- United States

- /

- Machinery

- /

- NYSE:DE

Does Deere's (DE) Battery Partnership Signal a New Phase in Its Technology Advantage?

Reviewed by Sasha Jovanovic

- Chervon, the parent company of EGO, recently announced that EGO 56V ARC Lithium batteries are powering John Deere’s new Z370RS Electric ZTrak mower, enhancing compatibility across 100+ EGO products and other Deere equipment.

- This product integration, alongside advanced features such as real-time battery monitoring and Bluetooth connectivity, underscores Deere’s ongoing push to broaden its technology leadership in the equipment market.

- We’ll explore how Deere’s electric mower collaboration and deeper technology integration could influence its investment outlook going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Deere Investment Narrative Recap

Owning Deere stock requires conviction in the company's ability to lead the transformation toward smarter, tech-driven agricultural and construction equipment, despite cyclical volatility and persistent cost pressures. The recent rollout of EGO battery technology into Deere’s new electric mower showcases advancements in product compatibility, but is not expected to materially shift the biggest near-term risk, which remains high end-market uncertainty and margin compression in North America. Investors should weigh how product innovation and deeper technology partnerships might help mitigate pressure on Deere’s earnings from sluggish demand and pricing headwinds.

Of the recent announcements, Trimble’s partnership with 4Rivers Equipment to distribute Trimble technology to John Deere construction users is particularly relevant. This adds another layer to Deere’s ongoing push for technology integration, supporting the catalyst of rising precision and automation adoption, areas expected to contribute to higher-value sales and possibly offsetting some of the risks from price competition in North America.

But with heightened competitive pricing and a heavy reliance on incentives, investors should be aware of the risk that...

Read the full narrative on Deere (it's free!)

Deere's outlook projects $45.1 billion in revenue and $8.6 billion in earnings by 2028. This scenario assumes a -0.7% annual revenue decline and a $3.4 billion increase in earnings from the current $5.2 billion.

Uncover how Deere's forecasts yield a $533.38 fair value, a 15% upside to its current price.

Exploring Other Perspectives

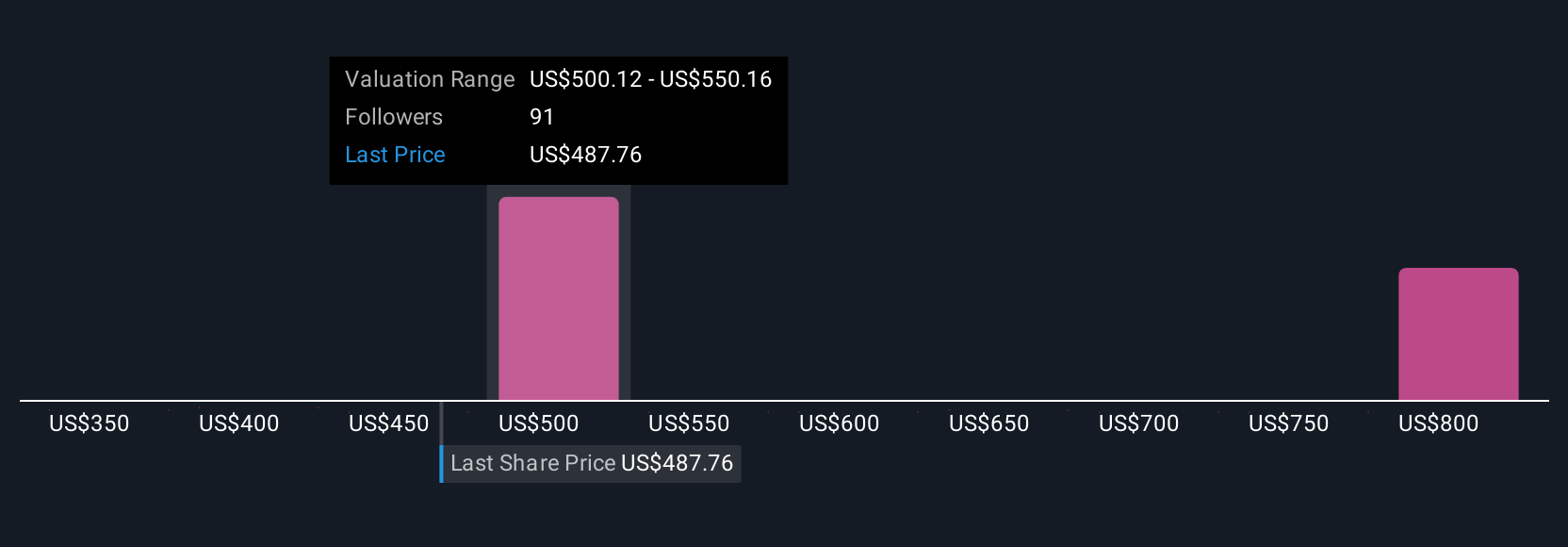

Simply Wall St Community contributors have shared 7 fair value estimates for Deere, ranging widely from US$350 to US$823 per share. With North American end-markets still facing a potential 30 percent drop in large ag equipment sales, consider exploring these diverse viewpoints for a broader context on where Deere could be headed.

Explore 7 other fair value estimates on Deere - why the stock might be worth 24% less than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives