- United States

- /

- Machinery

- /

- NYSE:CYD

Will China Yuchai (CYD) Balance Innovation and Leadership Stability After Executive Detentions and Engine Launch?

Reviewed by Sasha Jovanovic

- China Yuchai International Limited recently announced that two executives, Wu Qiwei, director and president of its main operating subsidiary, and Qin Xiaohong, former chief accountant, were detained by Chinese authorities, with no official confirmation of charges or reasons given.

- At the same time, the company introduced its high-output YC16VTF engine, reflecting a continued focus on technological progress and efforts to reinforce its role in high-end power generation and marine markets amid global demand shifts.

- We'll examine how the executive detentions and new engine launch could alter China Yuchai's investment narrative and risk considerations.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

China Yuchai International Investment Narrative Recap

To be a shareholder in China Yuchai, you need to believe that the company can sustain strong growth in engine sales, successfully expand into high-value applications, and leverage innovation while competing globally. The recent detentions of key executives introduce uncertainty, but for now, daily operations have not been materially disrupted as management continuity is maintained, keeping the focus on execution and industry demand, which remain the biggest catalyst and risk.

The recent launch of the YC16VTF engine, purpose-built for high-end power generation and marine use, is an announcement with heightened relevance: it not only shows continued investment in core R&D but also supports the company’s growth catalyst in next-generation export and industrial markets, balancing near-term leadership changes with ongoing product innovation.

Yet, against new technology launches, investors should be aware of the potential for sudden management changes to impact...

Read the full narrative on China Yuchai International (it's free!)

China Yuchai International's narrative projects CN¥30.3 billion revenue and CN¥509.0 million earnings by 2028. This requires 10.2% yearly revenue growth and a CN¥60.5 million earnings increase from CN¥448.5 million today.

Uncover how China Yuchai International's forecasts yield a $33.91 fair value, a 8% downside to its current price.

Exploring Other Perspectives

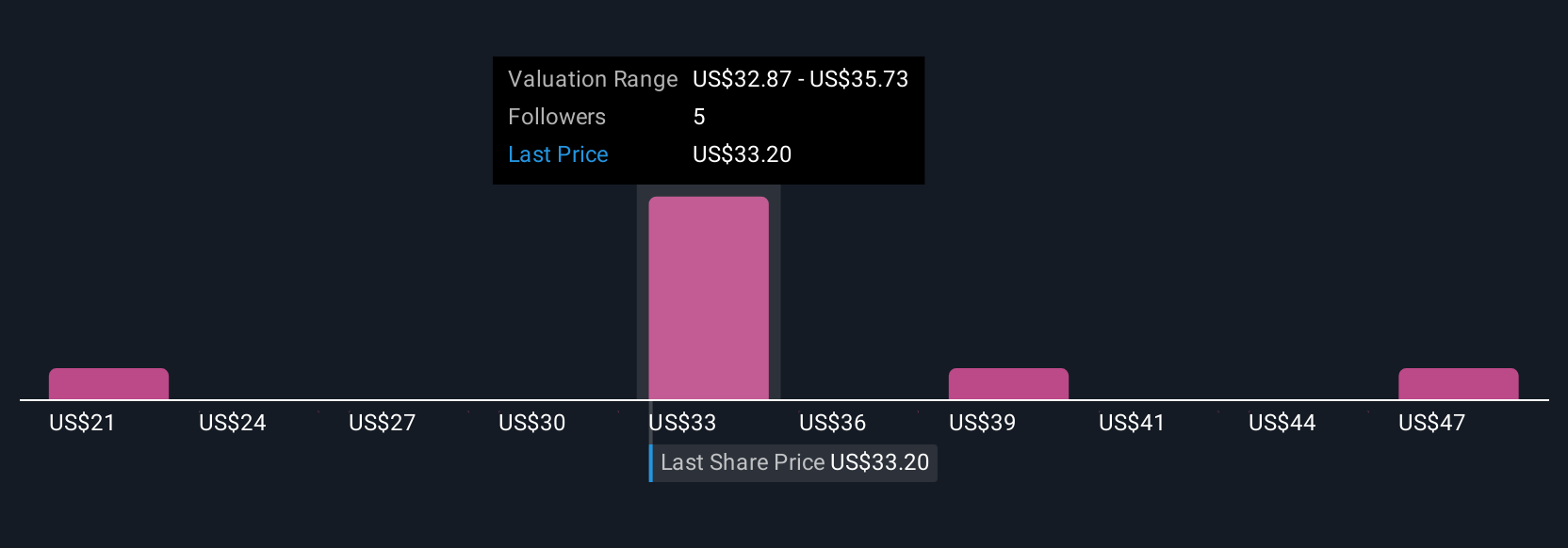

Eight Simply Wall St Community members estimate China Yuchai’s fair value between US$21.06 and US$55 per share. With leadership uncertainty now in focus, broader questions remain about management stability and its effect on future performance.

Explore 8 other fair value estimates on China Yuchai International - why the stock might be worth as much as 48% more than the current price!

Build Your Own China Yuchai International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Yuchai International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Yuchai International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Yuchai International's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Manufactures, assembles, and sells diesel and natural gas engines for trucks, buses, pickups, construction and agricultural equipment, and marine and power generation applications.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives