- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (DOV): Is the Recent Share Price Dip a Sign of Undervaluation?

Reviewed by Kshitija Bhandaru

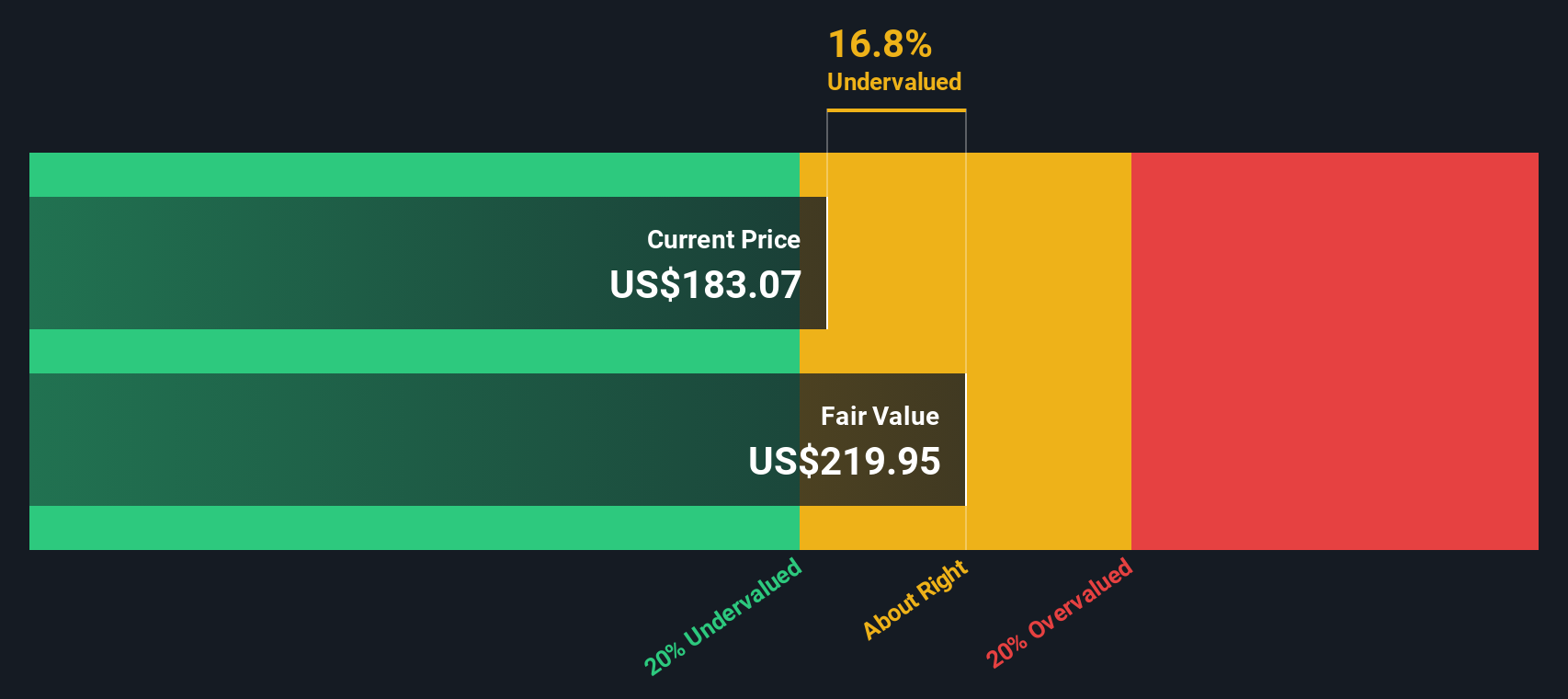

If you’ve been watching Dover (DOV) lately, you might have noticed the recent dip in its share price, a move that could be catching the eye of investors looking for an entry point. There isn’t a single event driving the headlines this time, but the downward trend is enough to raise the question: is this just noise, or a sign of deeper value concerns?

Over the past year, Dover’s stock hasn’t managed to keep pace with the broader market, posting a negative return. That contrasts sharply with its strong performance over longer periods, including half-decade gains and steady growth in revenue and net income. Recent months have seen momentum fade, but it’s worth noting that the business itself hasn’t delivered any big shocks or surprises, just a loss of investor enthusiasm as the year unfolded.

Now, with shares lagging and growth metrics still positive, it’s time to ask: is the market discounting Dover’s future too heavily, or is the current price simply a fair reflection of what’s ahead?

Most Popular Narrative: 20.8% Undervalued

The most widely followed narrative sees Dover as considerably undervalued, with its fair value sitting well above the current share price. According to analysts, the risk-reward equation leans in favor of future returns if the company delivers on its long-term ambitions.

A growing base of recurring, higher-margin aftermarket and service revenues, combined with investments in product innovation and digitization, strengthens revenue visibility and margin resilience. This is particularly relevant as demand for connected, sensor-enabled and energy-efficient solutions builds across industrial end markets.

Want to know what’s powering this bullish outlook? The analysts’ numbers bank on ambitious revenue growth and profit resilience, with valuation calculations that hinge on bold future multiples. Curious how these projected figures build up to an impressive fair value edge? Unlock the full story to discover the assumptions driving this valuation call.

Result: Fair Value of $213.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic uncertainty or execution missteps could disrupt Dover’s growth story and challenge the optimistic valuation outlook that analysts currently favor.

Find out about the key risks to this Dover narrative.Another View: SWS DCF Model

Looking beyond what analysts expect, our SWS DCF model also points toward an undervalued stock. This suggests that Dover’s current price may not capture its true long-term potential. But is this model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dover Narrative

If you’re keen to interpret Dover’s story in your own way or prefer hands-on analysis, take a few minutes to dig into the data and shape your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dover.

Looking for More Investment Ideas?

Step beyond Dover and put your money to work in sectors shaping tomorrow. The Simply Wall Street Screener can help you spot hidden gems, innovators, and reliable income sources you may be missing out on.

- Capture the momentum of artificial intelligence breakthroughs and stay ahead of tech revolutions with access to AI penny stocks.

- Unlock opportunities for steady portfolio growth by targeting companies offering consistent yields. Get started with dividend stocks with yields > 3%.

- Capitalize on the next wave in digital finance by finding market movers at the intersection of cryptocurrency and blockchain through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives