- United States

- /

- Machinery

- /

- NYSE:CR

Crane (CR): Revisiting Valuation Following Strategic PSI Acquisition and Future Growth Prospects

Reviewed by Kshitija Bhandaru

Crane (NYSE:CR) recently closed its acquisition of PSI, including Druck, Panametrics, and Reuter-Stokes, aiming to boost future revenues and margins. This strategic step positions the company in line with sector trends focused on automation and infrastructure upgrades.

See our latest analysis for Crane.

Crane’s share price has pulled back about 4% in the past month following steady gains year to date, yet its one-year total shareholder return sits at an impressive 10.8% and the company has delivered a remarkable 192% return over the past three years. With the PSI acquisition and a new $900 million credit facility to fund ongoing growth, momentum looks well supported for investors keeping an eye on automation and infrastructure themes.

If you’re looking for other promising names set to benefit from industry growth, consider broadening your search and discover fast growing stocks with high insider ownership

With healthy returns, a sizable acquisition, and a stock price still trading at a notable discount to analyst targets, the key question now is whether Crane is undervalued or if the market is already factoring in all future growth.

Most Popular Narrative: 17% Undervalued

Crane's last close of $175.03 is significantly below the narrative's fair value estimate of $211.88, suggesting considerable upside if future projections are realized. The narrative builds its case for strong value based on ambitious growth catalysts, outlining key factors that could drive the stock in the coming years.

Crane's recent acquisition of PSI (Druck, Panametrics, Reuter-Stokes) positions the company to capture rising demand for advanced sensing and fluid control in both aerospace and process industries. This move allows Crane to benefit directly from infrastructure modernization and increasing automation, supporting sustained revenue and potential future margin expansion. Accelerating global investment in nuclear energy, including plant restarts and new small modular reactor projects, is expected to enhance demand for Reuter-Stokes' radiation sensing technologies. This expands Crane's exposure to long-cycle, mission-critical infrastructure markets and may drive growth that outpaces the broader market over the long term.

Want to know what bold return assumptions make this growth story compelling? There is a surprising blend of ambitious earnings targets and aggressive margin expansion supporting this price target. Interested in how these projections compare to typical industry expectations? Explore the numbers and narrative behind this fair value conclusion.

Result: Fair Value of $211.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges with recent acquisitions and any downturn in key end markets could quickly undermine Crane's upbeat outlook and growth ambitions.

Find out about the key risks to this Crane narrative.

Another View: Multiples Tell a Different Story

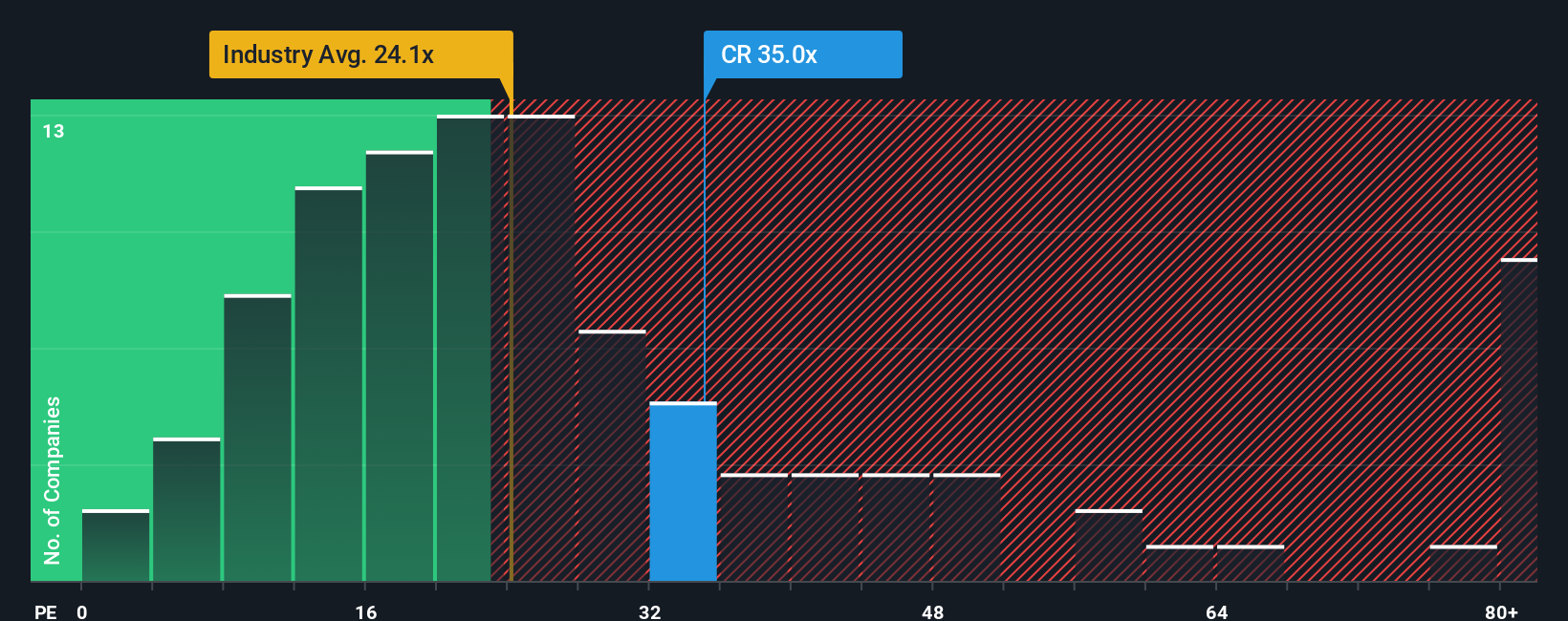

While analysts see double-digit upside, Crane trades at a price-to-earnings ratio of 33.4, which is much higher than both the US Machinery industry average of 23.4 and its peers at 20.6. Even compared to its fair ratio of 25.6, the premium is clear and raises the question: is the market already looking past future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crane Narrative

If you want to dive into the data and shape your perspective on Crane, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Crane research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Skip the FOMO and check out our expertly selected screeners, built to fast-track your search for outstanding stocks and innovative opportunities you might otherwise miss.

- Boost your potential payout when you review these 19 dividend stocks with yields > 3%, which reward investors with impressive yields above 3%.

- Spot tomorrow’s tech leaders by scanning these 24 AI penny stocks, which are shaping powerful advances in artificial intelligence and automation.

- Upgrade your watchlist with these 892 undervalued stocks based on cash flows, featuring companies trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CR

Crane

Manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives