- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (NYSE:ETN) Collaborates On HiZ Wildfire Prevention Tech With 90% Detection Accuracy

Reviewed by Simply Wall St

Eaton (NYSE:ETN) introduced its new HiZ Protect™ solution aimed at wildfire prevention, enhancing safety in utility distribution systems. This innovation, achieving over 90% accuracy in detecting high-impedance faults, reflects the company's commitment to improving grid safety. Over the past week, Eaton's stock saw a 1.89% increase, potentially influenced by this product's promising implications, while the broader market also experienced a partial recovery with major indexes rising amid news of easing tariffs. The combined market uplift and Eaton's technological advancement likely contributed positively to the company's share price performance during this period.

Buy, Hold or Sell Eaton? View our complete analysis and fair value estimate and you decide.

Over the past five years, Eaton has achieved a total shareholder return of 326.86%, including share price appreciation and dividends. This robust performance stands out in comparison to industry peers, particularly as Eaton outperformed the US Electrical industry, which faced declines over the past year. Key factors contributing to this impressive result include significant growth in the Electrical Americas segment, driven by demand for data centers and megaprojects, and strategic acquisitions aimed at expanding its presence in high-growth sectors like aerospace and data infrastructure.

Eaton's recent initiatives further illustrate its commitment to long-term growth. The introduction of the HiZ Protect™ technology for improving fault detection aligns with global demand for enhanced utility safety. Additionally, ongoing share buybacks, such as the US$891.1 million repurchase in 2024, reflect confidence in its financial health and earnings potential. Eaton's strategic focus on innovation and growth has positively impacted shareholder returns, as evidenced by its strong earnings growth and enhanced dividend payouts.

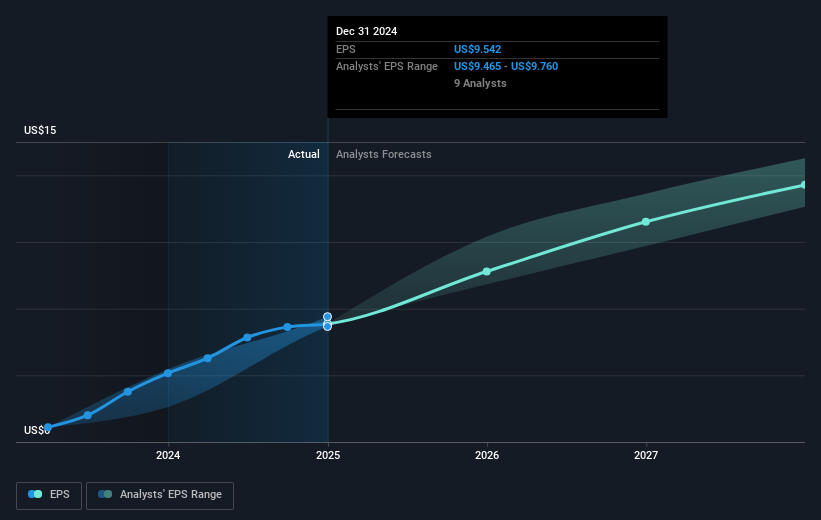

Explore Eaton's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives