- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (DOV) Projects 2025 Earnings Growth With 4%-6% Revenue Increase

Reviewed by Simply Wall St

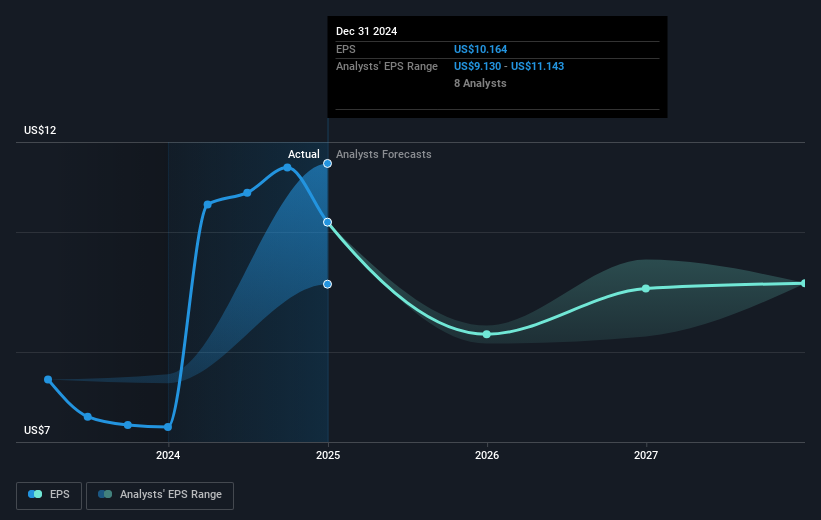

Dover (DOV) has projected optimistic earnings guidance for 2025, targeting a GAAP EPS range of $8.00 to $8.20. During the last quarter, the company's stock price increased by 10.43%. This gain aligns with the broader market trend, as the S&P 500 and Nasdaq also hit new highs, supported by generally strong corporate earnings. Notably, Dover's Q2 report showed increased sales but a decline in net income, which contrasts with their optimistic outlook. Additionally, product launches such as the OPW Retail Fueling valve may have contributed to investor enthusiasm amid broader positive market sentiment.

Buy, Hold or Sell Dover? View our complete analysis and fair value estimate and you decide.

The positive earnings guidance shared recently by Dover reflects a continuation of their future-focused investments in clean energy and automation, as outlined in their narrative. These strategic priorities are intended to bolster their revenue and margins over time, potentially aligning with their optimistic outlook for 2025 EPS. When considering the company's long-term performance, the total shareholder return, including dividends, stands at a robust 90.91% over a five-year period. This longer-term growth is noteworthy, although in the past year, Dover has underperformed both the U.S. market and the U.S. Machinery industry.

Recent gains in Dover’s stock price, driven by new product launches and a favorable broader market, could support improved investor sentiment and confidence in their revenue projections. The guidance's implication on revenue and earnings forecasts suggests enhanced EPS potential if the projected GAAP EPS of $8.00 to $8.20 for 2025 is realized. With a current share price of US$186.63, there remains a modest gap to the analyst consensus price target of US$207.16. This price movement relative to projected fair value indicates some room for appreciation while reflecting analyst confidence in long-term growth prospects. However, achieving these forecasts will hinge on executing strategic initiatives and navigating potential challenges such as tariff risks and foreign exchange volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives