- United States

- /

- Machinery

- /

- NYSE:CYD

How S&P Global BMI Index Inclusion May Shape China Yuchai International's (CYD) Investor Landscape

Reviewed by Sasha Jovanovic

- China Yuchai International Limited (NYSE:CYD) was added to the S&P Global BMI Index on September 22, 2025, a move that typically leads index-tracking funds to adjust their portfolios.

- This inclusion raises the company's visibility among a wider base of institutional investors, potentially influencing trading patterns and capital flows into the shares.

- We’ll explore how being added to a major global index could influence China Yuchai’s investment narrative and future investor attention.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

China Yuchai International Investment Narrative Recap

At its core, being a shareholder in China Yuchai International means believing in the company's ability to outpace industry peers in both domestic and export engine markets, while navigating the transition to alternative fuels and balancing growing R&D investments. The recent addition to the S&P Global BMI Index significantly improves liquidity and could boost near-term institutional interest, but doesn't alter core business catalysts like data center engine demand or address the ongoing risk of a sharp demand slowdown in traditional markets.

Among recent developments, China Yuchai’s half-year earnings for June 2025 stood out: sales rose to CNY 13,806.17 million and net income climbed to CNY 365.79 million. This ongoing financial momentum may benefit from the increased investor visibility enabled by the company’s index inclusion, supporting the narrative that shareholder returns could remain closely tied to the performance of core engine segments and demand trends in key export markets. Yet, in contrast, one risk investors should watch for is that increased scrutiny from global markets isn’t a buffer against sharp cyclical downturns…

Read the full narrative on China Yuchai International (it's free!)

China Yuchai International is projected to reach CN¥30.3 billion in revenue and CN¥509.0 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 10.2% and a CN¥60.5 million increase in earnings from the current level of CN¥448.5 million.

Uncover how China Yuchai International's forecasts yield a $33.91 fair value, a 13% downside to its current price.

Exploring Other Perspectives

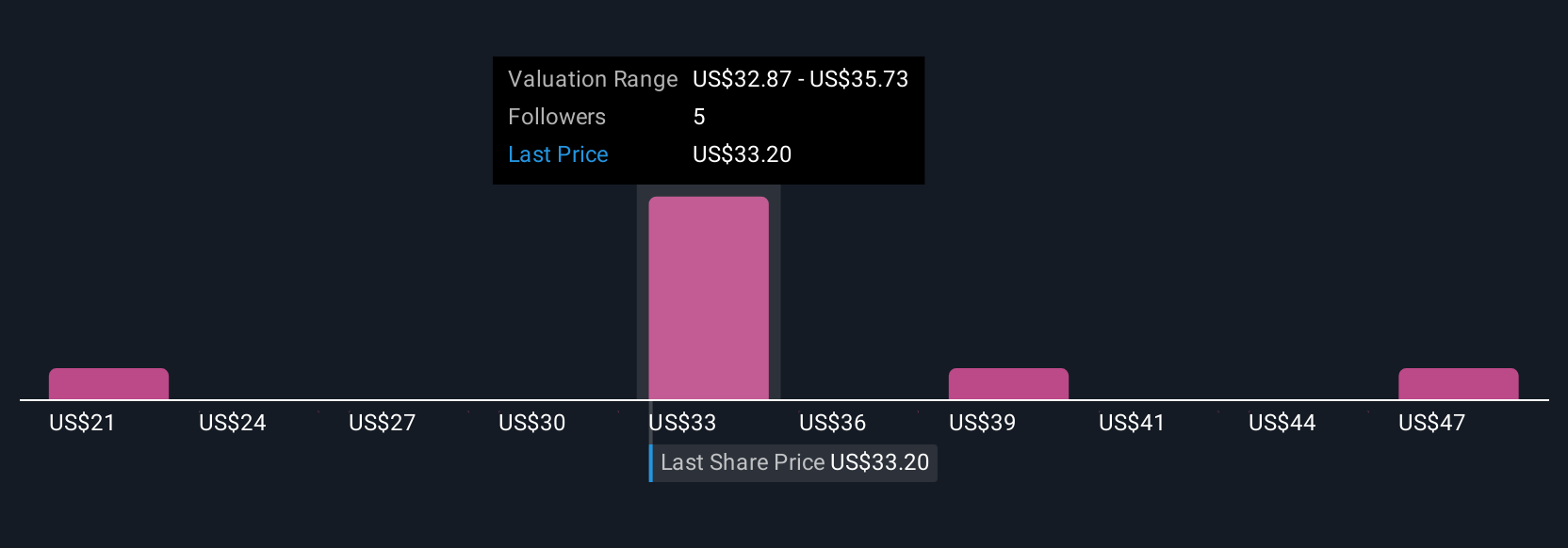

Seven members of the Simply Wall St Community estimate China Yuchai’s fair value between CN¥21.53 and CN¥55 per share, with opinions spanning the entire range. Shifting investor attention following the S&P Global BMI Index inclusion could amplify these divergent outlooks, reflecting real uncertainty surrounding export trends and evolving demand for conventional engines.

Explore 7 other fair value estimates on China Yuchai International - why the stock might be worth as much as 42% more than the current price!

Build Your Own China Yuchai International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Yuchai International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Yuchai International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Yuchai International's overall financial health at a glance.

No Opportunity In China Yuchai International?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Manufactures, assembles, and sells diesel and natural gas engines for trucks, buses, pickups, construction and agricultural equipment, and marine and power generation applications.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives