- United States

- /

- Machinery

- /

- NYSE:DCI

Donaldson (DCI): Assessing Valuation After a Strong Year-to-Date Rally and Recent Share Price Pullback

Reviewed by Simply Wall St

Donaldson Company (DCI) has quietly built a strong track record, and the recent pullback after a steady climb this year has investors asking whether the stock still offers a reasonable entry point.

See our latest analysis for Donaldson Company.

Despite a soft patch this week, with a recent dip from the latest share price of $87.6, Donaldson’s roughly 30 percent year to date share price return and strong multi year total shareholder returns suggest momentum is still very much intact.

If Donaldson’s steady climb has caught your eye, now is a good time to broaden your watchlist and explore aerospace and defense stocks that could offer similar long term potential.

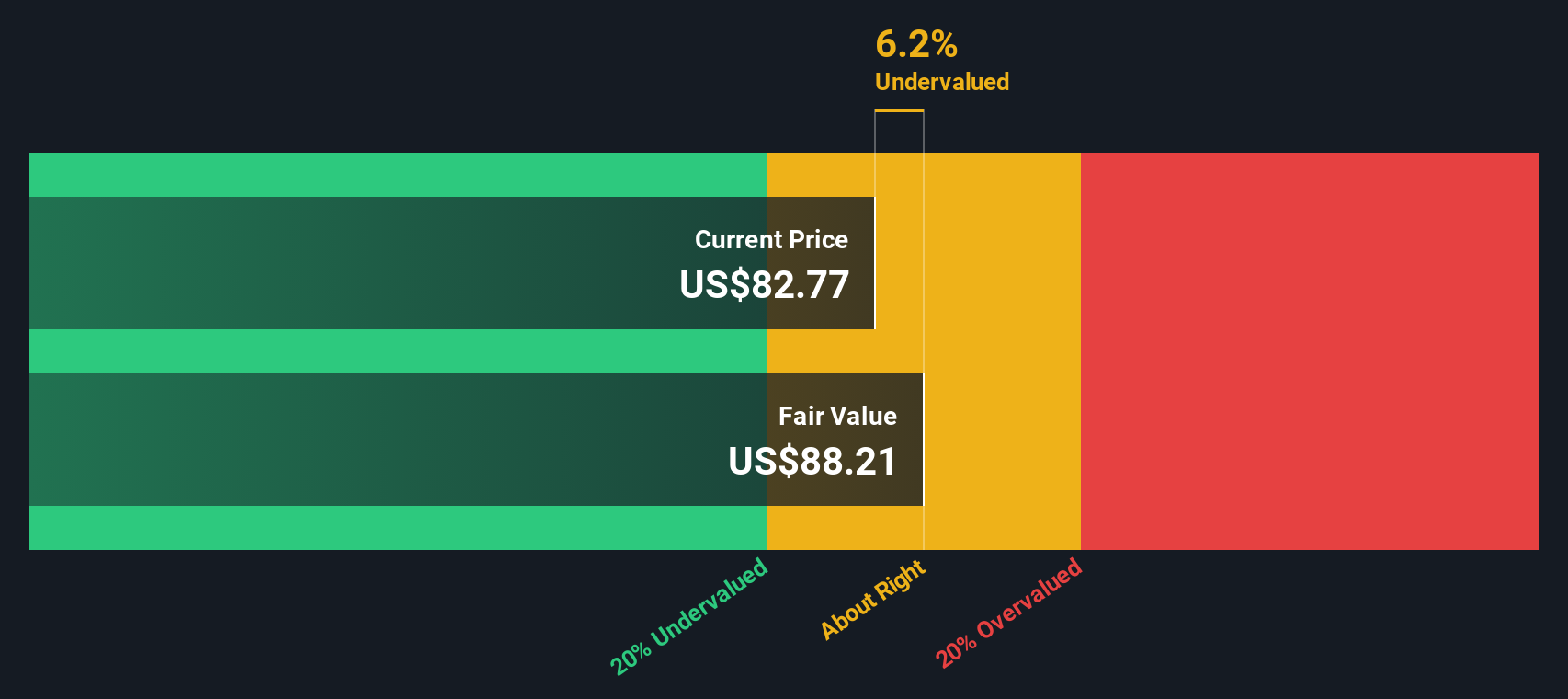

Yet with shares now hovering near fair value after a strong run and analysts’ targets sitting slightly below the current price, the key question is whether Donaldson remains attractive at today’s levels, or if markets are already pricing in its future growth.

Most Popular Narrative: 5% Overvalued

Based on the most followed narrative, Donaldson’s fair value sits below the last close of $87.60, framing today’s price as slightly ahead of fundamentals.

Strategic investments and M&A in high margin, structurally growing segments (e.g., Life Sciences and Food & Beverage filtration) are expected to enhance margin mix and earnings quality, with Life Sciences segment margins improving notably and diversified R&D accelerating product innovation. Ongoing replacement parts/service model and the rising installed base are improving revenue predictability and resilience, increasing aftermarket sales mix (now over 50% of certain businesses), which supports stable cash flow and long term earnings durability.

Curious how modest top line growth, expanding margins, and a lower future earnings multiple can still justify today’s rich pricing? The full narrative explains the math in detail.

Result: Fair Value of $83.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent bioprocessing delays and a faster shift to electrification could undermine growth in high margin filtration and challenge today’s optimistic earnings assumptions.

Find out about the key risks to this Donaldson Company narrative.

Another View on Valuation

While narratives point to Donaldson trading a little rich versus its fair value of $83.60, our DCF model tells a cooler story, putting fair value at about $87.85, slightly above today’s $87.60. If cash flows say fairly priced, are worries about overpaying overdone?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Donaldson Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Donaldson Company Narrative

If you see the story differently or would rather dig into the numbers yourself, you can craft a complete view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Donaldson Company.

Looking for more investment ideas?

Before the next move in Donaldson’s story, give yourself an edge by lining up fresh opportunities that match your strategy using targeted stock screeners on Simply Wall St.

- Capture potential mispricings by zeroing in on companies flagged as attractively valued with these 916 undervalued stocks based on cash flows.

- Ride structural shifts in automation and smart software by focusing on fast moving innovators through these 25 AI penny stocks.

- Strengthen your portfolio’s income engine by locking onto companies offering reliable payouts via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCI

Donaldson Company

Manufactures and sells filtration systems and replacement parts worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026