- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (NYSE:FIX) Reports Strong Quarterly Earnings With Sales of US$1,831 Million

Reviewed by Simply Wall St

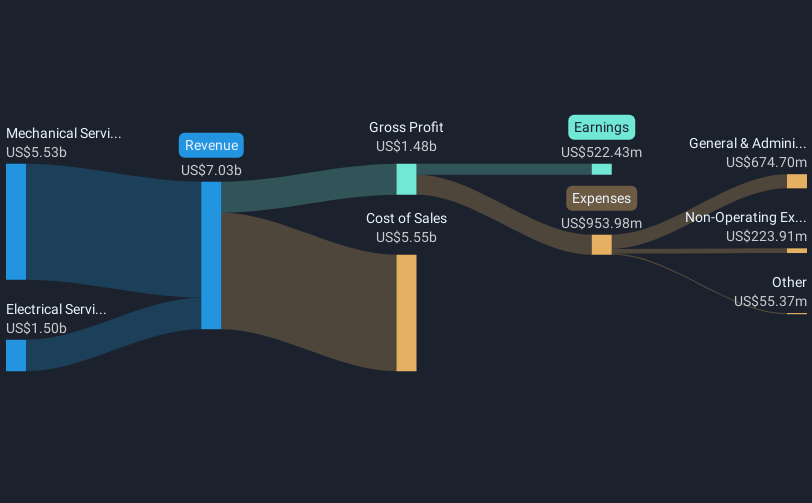

Comfort Systems USA (NYSE:FIX) recently experienced a significant 47% price increase over the past month, coinciding with the company’s notable first quarter earnings report. The earnings showed impressive year-over-year growth with sales reaching $1,831 million and net income of $169 million. Additionally, the company announced a dividend increase and provided an update on its ongoing share buyback program, which may have further bolstered investor sentiment. Despite broader market fluctuations and mixed market news including tariff uncertainties and federal policy expectations, Comfort Systems USA's strong financial performance stood out amidst these developments.

Comfort Systems USA (FIX) experienced a significant share price increase in response to encouraging first-quarter earnings, a dividend increase, and updates on its share buyback program. These factors may positively influence the company's market perception, supporting a stronger revenue and earnings outlook. The introduction of advanced technologies and a strategic focus on modular construction are expected to solidify Comfort Systems USA's market presence, particularly against the backdrop of tariff and supply chain cost concerns. Over the past five years, FIX achieved a very large total shareholder return of over 1276.55%, reflecting strong long-term performance.

Within the past year, FIX has outperformed the US Construction industry and broader market, boasting a return of 64.2% compared to industry growth of 37.5% and market gains of 17.7%. The company's strong earnings growth and robust backlog, nearly $7 billion, support positive revenue forecasts. However, profit margins may face pressure from potential policy changes and inflation. With current analyst consensus placing its price target at approximately $488.20, FIX's recent share price movement to $397.54 suggests potential for future growth, albeit at a premium compared to the industry average Price-to-Earnings ratio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives