- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Carpenter Technology (CRS): Assessing Valuation After $700 Million Debt Offering and Capital Structure Move

Reviewed by Simply Wall St

Carpenter Technology (CRS) just announced a $700 million private offering of senior notes due 2034. The company aims to refinance existing debt and strengthen its financial flexibility with this move. This signals important changes for the company’s capital structure.

See our latest analysis for Carpenter Technology.

After surging on the back of robust earnings and now unveiling this major refinancing initiative, Carpenter Technology’s share price has delivered rapid momentum, boasting a 34% return over the past month and climbing an impressive 85% year-to-date. Its long-term story is even more remarkable, with a 3-year total shareholder return of 714%, signaling that investors have steadily rewarded the company’s transformation and improving fundamentals.

If Carpenter’s winning streak has piqued your interest, now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

With shares sitting 16% below analyst targets after an astonishing run, the pressing question is whether Carpenter Technology remains undervalued or if the market is fully pricing in years of anticipated growth ahead.

Most Popular Narrative: 13.7% Undervalued

Compared to the last close price, the most followed narrative values Carpenter Technology notably higher, offering a strong upside from current levels. The analysis brings together recent financial momentum and forecasts to make a compelling case for re-rating the shares.

The ongoing ramp in global aerospace demand, highlighted by extended lead times, urgent defense orders, and robust multi-year supply contracts, positions Carpenter to accelerate revenue growth as OEM build rates increase, particularly in next-generation and more fuel-efficient aircraft. This supports both top-line expansion and recurring revenues.

Could a future defined by relentless aerospace demand and expanding margins push Carpenter Technology into a new growth league? The real jaw-droppers are in the forecasted earnings surge and the kind of valuation multiples usually reserved for market leaders. Want to know what bold forecasts justify this fair value? Get inside the full narrative and uncover the numbers that change everything.

Result: Fair Value of $376.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Carpenter Technology’s dependence on aerospace demand and the risks tied to major expansion projects could challenge its upbeat outlook if industry dynamics shift.

Find out about the key risks to this Carpenter Technology narrative.

Another View: What Does the SWS DCF Model Say?

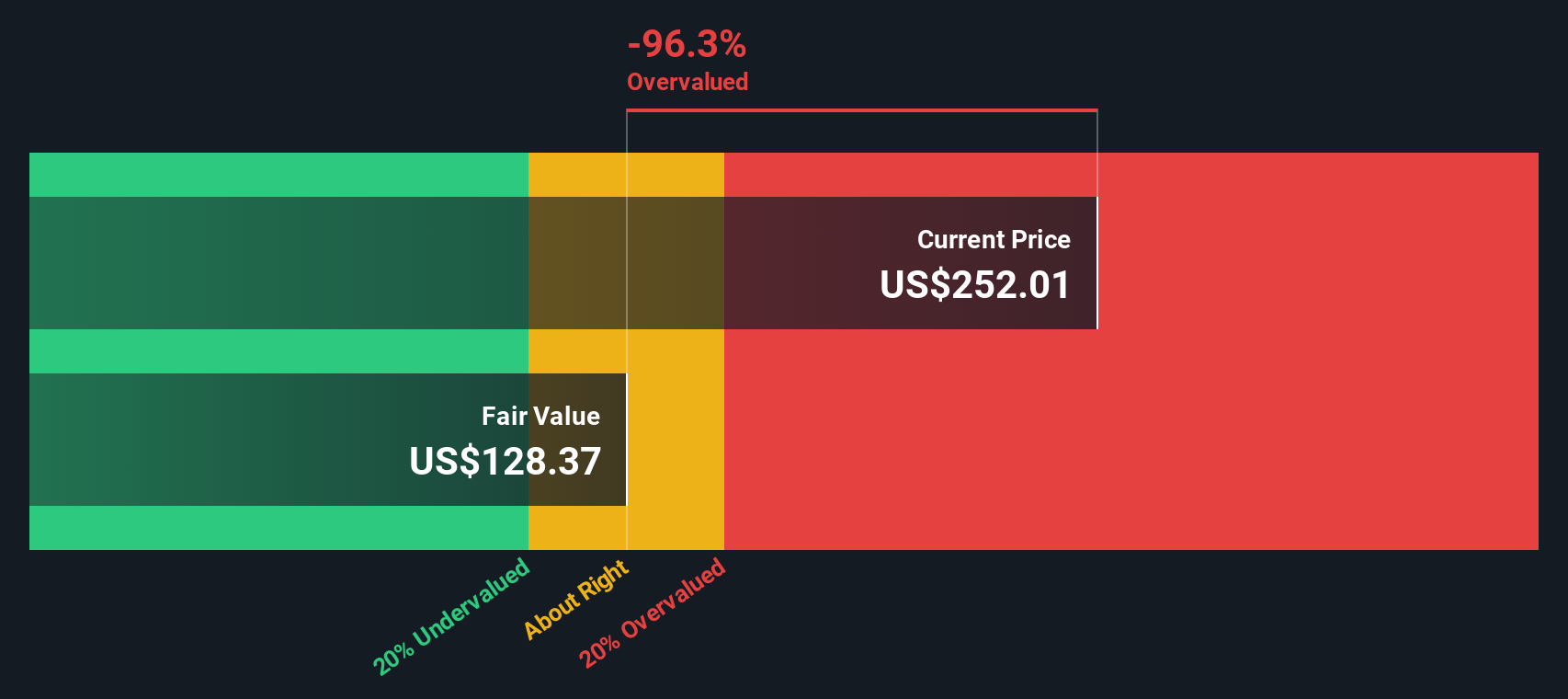

While analyst forecasts point to plenty of upside, our DCF model offers a completely different perspective. The SWS DCF calculation estimates Carpenter Technology’s fair value is just $135.38 per share, suggesting that at recent prices, the stock could be significantly overvalued. If this is the case, are investors overlooking potential red flags or betting on a future that surpasses even the most optimistic projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carpenter Technology Narrative

Not convinced by these conclusions or want to dive deeper into Carpenter Technology’s numbers on your own? You can craft your unique narrative in just a few minutes. Do it your way

A great starting point for your Carpenter Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Hungry for the next big opportunity? Take action now and broaden your horizons with unique stock ideas that could shape your portfolio's future success.

- Chase high yields and steady returns with these 14 dividend stocks with yields > 3%, featuring companies offering healthy dividend payouts and the potential for market-beating growth.

- Capitalize on the artificial intelligence boom and target innovators powering the future by investigating these 27 AI penny stocks.

- Catch tomorrow’s hidden gems trading below their true worth by hunting for value in these 882 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives