- United States

- /

- Construction

- /

- NYSE:CTRI

Will Centuri Holdings’ (CTRI) New Gas Segment Leader Reshape Its Competitive Edge?

Reviewed by Sasha Jovanovic

- On October 15, 2025, Centuri Holdings announced the appointment of Ryan Palazzo as President of its U.S. Gas segment, entrusting him with leadership of a division that contributes about half of the company’s revenue.

- Palazzo’s decades of experience and leadership roles at prominent pipeline and energy infrastructure companies may provide a fresh operational advantage for Centuri’s gas infrastructure services.

- We’ll explore how Palazzo’s industry expertise and operational background could influence Centuri Holdings’ investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Centuri Holdings' Investment Narrative?

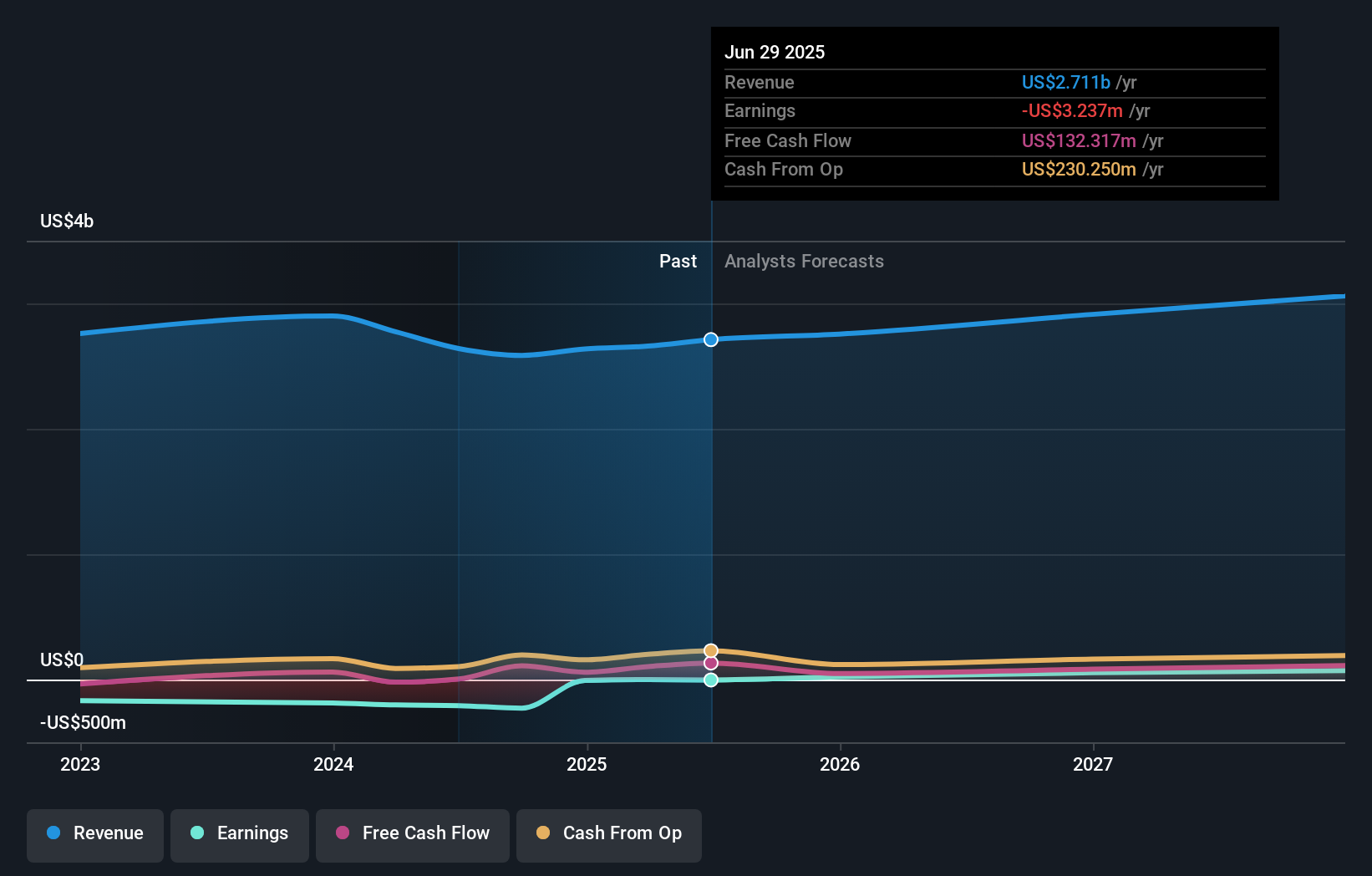

To believe in Centuri Holdings, investors are essentially betting that leadership change can quickly sharpen the company's performance and extract more from its major U.S. Gas segment, which now has Ryan Palazzo at the helm. With Centuri still unprofitable and facing ongoing board turnover, short term catalysts hinge on securing consistent large customer awards and translating growing revenues into improving bottom-line results. Palazzo’s arrival brings decades of industry know-how, which could help address operational inefficiencies and improve execution, especially in an environment where profit growth is expected but not yet realized. However, risks tied to management inexperience remain relevant, as recent price performance lags both the construction sector and the broader market. If Palazzo’s leadership sparks faster progress, these risks could shift, but for now, most short term risks are unchanged until tangible financial improvement is seen.

But management turnover may still make the path forward less predictable for now.

Exploring Other Perspectives

Explore 3 other fair value estimates on Centuri Holdings - why the stock might be worth less than half the current price!

Build Your Own Centuri Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuri Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Centuri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuri Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRI

Centuri Holdings

Operates as a utility infrastructure services company in North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives