- United States

- /

- Building

- /

- NYSE:CSW

Why CSW Industrials (CSW) Is Up 11.9% After JPMorgan’s Upgrade And Acquisition Momentum

Reviewed by Sasha Jovanovic

- Earlier this week, JPMorgan upgraded CSW Industrials to Overweight, pointing to improving fundamentals, attractive valuation, and momentum supported by recent acquisitions and disciplined capital deployment.

- At the same time, insider share sales and a series of bolt-on deals in HVAC and specialty lubricants are sharpening investor focus on how CSW Industrials balances growth, integration, and profitability.

- Next, we’ll examine how JPMorgan’s upgraded view, anchored in CSW Industrials’ recent acquisition spree, may reshape the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

CSW Industrials Investment Narrative Recap

To own CSW Industrials, you need to believe its acquisition heavy playbook in HVAC and specialty lubricants can translate into durable earnings growth despite a rich valuation and exposure to U.S. construction cycles. JPMorgan’s upgrade and the stock’s sharp move higher do not fundamentally change the near term tension between integration risk, margin pressure from past deals, and the need to prove that underlying organic demand is improving rather than being masked by M&A.

The most relevant development here is CSW Industrials’ recent purchase of Motors & Armatures Parts for about US$650,000,000, alongside over US$26,500,000 of deals in specialty oils and lubricants. These transactions sit at the heart of JPMorgan’s thesis that disciplined, accretive acquisitions can expand CSW Industrials’ addressable market and reinforce its positioning in regulated HVAC and maintenance markets, but they also concentrate the story even more on execution quality and margin resilience.

Yet investors should also weigh how reliance on acquisitions, amid signs of softer organic growth in core HVAC markets, could eventually affect...

Read the full narrative on CSW Industrials (it's free!)

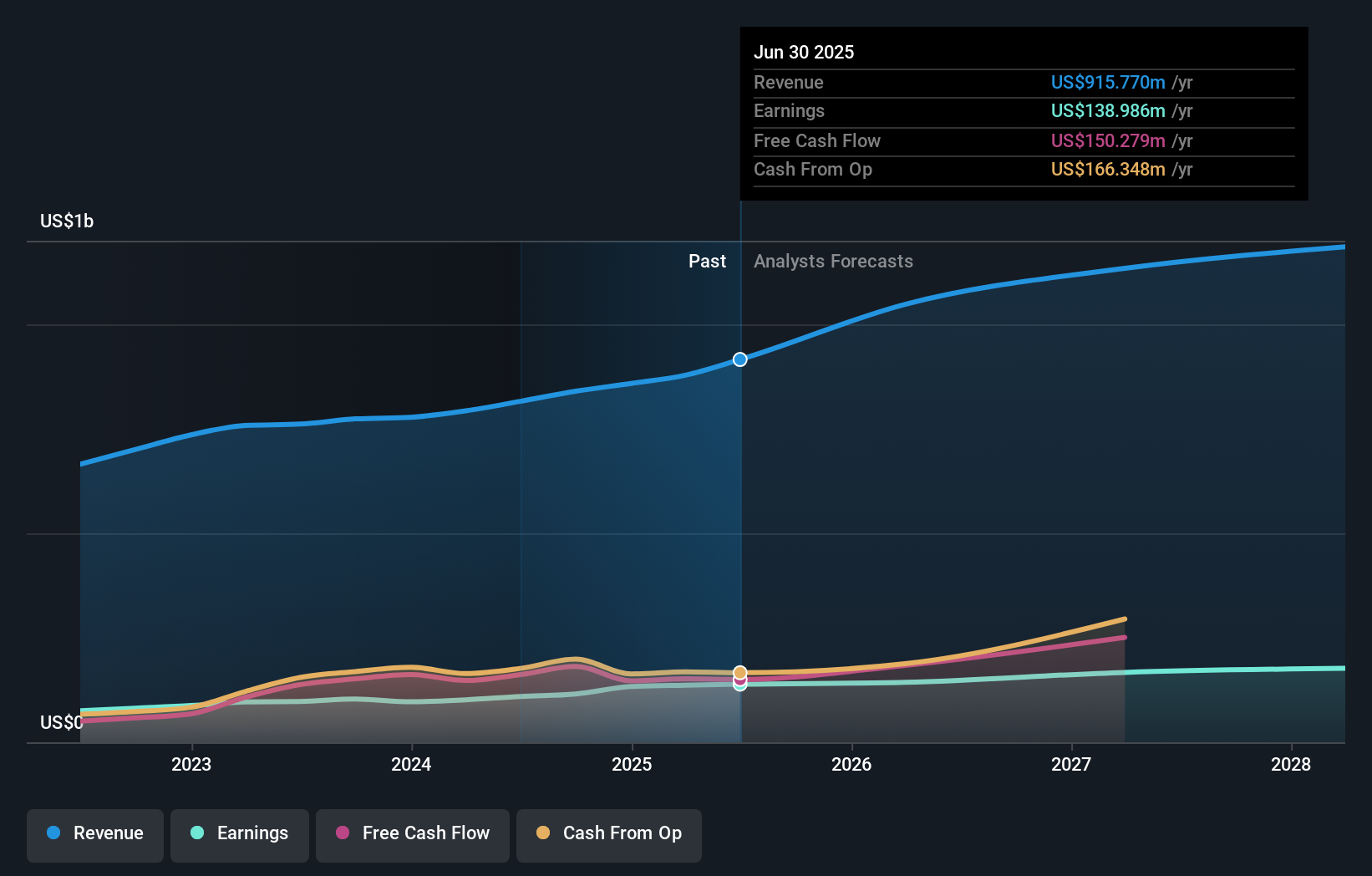

CSW Industrials' narrative projects $1.3 billion revenue and $186.5 million earnings by 2028. This requires 11.0% yearly revenue growth and about a $47.5 million earnings increase from $139.0 million today.

Uncover how CSW Industrials' forecasts yield a $283.33 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for CSW Industrials span roughly US$215 to US$283. In contrast, recent acquisitions in HVAC and specialty lubricants place even more weight on successful integration and margin protection.

Explore 3 other fair value estimates on CSW Industrials - why the stock might be worth 29% less than the current price!

Build Your Own CSW Industrials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSW Industrials research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free CSW Industrials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSW Industrials' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026