- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Assessing Current Valuation After Recent Strong Performance

Reviewed by Simply Wall St

Most Popular Narrative: 5.8% Undervalued

The most popular narrative currently sees Eaton as undervalued, with a fair value that is nearly 6% higher than the current share price based on forward-looking growth expectations and certain financial assumptions.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt. Major partnerships (for example, NVIDIA and Siemens Energy) and acquisitions (such as Fibrebond and Resilient Power) are positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Think the only thing powering Eaton’s climb is broad market momentum? You’d be surprised at just how much this narrative leans on bold growth projections, ambitious margin targets, and valuation multiples that would turn heads. Want to see which headline assumptions are fueling this bullish price target and where the numbers actually come from? The narrative may surprise you.

Result: Fair Value of $394.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing momentum in vehicle segments or setbacks in new facility ramp-ups could quickly challenge these positive expectations and influence the direction ahead.

Find out about the key risks to this Eaton narrative.Another View: Is There an Overlooked Cost?

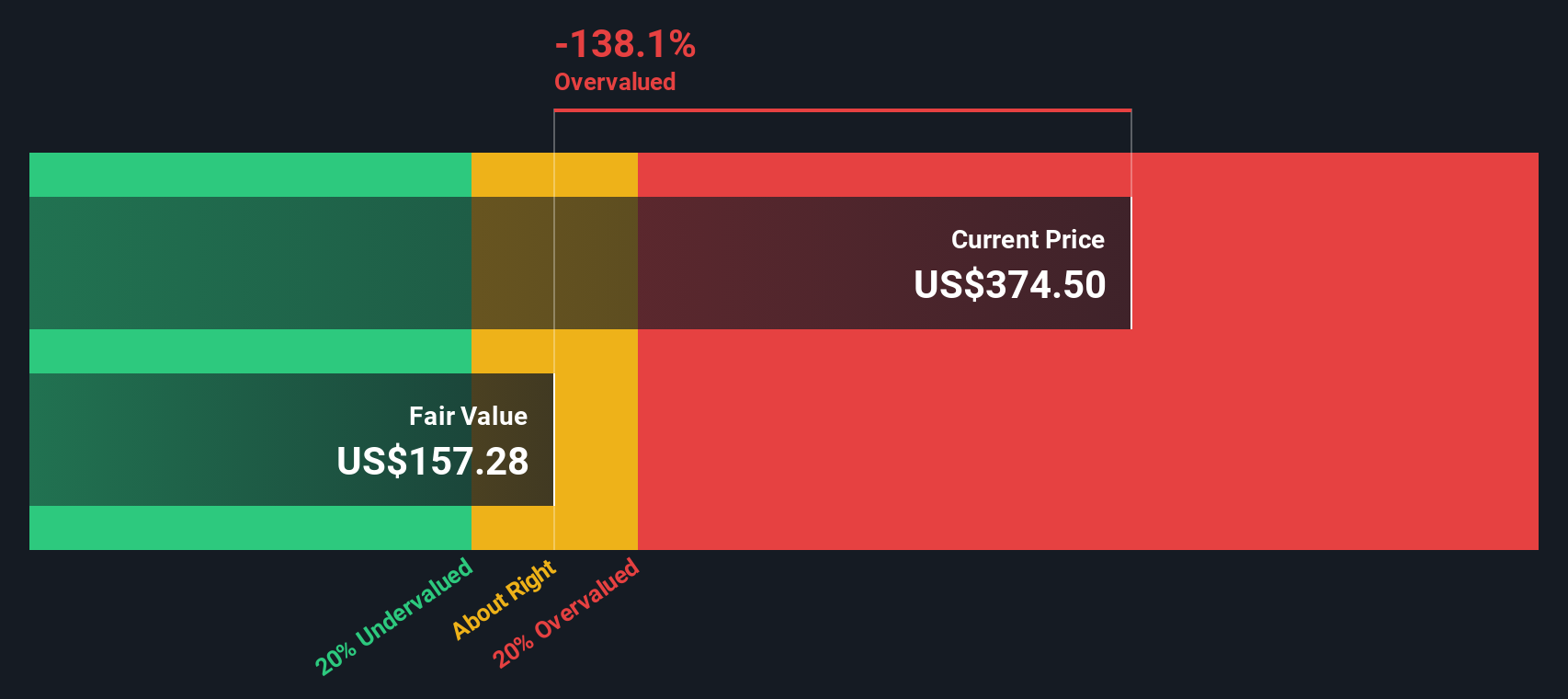

Looking beyond analysts’ consensus, our DCF model suggests Eaton’s current share price may be overvalued relative to future projected cash flows. This sets a starkly different tone. Could this mean the market’s optimism is running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eaton Narrative

If you see things differently or want to dig into the data on your own terms, shaping your own take takes only a few minutes. Do it your way.

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Moves?

Why stop with Eaton? If you want to stay ahead of the curve, there is a world of fresh opportunities ready for you now, waiting just a click away.

- Unlock hidden gems in the micro-cap universe and see which up-and-comers stand out for strong balance sheets with penny stocks with strong financials.

- Capture income potential by checking out companies consistently paying attractive yields through dividend stocks with yields > 3%.

- Get a jump on tomorrow’s breakthroughs by finding pioneers in healthcare’s AI transformation using healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives