- United States

- /

- Construction

- /

- NYSE:DY

Dycom Industries (DY): Reassessing Valuation After Strong Q3 Results and Upgraded 2025 Revenue Outlook

Reviewed by Simply Wall St

Dycom Industries (DY) just turned in another strong quarter, with double digit revenue and earnings growth plus a higher full year sales outlook, a combination that usually forces investors to revisit their assumptions.

See our latest analysis for Dycom Industries.

That backdrop has helped Dycom’s share price climb to $354.31, with a roughly 23% one month share price return feeding into a powerful year to date surge and three year total shareholder return nearing 300%, suggesting momentum is still very much with the bulls.

If Dycom’s run has you thinking about what else could surprise to the upside, this might be a good moment to scan fast growing stocks with high insider ownership.

Yet with Dycom now trading near its analyst targets after a blistering rally, the real question is whether the market is still underestimating its earnings power or already pricing in years of future growth.

Most Popular Narrative: 8.1% Undervalued

With Dycom closing at $354.31 against a narrative fair value near $385, the storyline leans toward further upside if its growth trajectory holds.

The accelerating buildout of fiber to the home and data center connectivity, driven by surging AI workloads and hyperscaler investments, is creating multi year, visibility rich opportunities for Dycom. This is expected to support robust backlog growth and sustained double digit revenue expansion as these build cycles ramp into 2027 and beyond.

Investors may be curious what kind of revenue ramp, margin path, and future earnings multiple are needed to defend that higher fair value. The underlying projections might surprise you.

Result: Fair Value of $385.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if key telecom customers pare back capital spending or if permitting delays push out large fiber and data center projects.

Find out about the key risks to this Dycom Industries narrative.

Another View: Richer Valuation on Earnings

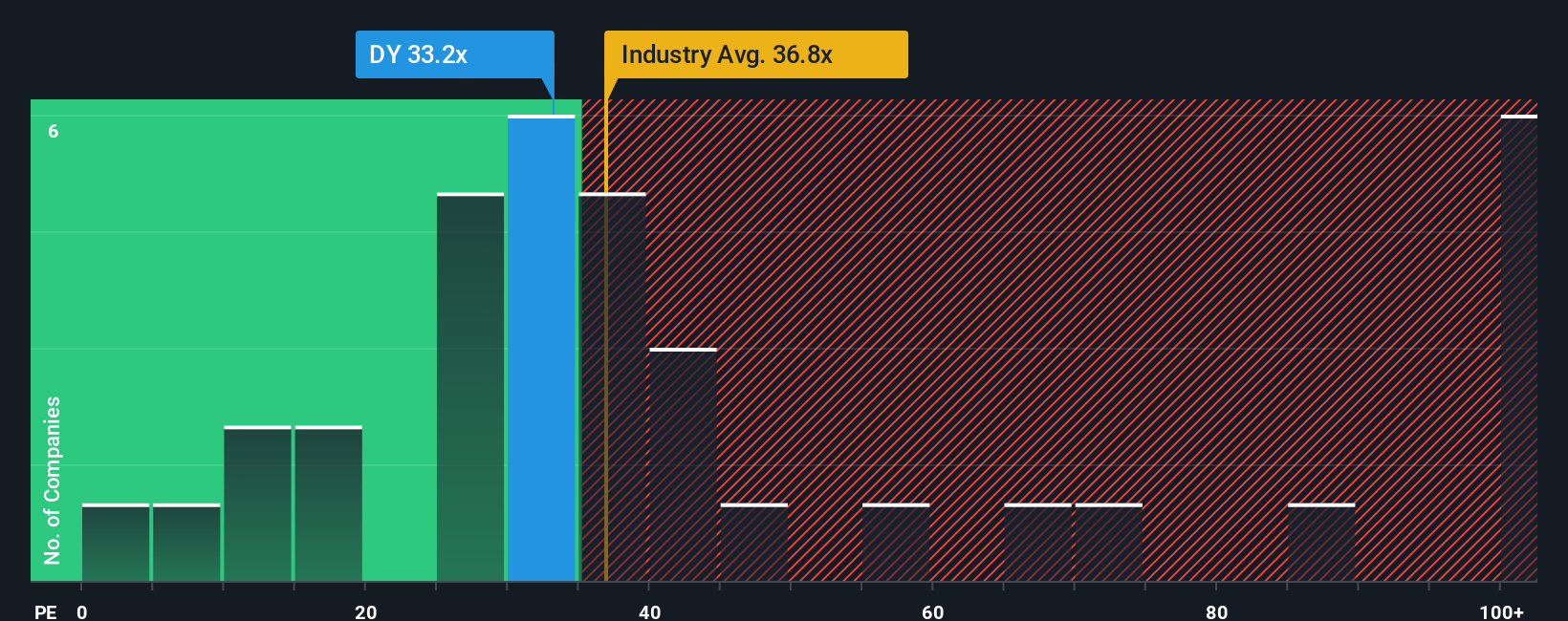

On earnings, Dycom looks less forgiving. Its price to earnings ratio of 34.5 times sits above both the US Construction industry at 33 times and peers at 32.3 times, and even above a 30.4 times fair ratio the market could drift back toward, which would pressure returns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dycom Industries Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Dycom Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop with a single great idea when the market is full of potential. Use the Simply Wall Street Screener to uncover your next advantage today.

- Capture fast moving growth by scanning these 25 AI penny stocks that are reshaping industries with automation, data driven insights, and scalable digital business models.

- Lock in income potential with these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets swing between fear and optimism.

- Position yourself early in the next market leaders by tracking these 926 undervalued stocks based on cash flows before the crowd notices their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026