easy to use tool on Simply Wall St’s Community page that millions of investors already tap into to compare their Fair Value to the current Price, see in real time how new information like earnings or major contract wins reshapes those assumptions, and understand why one investor might build a bullish Narrative that leans into record backlog, modular expansion, and resilient margins to justify a Fair Value well above today’s price, while another, more cautious Narrative might stress concentration in data centers, labor constraints, and cyclicality to arrive at a much lower Fair Value and a potential sell signal instead.

Do you think there's more to the story for Comfort Systems USA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026