- United States

- /

- Electrical

- /

- NYSE:EMR

Emerson Electric (EMR) Advances AI Integration With Nigel AI And TotalEnergies Collaboration

Reviewed by Simply Wall St

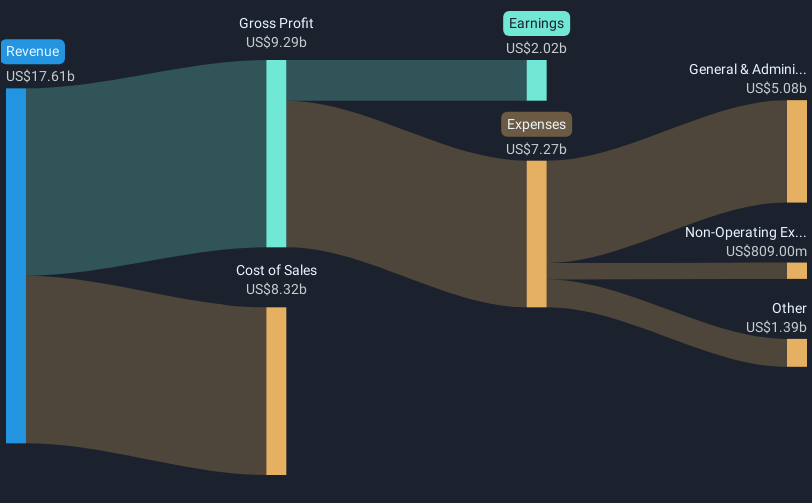

Emerson Electric (EMR) recently unveiled the Nigel™ AI Advisor, enhancing its software offerings, and entered a strategic collaboration with TotalEnergies, focusing on digital technologies for improved operational efficiency. These proactive strides in AI and industry partnerships reflect Emerson’s commitment to innovation. During the last quarter, Emerson's share price rose 43%, a notable performance in a market where major indexes like the S&P 500 and Nasdaq were slightly mixed after retreating from record highs. This price surge aligns with the broader market’s 14% growth over the past year, suggesting Emerson’s announcements likely supported its positive trend.

Emerson Electric has 2 weaknesses we think you should know about.

Emerson Electric's advancements with the Nigel™ AI Advisor and its partnership with TotalEnergies could enhance operational efficiencies and potentially support revenue growth, aligning with the narrative's emphasis on cost synergies and strategic investments. Over the last five years, Emerson's total shareholder return, including dividends, was 151.42%. This long-term performance reflects steady progression despite short-term market fluctuations. However, in the past year, Emerson underperformed compared to the US Electrical industry's return of 42.1%, highlighting potential sector-specific challenges.

The development of AI solutions and strong industry partnerships might contribute positively to Emerson's projected earnings of $3.2 billion by 2028. These initiatives could enhance revenue, supporting analysts' forecasts of a 5.1% annual revenue growth, though this is expected to be slower than the broader market's 9% growth. Analysts' current price target stands at US$143.75, slightly above the current share price of US$142.91, indicating limited upside. This aligns with the anticipated revenue and earnings improvements but suggests that the share price is near its estimated fair value based on existing market conditions.

Understand Emerson Electric's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives