- United States

- /

- Aerospace & Defense

- /

- NYSE:EVTL

Weekly Picks: 🥃 A bruised bourbon maker ready for a rebound

Each week our analysts hand pick their favourite Narratives.

Narratives are a game-changing way for investors to make smart decisions on their stocks. A narrative always has 3 parts: a story, a forecast and a fair value . You can create one yourself in 3 minutes or you can select one from our thriving community.

This week’s picks cover:

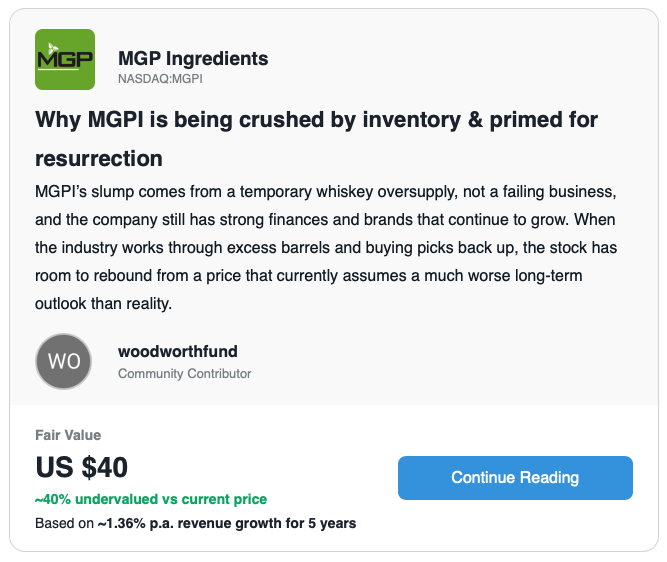

- 🥃 How MGP Ingredients’ inventory pile-up could set the stage for a surprisingly strong comeback once demand steadies.

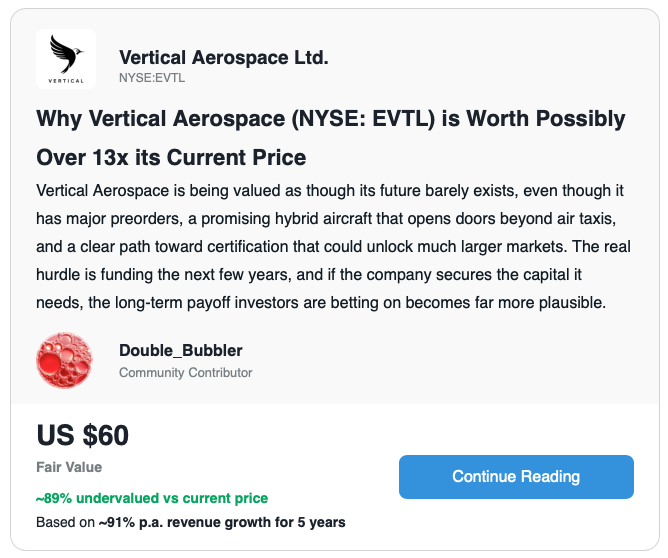

- 🚁 Why Vertical Aerospace’s early progress might turn today’s doubts into tomorrow’s opportunity as flying taxis inch closer to real use.

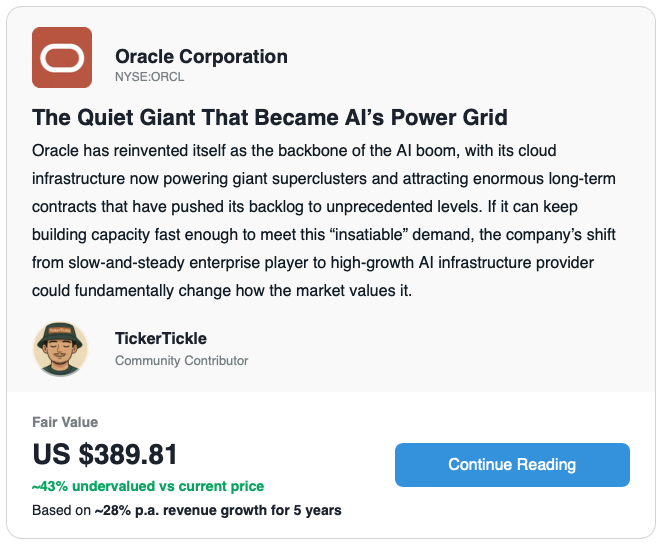

- 🔌 How Oracle quietly became a key player in the AI boom, building the kind of infrastructure that’s now in sudden, heavy demand.

💡 Why we like it: It weaves MGPI’s three business engines into a tight, convincing story that’s more about misunderstood structure than short-term noise.

💡 Why we like it: It brings a spark of real excitement to a sector most people have already given up on, making the future feel possible again. The enthusiasm is contagious without ever feeling forced, and it pulls you into the story even if you’re skeptical.

💡 Why we like it: The narrative turns a huge, complicated shift inside Oracle into a simple, easy-to-follow story that feels surprisingly exciting. The writing makes a giant company’s reinvention feel clear and human, pulling you in without overwhelming you.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page.

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

Disclaimer

Simply Wall St analyst Stella Ong and Simply Wall St have no position in any of the companies mentioned. TickerTickle is an employee of Simply Wall St, but has written a narrative in their capacity as an individual investor. These narratives are general in nature and explore scenarios and estimates created by the authors. These narratives do not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimate’s are estimations only, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stella and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stella Ong

About NYSE:EVTL

Vertical Aerospace

An aerospace and technology company, engages in designing, manufacturing, and selling zero operating emission electric vertical takeoff and landing (eVTOL) aircraft for use in the advanced air mobility market in the United Kingdom.

Medium-low risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026