- United States

- /

- Construction

- /

- NYSE:EME

Has EMCOR Group’s Impressive 2025 Surge Priced In the Recent Record-High Backlog?

Reviewed by Bailey Pemberton

Trying to figure out what your next move should be with EMCOR Group stock? You are not alone, and with the remarkable run this stock has had, it is a smart question to ask. Over just the past week, EMCOR rose 4.6%, boosted by market optimism, and the past month was even stronger with a 7.1% increase. Looking at the bigger picture, the returns are even more eye-catching: 46.4% year to date, 52.5% over the last year, and an impressive 454.7% over three years. Anyone who has held on for five years is sitting on an 827.4% gain. Investors clearly see major growth potential, or at least far less risk than before.

But what about valuation? That is the question every prudent investor has to ask once a stock climbs to new heights. EMCOR’s valuation score stands at 5 out of 6, meaning it is considered undervalued in five out of six key checks. That is rare for a company with returns like these and definitely suggests the market sees room for more upside, or perhaps is underestimating potential risks.

Let’s dig deeper into the numbers and walk through the most widely used valuation methods. We will see where EMCOR stands, why it ranks so highly, and if you keep reading, reveal one often-overlooked way to get an even clearer read on its real value.

Approach 1: EMCOR Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting those amounts back to their present value. This method aims to capture what the business is really worth based on how much cash it is expected to generate going forward.

For EMCOR Group, the model starts with its latest Free Cash Flow (FCF), which stands at $1.21 billion. Analysts provide direct forecasts for the next several years, with FCF projected to climb to around $2.76 billion by the end of 2029. After that, longer-range projections are extrapolated, but all calculations stick to the dollar for consistency. These estimates point to a steady growth rate in the company’s cash generation abilities over the next decade.

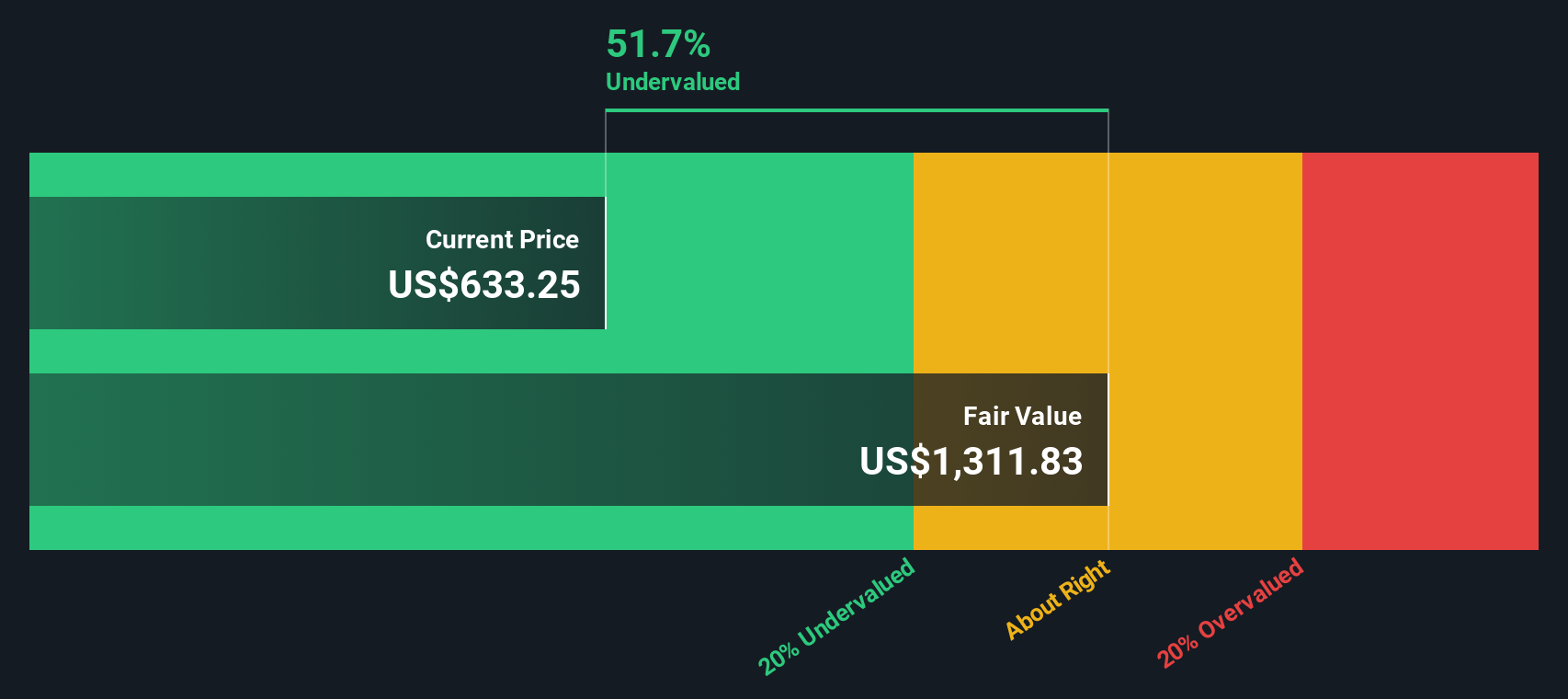

Once all future cash flows are discounted back to today, the DCF model gives EMCOR Group an intrinsic value of $1,310.93 per share. Comparing this figure to the current share price, the stock appears to be trading at a 48.9% discount. In other words, it is significantly undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EMCOR Group is undervalued by 48.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: EMCOR Group Price vs Earnings (PE)

For companies with consistent profits like EMCOR Group, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It tells investors how much they are paying for each dollar of company earnings. Generally, higher growth or lower risk should justify a higher PE ratio, while slower growth or greater risks should bring that multiple down.

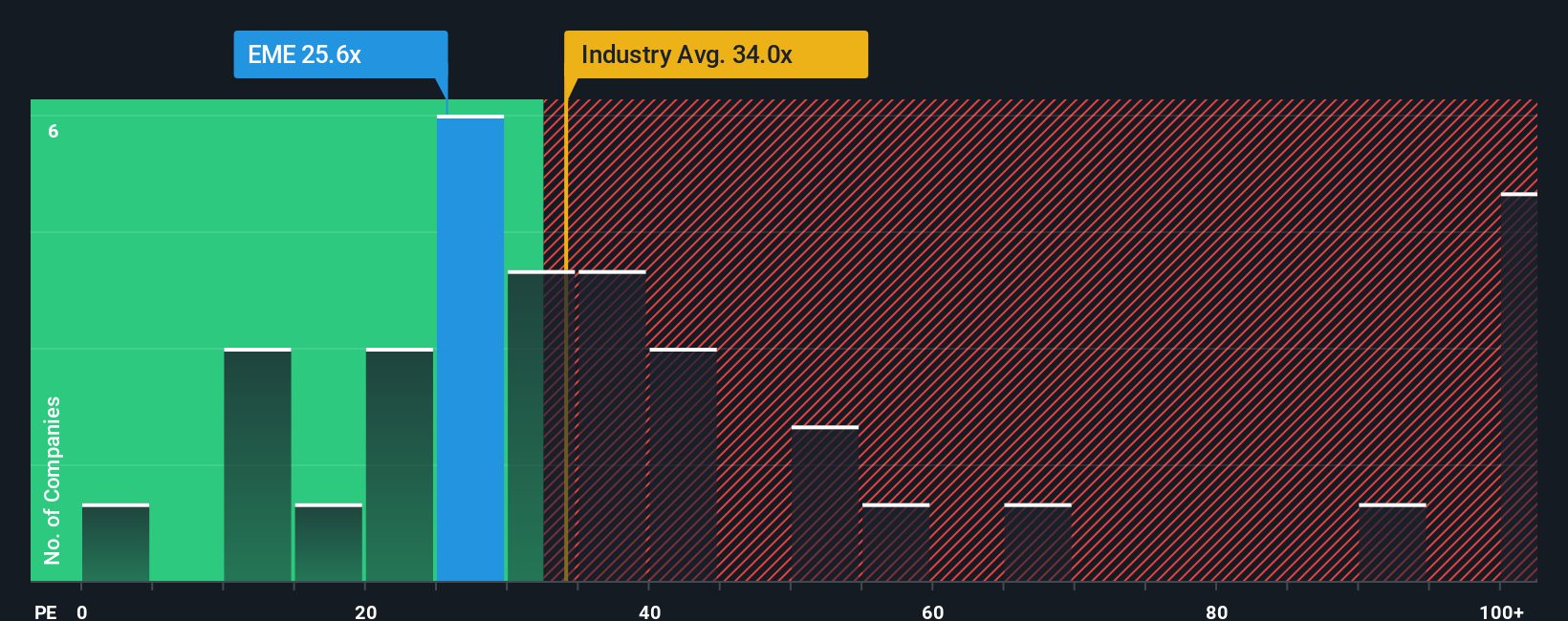

EMCOR Group’s current PE ratio is 27.14x. This is below both the Construction industry average of 36.01x and the average of its closest peers at 49.08x. On the surface, this would suggest the stock is cheaper than its competitors and the wider sector when simply comparing profit multiples.

However, looking at the “Fair Ratio,” a metric developed by Simply Wall St to reflect a company-specific appropriate multiple based on earnings growth, industry, profit margins, size, and risk, provides more context. For EMCOR Group, the Fair Ratio is 28.34x. Unlike comparing with peers or just the industry, this approach factors in everything from how efficiently EMCOR turns sales into profit to the risks unique to the business, making it a more holistic guide to fair value.

With EMCOR’s PE ratio just slightly below its Fair Ratio, shares look to be valued about right relative to its underlying fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EMCOR Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is an investment story: your perspective or hypothesis about a company’s future, which you can express by making judgments about its likely revenue, earnings growth, margins, and fair value. Narratives bridge the gap between a company’s story, its expected financial performance, and what its stock should be worth. This empowers you to move beyond headline numbers and root your decisions in your own analysis.

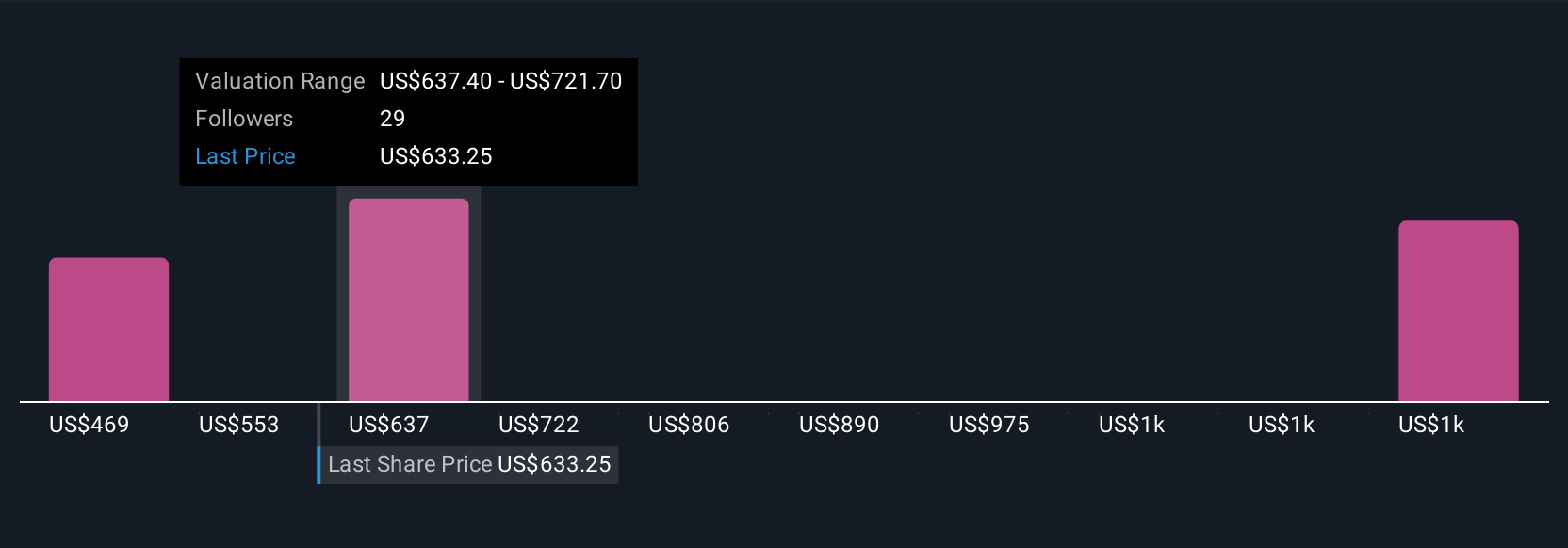

Narratives are easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors actively share viewpoints that help shape their buy or sell decisions. By comparing each Narrative’s Fair Value with the current stock Price, you can instantly see whether the market aligns with your view or if an opportunity exists. Since Narratives update dynamically with new data or news, your analysis stays current and relevant.

For instance, one investor’s Narrative might see EMCOR Group as fairly valued at $468.79 per share using cautious growth assumptions, while a more optimistic view values it at $681.67. This shows just how diverse perspectives can be among investors looking at the same company.

For EMCOR Group, we’ll make it really easy for you with previews of two leading EMCOR Group Narratives:

- 🐂 EMCOR Group Bull Case

Fair Value: $681.67

Current price is 1.7% below the narrative's fair value

Revenue Growth Rate: 9.7%

- Strong demand in data centers, healthcare, and sustainability projects has resulted in a record-high, diversified backlog that supports revenue growth and improved margins.

- Strategic acquisitions and investment in technical talent and prefabrication have expanded market reach and improved operational efficiency, helping EMCOR navigate labor shortages and strengthen its competitive advantage.

- Key risks to the outlook include ongoing labor shortages, exposure to industry cycles and oil/gas, M&A integration risks, and a limited focus on renewables relative to emerging trends.

- 🐻 EMCOR Group Bear Case

Fair Value: $468.79

Current price is 42.9% above the narrative's fair value

Revenue Growth Rate: 9%

- Long-term growth is supported by federal infrastructure investments, accelerating data center and AI demand, electrification, and manufacturing reshoring, all of which boost EMCOR's top line.

- Labor shortages, wage pressures, supply chain disruptions, and regulatory or economic cyclicality pose significant risks to project execution and margins.

- The company remains high quality with strong fundamentals and cash flow, but the current price reflects these positives, suggesting the stock could be fully valued at present levels.

Do you think there's more to the story for EMCOR Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives