- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (NYSE:ETN) Reports Robust Q1 Earnings with Year-Over-Year Sales Increase

Reviewed by Simply Wall St

Eaton (NYSE:ETN) recently declared a quarterly dividend, highlighting its ongoing commitment to shareholder returns. The company's robust Q1 earnings, featuring a notable increase in sales and net income year-over-year, coincide with positive guidance for future growth. Additionally, Eaton's investment in expanding its Orchard Park facility points to increasing demand in its aerospace segment. These developments align with the company's impressive 19% price rise over the past month, which significantly outpaced the market's 4% increase in the same period. Such performance underscores Eaton's growth momentum and alignment with overall market optimism.

You should learn about the 2 risks we've spotted with Eaton.

Eaton's recent dividend declaration and strong Q1 earnings illustrate its commitment to enhancing shareholder value and align well with the company's strategic growth initiatives. Over the past five years, Eaton's shares have delivered a substantial total return of 375.44%, showcasing its strong performance compared to both its historical achievements and the broader market trends.

However, in the past year, Eaton underperformed the US Electrical industry benchmark, which returned 14.3%. This underperformance highlights the competitive nature of the industry and the potential challenges Eaton faces as it continues to invest in expanding its market presence, particularly in the aerospace and data center sectors. The current price movement, with a recent 19% increase, reflects market optimism towards Eaton's strategies but also positions its share price closely with the consensus price target of US$339.62, a 12.2% premium over the current share price of US$298.11.

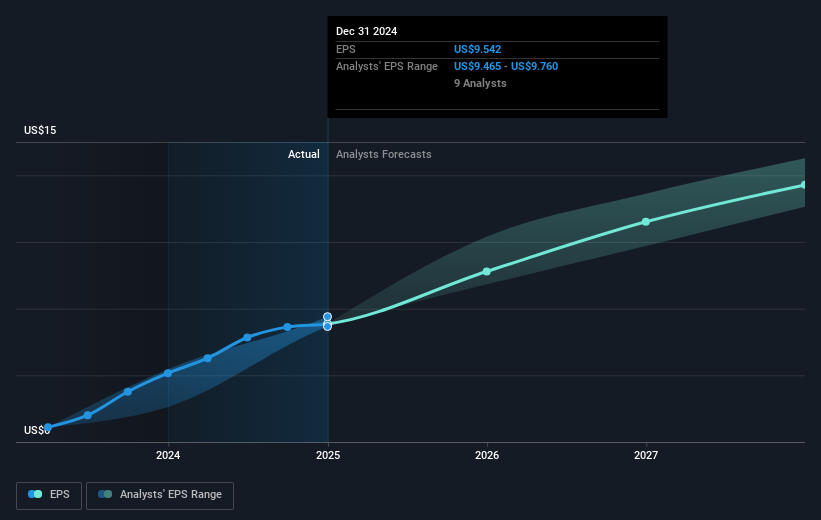

The company's acquisition of Fibrebond and investments in localized manufacturing are expected to support revenue growth and improve margins, potentially enhancing earnings projections. Analysts forecast a revenue growth rate of 8.4% per year over the next three years, with earnings expected to rise to US$5.6 billion by 2028. This aligns with expectations for higher net margins and a projected PE ratio adjustment. These strategic actions are crucial in driving Eaton's future revenue and earnings potential, despite risks from global trade uncertainties and industry-specific challenges.

Evaluate Eaton's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives