- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Custom Truck One Source (CTOS): Evaluating Valuation Ahead of Q3 2025 Earnings and Shifting Profit Expectations

Reviewed by Simply Wall St

Custom Truck One Source (CTOS) is gearing up to report its Q3 2025 earnings, and this announcement is getting plenty of attention as markets weigh recent changes to expectations. Investors are watching closely as revenue estimates have moved upward over the past three months; however, earnings forecasts have slipped, hinting at questions around profitability. Last quarter, CTOS outperformed on revenue but came up short on earnings, and the stock climbed 9% after results were released.

See our latest analysis for Custom Truck One Source.

Custom Truck One Source’s momentum has been building, with the 1-year total shareholder return more than doubling at 104% and a share price rally of nearly 37% year-to-date. The recent uptick comes as investors digest better revenue figures alongside ongoing concerns about sustained profitability. This keeps volatility in focus despite evident growth potential.

If you’re interested in what else could be gaining traction, try broadening your search and discover fast growing stocks with high insider ownership.

The big question now is whether Custom Truck One Source’s recent surge has left the shares undervalued or if Wall Street has already factored in all of the anticipated growth. Could there still be a buying opportunity on the table?

Most Popular Narrative: 11.9% Undervalued

Custom Truck One Source's most-followed narrative currently values the company at $7.50 per share, compared to its last close at $6.61. This sets up a valuation story built on anticipated profit improvements and analyst optimism about future catalysts.

“Sustained and growing demand from electricity grid modernization and maintenance, fueled by increasing electricity usage and multi-year utility infrastructure upgrades, is driving recurring rental revenue and supporting long-term top-line growth. Legislative tailwinds, such as the federal bonus depreciation provision, are incentivizing capital spending by smaller and mid-sized customers, which should accelerate equipment purchases and bolster TES segment revenues and margins.”

Curious what’s fueling this bullish outlook? There’s a future forecast at the heart of the narrative, pivoting on dramatic margin upgrades, ongoing fleet investments, and robust recurring revenue. Which number do analysts believe most in—the aggressive profit turnaround or a record valuation multiple? Unpack the bold assumptions driving this fair value.

Result: Fair Value of $7.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high leverage and declining TES segment backlogs could pressure profitability and shake confidence in the bullish growth narrative.

Find out about the key risks to this Custom Truck One Source narrative.

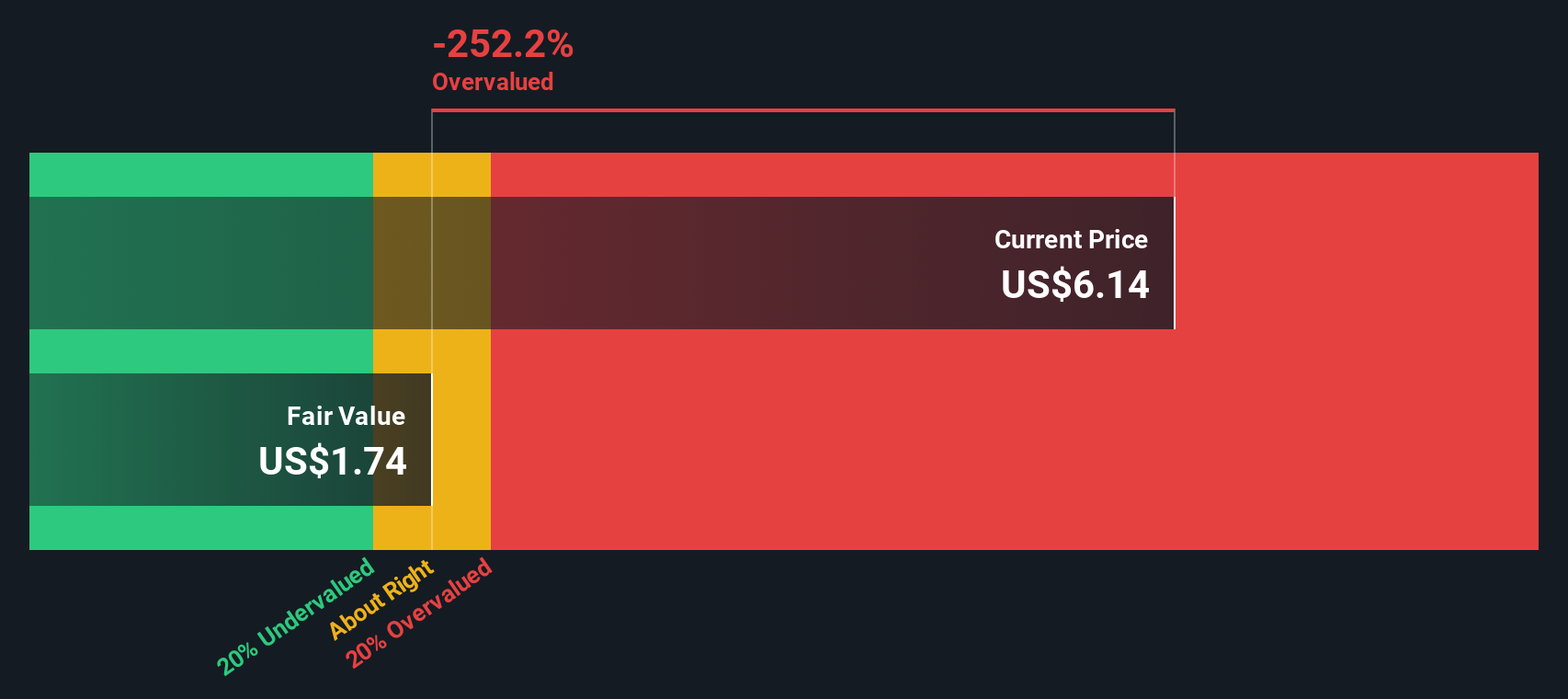

Another View: DCF Model Challenges the Optimism

While the narrative-based price target suggests undervaluation, our SWS DCF model estimates Custom Truck One Source’s fair value at just $5.43, which is below the current market price of $6.61. This implies the shares may actually be overvalued from a discounted cash flow perspective and raises questions about the sustainability of bullish assumptions.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

Feel differently or want to dig into the numbers on your own? You can quickly build your own view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for more investment ideas?

Stop wondering what you could be missing. Smart investors always stay a step ahead by tracking the latest stock opportunities as markets shift each day.

- Boost your portfolio’s income potential by checking out these 17 dividend stocks with yields > 3%, which offers steady yields above 3% and strong fundamentals behind their payouts.

- Uncover the next wave of innovation by getting ahead with these 27 quantum computing stocks, a group pioneering real-world breakthroughs in quantum computing technology.

- Tap into the rapidly growing artificial intelligence trend and see which companies top our these 27 AI penny stocks, positioning themselves as industry leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives