- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN) Valuation Check After Recent 10% Pullback and Slowing Share Price Momentum

Reviewed by Simply Wall St

Eaton (ETN) has been grinding sideways lately, with the stock roughly flat over the past week and down about 10% this month. That pullback is catching value focused investors’ attention.

See our latest analysis for Eaton.

Zooming out, the recent 10.3% 1 month share price pullback comes after a strong multi year run, with the 3 year total shareholder return still above 120%. This suggests momentum is cooling rather than collapsing as investors reassess growth expectations.

If Eaton’s reset has you thinking about what else might be setting up for the next leg higher, this could be a good moment to explore aerospace and defense stocks.

With double digit earnings growth, a modest year to date gain, and a stock still trading below consensus targets, Eaton’s pause raises the key question: is this a fresh buying window or is future growth already priced in?

Most Popular Narrative: 18% Undervalued

With Eaton last closing at $338.93 against a narrative fair value of $410.77, the spread implies meaningful upside if the growth path plays out.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt, with major partnerships (e.g., NVIDIA, Siemens Energy) and acquisitions (Fibrebond, Resilient Power) positioning Eaton as the go to provider for next generation high density and AI centric infrastructure. This supports outsized revenue growth and structurally higher margins due to richer, more sophisticated product mix.

Want to see how double digit growth, higher margins, and a premium future earnings multiple all fit together into that upside case? Dig into the full narrative to unpack the assumptions driving this valuation roadmap.

Result: Fair Value of $410.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in vehicle and eMobility, or a slowdown in AI driven data center demand, could quickly challenge the upbeat growth narrative.

Find out about the key risks to this Eaton narrative.

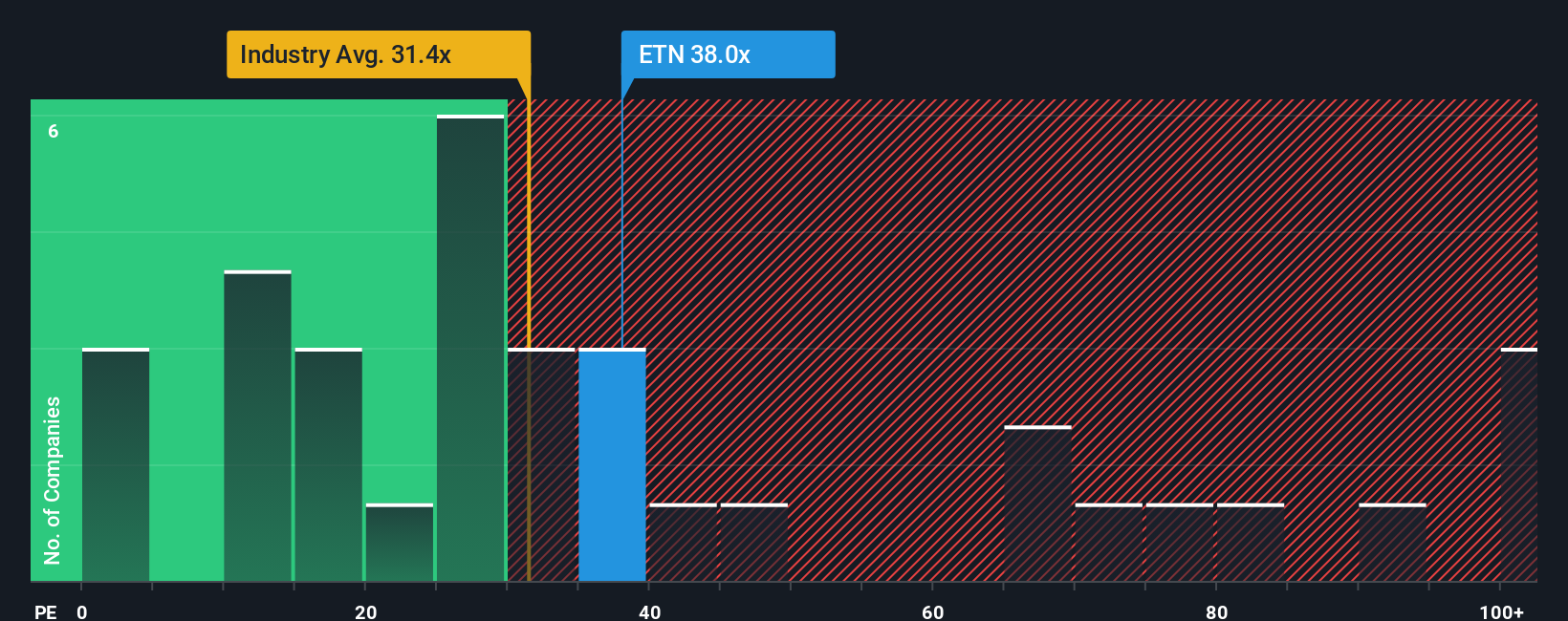

Another View: Rich On Earnings Today

While the narrative fair value points to upside, Eaton’s current price equates to about 33.5 times earnings, above the US Electrical industry at 31.2 times but below peers on roughly 46.2 times, and under a fair ratio of 37.9 times. This leaves investors to weigh how much growth is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eaton Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Eaton research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, turn this research momentum into action by scanning fresh opportunities on Simply Wall Street’s powerful stock screener so you do not miss potential opportunities that fit your strategy.

- Explore mispriced opportunities by reviewing companies flagged as undervalued using these 909 undervalued stocks based on cash flows, which focuses on businesses whose cash flows suggest they may be trading below estimated value.

- Identify the next wave of innovation by focusing on emerging leaders in artificial intelligence with these 26 AI penny stocks and build a watchlist of companies with long-term growth potential.

- Assess potential income streams by searching for consistent payouts through these 15 dividend stocks with yields > 3% and highlight businesses with historically attractive dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026