- United States

- /

- Trade Distributors

- /

- NYSE:DNOW

DNOW (DNOW): Valuation in Focus as Analysts Upgrade Earnings Outlook and Spur Investor Interest

Reviewed by Simply Wall St

If you’ve been keeping an eye on DNOW (DNOW), the latest boost in analyst sentiment might have caught your attention. The company’s full-year earnings estimate has climbed by 9% over the past three months, which suggests that analysts are seeing stronger business performance ahead. This upgrade has fueled investor interest in DNOW and is sparking conversation about where the stock could be headed next.

Recently, DNOW shares have gained close to 21% since the start of the year and have outpaced the Industrial Products sector by a good margin in the same period. Although the stock slipped slightly over the past week, broader momentum remains positive and is supported by steady revenue and double-digit net income growth. For longer-term investors, the share price has climbed more than 22% over the past year and delivered impressive gains in the last five years. This points toward both historically strong results and renewed market optimism.

The real question for investors now is whether DNOW’s current price still offers value or if the latest optimism has already been factored in by the market. Is this a buying opportunity, or are expectations running ahead of reality?

Most Popular Narrative: 10.1% Undervalued

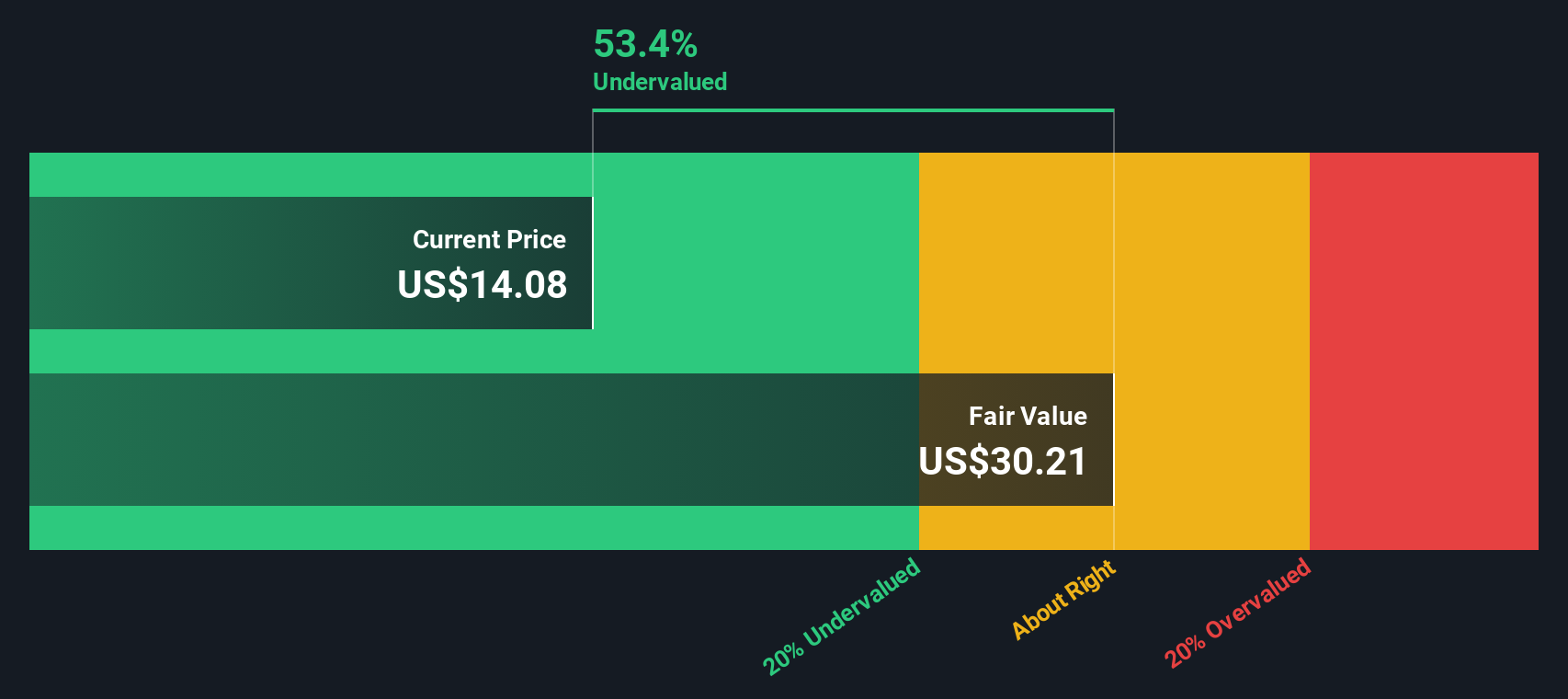

The prevailing view from analysts suggests DNOW shares remain undervalued, with the current price sitting below fair value based on future growth expectations and risk assumptions.

Expansion into the midstream market through the acquisition of Whitco is expected to bolster supply chain capabilities, particularly in the aging and undersized midstream infrastructure. This could potentially increase revenues by accessing a larger market and offering day-to-day MRO and capital project opportunities. The move aligns with increasing demand for midstream services as energy companies look to expand and upgrade infrastructure.

Curious why analysts are assigning even more value to DNOW despite projected margin pressures? The narrative hints at bold expectations, including market expansion, strategic innovation, and ambitious future earnings multiples that might surprise even seasoned investors. Interested in the full rationale behind this optimistic valuation? The details behind these numbers could change your outlook.

Result: Fair Value of $17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weak natural gas prices or further declines in U.S. rig activity could quickly put pressure on DNOW’s optimistic outlook and growth assumptions.

Find out about the key risks to this DNOW narrative.Another View: What Does Our DCF Model Say?

While analyst targets suggest DNOW is undervalued, our SWS DCF model reaches the same conclusion and reinforces the idea that the market might be missing something in the company’s outlook. Could this hidden value be real?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DNOW for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DNOW Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own perspective on DNOW in just minutes. Do it your way.

A great starting point for your DNOW research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities slip by. With so many promising trends in the market right now, why not target your next portfolio winner? Checking out these strategies could reveal your next standout pick.

- Secure consistent returns by targeting companies that boast dividend stocks with yields > 3%. This can help ensure your money works harder for you, year after year.

- Ride the AI revolution and spot tomorrow’s breakthroughs among AI penny stocks. Capture potential upside from cutting-edge technologies transforming entire industries.

- Seize value opportunities by focusing on undervalued stocks based on cash flows that the market has overlooked. This can help you position yourself ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DNOW

DNOW

Distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation, gas utilities, and customer on-site and off-site locations in the United States, Canada, the United Kingdom, Norway, Australia, the Netherlands, Singapore, and the Middle East.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives