- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Custom Truck One Source (CTOS): Evaluating Valuation After Strong Q3 Results and Reaffirmed Outlook

Reviewed by Simply Wall St

Custom Truck One Source (CTOS) announced its third quarter results, showing higher revenues and a much smaller net loss compared to last year. The company also reaffirmed its full-year revenue guidance, which signals ongoing confidence.

See our latest analysis for Custom Truck One Source.

Custom Truck One Source’s latest report sent a positive signal to the market, but momentum has softened lately. The share price is up 19% year-to-date, while total shareholder return for the past year sits at 12%. Stronger fundamentals and a confident outlook have drawn attention, even as recent weeks have seen a modest pullback.

If you’re interested in what else is building momentum across the sector, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

That begs the key question for investors: with the stock still trading well below analyst targets despite improved results, is there a real buying opportunity here, or is the market already pricing in future gains?

Most Popular Narrative: 24% Undervalued

Compared to its last close of $5.76, the most widely followed narrative puts Custom Truck One Source’s fair value at $7.58. This higher estimate hints at confidence in upcoming growth catalysts and strong industry positioning.

“Sustained and growing demand from electricity grid modernization and maintenance, fueled by increasing electricity usage and multi-year utility infrastructure upgrades, is driving recurring rental revenue and supporting long-term top-line growth. Legislative tailwinds, such as the federal bonus depreciation provision, are incentivizing capital spending by smaller and mid-sized customers, which should accelerate equipment purchases and bolster TES segment revenues and margins.”

Want to know the key quantitative levers justifying this valuation? Dig deeper into the narrative’s surprisingly high long-term profit targets and bold revenue assumptions. Behind this price, there are projections that defy industry norms. Find out what sets this view apart.

Result: Fair Value of $7.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and high leverage could quickly alter sentiment if demand softens or if borrowing costs rise further in coming quarters.

Find out about the key risks to this Custom Truck One Source narrative.

Another View: Putting the Value in Perspective

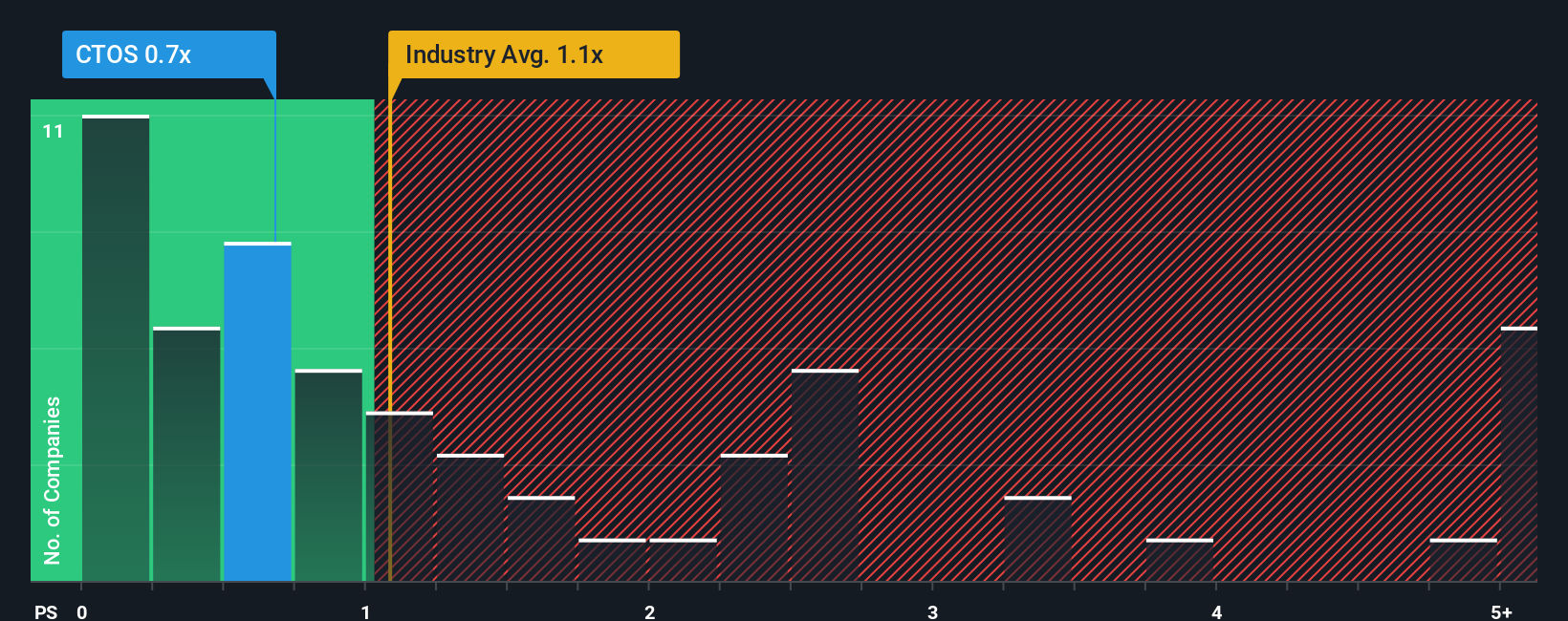

Beyond narrative-driven valuations, market comparisons tell a similar story. On a price-to-sales basis, Custom Truck One Source trades at just 0.7x, which is lower than both its industry average (1.1x) and its peer average (0.7x), and it is also meaningfully below its estimated fair ratio of 1x. This gap suggests the market may be undervaluing the company’s revenue potential, but does that mean there is untapped value or are risks still holding investors back?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Custom Truck One Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Custom Truck One Source Narrative

If you want a different perspective or enjoy delving into your own numbers, it’s simple to build your own take in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Custom Truck One Source.

Looking for More Investment Ideas?

Don’t wait for the next big opportunity to pass you by. Expand your search now and see what you could be adding to your portfolio.

- Boost your income stream by targeting companies with strong yields through these 16 dividend stocks with yields > 3% offering reliable returns above 3%.

- Jump ahead of market trends by evaluating the wave of innovation happening among these 25 AI penny stocks harnessing artificial intelligence breakthroughs.

- Unlock potential bargains others are missing by scanning these 884 undervalued stocks based on cash flows built on solid financials and low market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives