- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Does Custom Truck One Source (NYSE:CTOS) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Custom Truck One Source, Inc. (NYSE:CTOS) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Custom Truck One Source

What Is Custom Truck One Source's Net Debt?

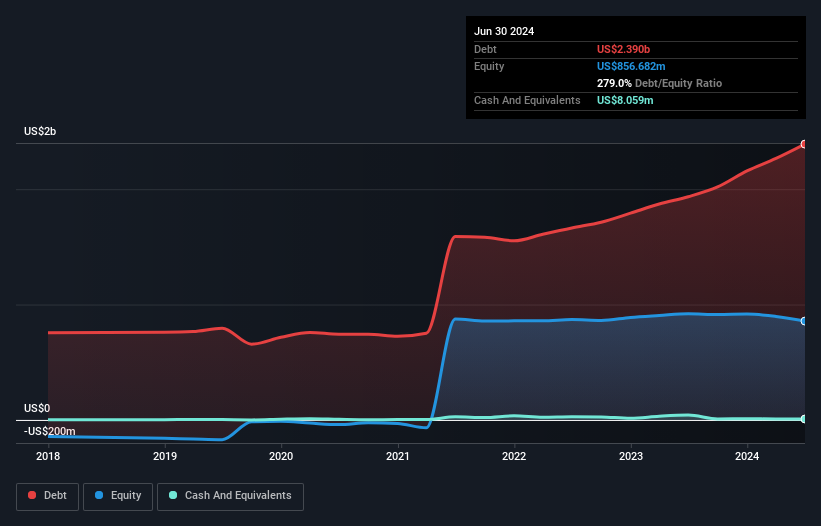

As you can see below, at the end of June 2024, Custom Truck One Source had US$2.39b of debt, up from US$1.93b a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Custom Truck One Source's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Custom Truck One Source had liabilities of US$1.06b due within 12 months and liabilities of US$1.60b due beyond that. On the other hand, it had cash of US$8.06m and US$181.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.48b.

The deficiency here weighs heavily on the US$765.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Custom Truck One Source would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.96 times and a disturbingly high net debt to EBITDA ratio of 12.2 hit our confidence in Custom Truck One Source like a one-two punch to the gut. The debt burden here is substantial. Investors should also be troubled by the fact that Custom Truck One Source saw its EBIT drop by 18% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Custom Truck One Source can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Custom Truck One Source burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Custom Truck One Source's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. It looks to us like Custom Truck One Source carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. Given our concerns about Custom Truck One Source's debt levels, it seems only prudent to check if insiders have been ditching the stock.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success