- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Mixed Analyst Forecasts Ahead of Q3 Results Might Change The Case For Investing In Custom Truck One Source (CTOS)

Reviewed by Sasha Jovanovic

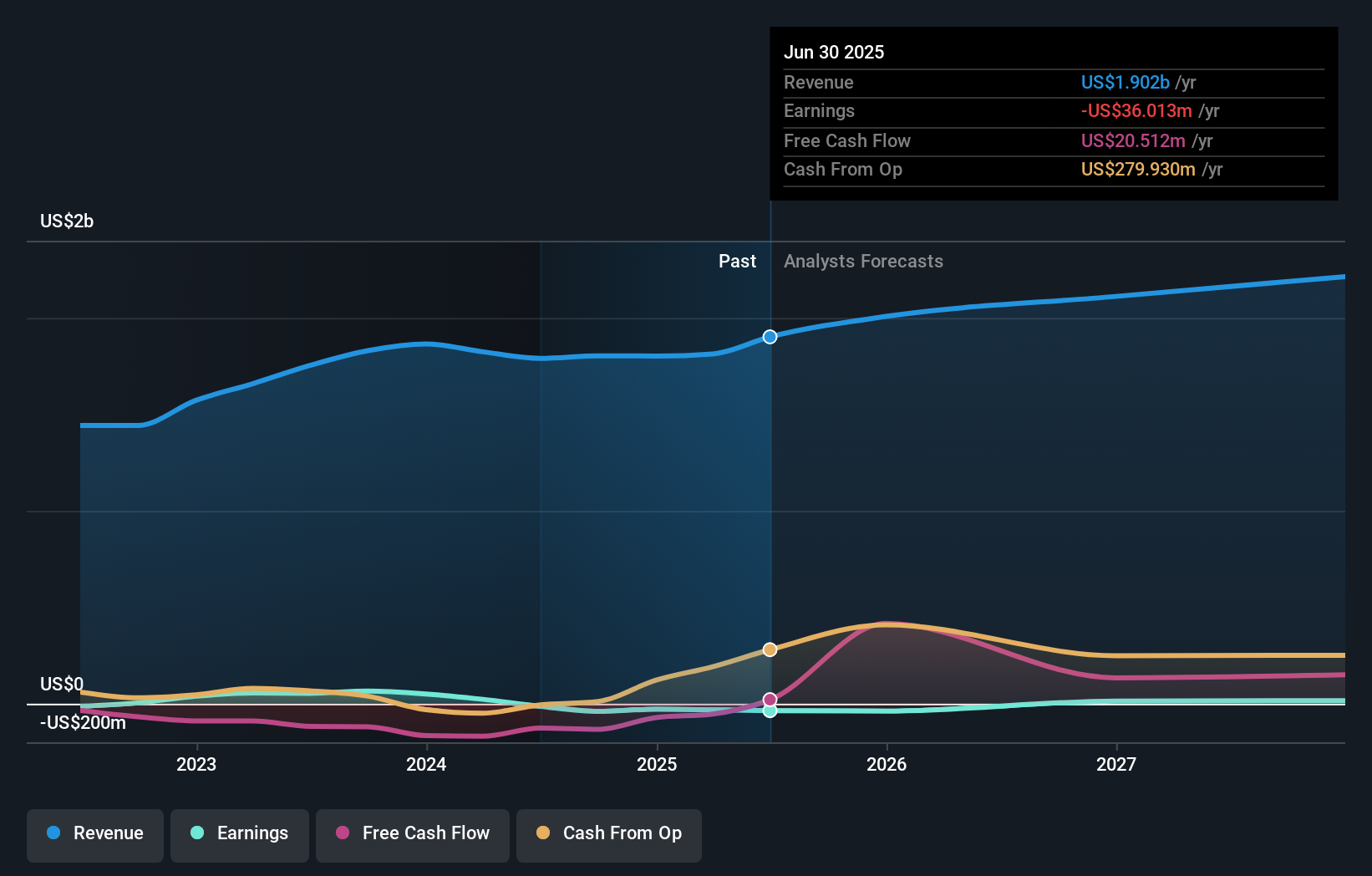

- Custom Truck One Source announced it would release its Q3 2025 results after market hours on October 27, 2025, following a previous quarter where it surpassed revenue expectations but missed on earnings.

- Recent analyst commentary highlights a mix of rising revenue projections and declining earnings forecasts, increasing anticipation ahead of the results and bringing heightened attention to how these will shape expectations for the company's path forward.

- We’ll explore how shifting analyst expectations for revenue and earnings could influence the investment narrative for Custom Truck One Source.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Custom Truck One Source Investment Narrative Recap

To be a shareholder of Custom Truck One Source, you have to believe in the long-term demand for utility and infrastructure fleet solutions, driven by ongoing grid modernization and infrastructure spending. While the upcoming Q3 results heighten near-term interest after mixed performance last quarter, the most important catalyst remains recurring demand across the utility and construction sectors, whereas the biggest short-term risk continues to be sustained gross margin pressure. The October 27 earnings announcement does not appear to materially change these factors in the immediate term.

Among recent developments, the company's unveiling of advanced equipment, including the all-electric bucket truck at Utility Expo 2025, is especially relevant. This aligns with infrastructure spending catalysts and signals a push for margin improvement via product innovation, but it must contend with the same margin and demand challenges as other offerings.

On the other hand, investors should be aware that margin pressure in core segments could...

Read the full narrative on Custom Truck One Source (it's free!)

Custom Truck One Source's narrative projects $2.3 billion in revenue and $28.6 million in earnings by 2028. This requires 6.6% yearly revenue growth and a $64.6 million earnings increase from the current earnings of -$36.0 million.

Uncover how Custom Truck One Source's forecasts yield a $7.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members supplied two fair value estimates for CTOS ranging from US$5.50 to US$7.50 per share. While some see room for further gains, others may view gross margin declines as a constraint on future upside, making it essential to compare these perspectives for a fuller picture.

Explore 2 other fair value estimates on Custom Truck One Source - why the stock might be worth as much as 13% more than the current price!

Build Your Own Custom Truck One Source Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Custom Truck One Source research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Custom Truck One Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Custom Truck One Source's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives