- United States

- /

- Construction

- /

- NYSE:EME

EMCOR Group (NYSE:EME) Announces Regular Quarterly Dividend of US$0.25 Per Share

Reviewed by Simply Wall St

EMCOR Group (NYSE:EME) announced a regular quarterly cash dividend of $0.25 per share, sparking a notable 12% increase in its stock price over the past week. While this performance surpasses the broader market's 5% rise, the dividend affirmation likely added weight to the company's stronger-than-market movements. There were no other significant news items or earnings updates for EMCOR during this period that could have influenced its shares, suggesting investor sentiment around the reliable dividend announcement contributed positively to its short-term stock price trajectory.

We've spotted 1 warning sign for EMCOR Group you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

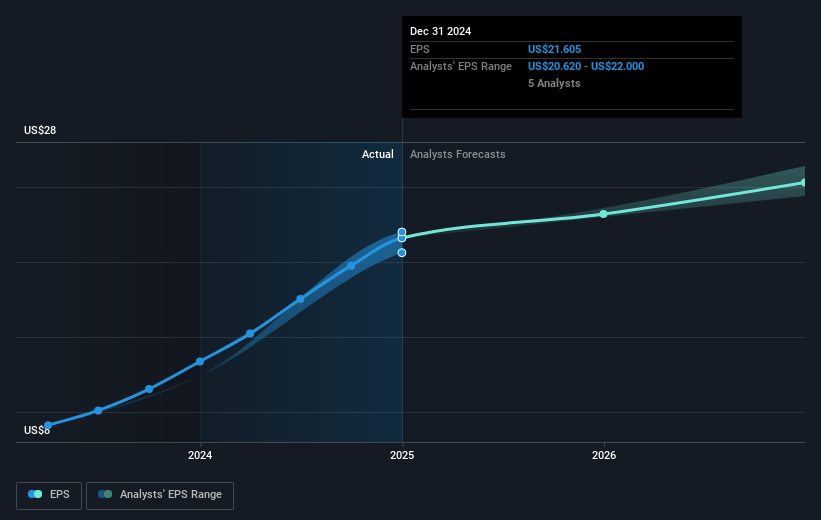

The recent announcement of EMCOR Group's quarterly cash dividend has positively influenced investor sentiment, as evidenced by a 12% increase in its stock price. This upward movement highlights the appeal of the company's consistent dividend policy, suggesting confidence in its financial stability and future earnings potential. Over the longer term, EMCOR shares have experienced a very large total return of 517.65% over five years, illustrating significant growth and resilience. Compared with the U.S. market and the wider Construction industry, EMCOR's performance over the past year has been superior, with a return that surpassed the market's 3.6% and the industry's 6.0% increase.

In terms of revenue and earnings, the dividend announcement could point towards ongoing operational stability, supporting the company's strategic initiatives such as the acquisition of Miller Electric. This acquisition is expected to enhance EMCOR's presence in key growth sectors, which may positively affect revenue projections and profit margins. The market's response, however, reveals the stock is trading at $354.26, which is notably below the consensus price target of $486.60. This discount implies potential room for price appreciation if the company's financial performance aligns with analysts' optimistic forecasts.

Review our historical performance report to gain insights into EMCOR Group's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EMCOR Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives