- United States

- /

- Construction

- /

- NYSE:EME

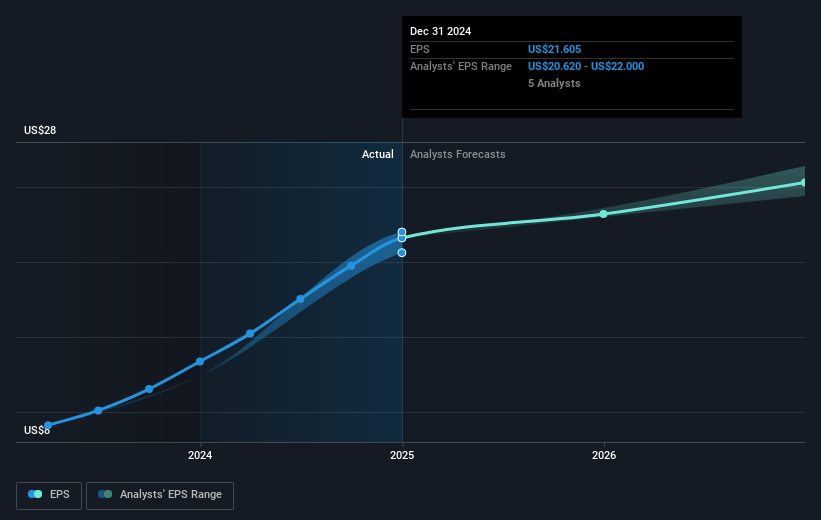

EMCOR Group (EME) Sees EPS Surge as Net Income Climbs to US$241 Million

Reviewed by Simply Wall St

EMCOR Group (EME) recently announced a regular quarterly cash dividend of $0.25 per common share, to be paid on July 31, 2025. This steady dividend approach aligns with the company's robust quarterly performance, which saw net income rise to $241 million and EPS increase substantially year-over-year. Additionally, the ongoing share buyback program has strengthened shareholder returns. Despite the broader market's moderate growth of 1.4% over the past week and 17% over the past year, EMCOR's notable share repurchases and solid financial outcomes appear to have amplified investor confidence, contributing to the company's impressive 55% stock price surge last quarter.

We've spotted 1 risk for EMCOR Group you should be aware of.

EMCOR Group's recent announcement of a quarterly dividend and the implementation of its share buyback program underline its commitment to enhancing shareholder returns. Despite a potential downside to the current share price of US$635.06, which exceeds the consensus analyst price target of US$549.57 by 13.46%, these actions could continue to buoy investor confidence. The company's performance over the past five years, with a total return exceeding 844.60%, showcases its robust long-term trajectory.

In the last year, EMCOR's share performance exceeded both the broader market's 17.2% and the US Construction industry’s 54.2% return, highlighting its strong standing relative to peers. The successful integration of acquisitions and strategic diversification into sectors like data centers and healthcare is anticipated to impact future revenue positively. This, coupled with operational efficiencies and strong revenue collaboration, may reinforce earnings projections. However, EMCOR's earnings forecasts of a 6.2% annual growth rate lag behind the broader market's 14.9% forecast, which could present challenges in meeting broader industry expectations.

The company's impressive share price rise of 55% last quarter signals optimism, though its current value being above the target may indicate overvaluation concerns. Nevertheless, the consistent cash flow and healthy margins underscore its potential resilience against margin pressures, supply chain challenges, and other economic uncertainties. As analysts estimate revenue growth to 7.9% annually over the next three years, any tangible improvement in operational metrics could shift the valuation outlook positively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives