- United States

- /

- Machinery

- /

- NYSE:DE

Does Deere's Facility Relocation Reflect a Deeper Shift in Its Efficiency Strategy for DE?

Reviewed by Sasha Jovanovic

- In the past week, John Deere announced it will relocate product verification and validation testing jobs from its Ottumwa Works and Des Moines Works facilities to other plants in Iowa and Illinois to lower overhead and improve operational efficiency.

- This operational adjustment follows a period of renewed analyst optimism, which has highlighted the company's focus on cost reduction and technological adoption in agricultural equipment manufacturing.

- We'll now consider how Deere's plan to streamline operations may shape investor expectations and the company's future earnings narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Deere Investment Narrative Recap

For long-term shareholders, the key story behind owning Deere is the company’s commitment to leadership in precision agriculture and advanced tech solutions, plus disciplined cost control and resilient margin potential. Deere’s decision to relocate product testing roles to consolidated facilities is part of ongoing operational streamlining; however, this is unlikely to materially affect key near-term drivers such as North American large ag equipment sales volatility or the primary risk from rising tariffs and cost pressures.

Of the recent announcements, the August 2025 earnings report stands out, where Deere revised net income guidance for fiscal 2025 to between US$4.75 billion and US$5.25 billion. Paired with the current cost-cutting efforts, this guidance reflects how management is aiming for margin stability as end-market demand remains pressured, a central concern given ongoing margin and revenue risks.

Yet, while Deere is tightening its operational focus, investors should not overlook the contrasting risk if cost reductions can’t keep pace with mounting tariff and input inflation...

Read the full narrative on Deere (it's free!)

Deere's outlook projects $45.1 billion in revenue and $8.6 billion in earnings by 2028. This assumes a 0.7% annual decline in revenue and a $3.4 billion increase in earnings from the current $5.2 billion.

Uncover how Deere's forecasts yield a $525.66 fair value, a 14% upside to its current price.

Exploring Other Perspectives

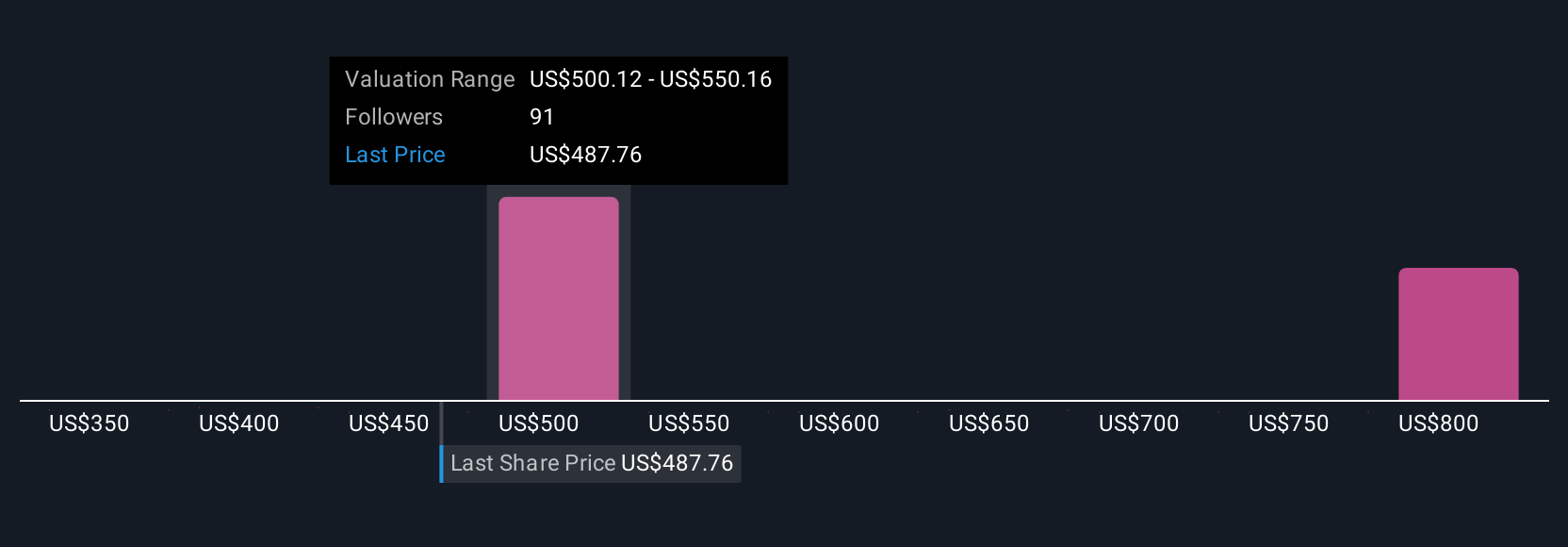

Six different fair value estimates from the Simply Wall St Community range from US$430 to US$827, showing wide variation in shareholder expectations. With cost pressures at the forefront, you can see how opinions differ on Deere’s resilience and future earnings, consider checking these views to round out your understanding.

Explore 6 other fair value estimates on Deere - why the stock might be worth as much as 80% more than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives