- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Core & Main, Inc. Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

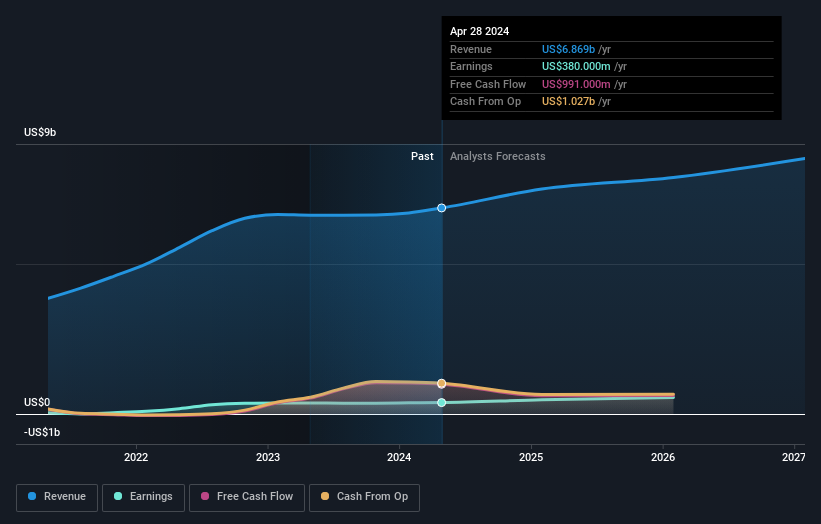

It's been a mediocre week for Core & Main, Inc. (NYSE:CNM) shareholders, with the stock dropping 18% to US$47.36 in the week since its latest quarterly results. It looks like the results were a bit of a negative overall. While revenues of US$1.7b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 7.8% to hit US$0.49 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Core & Main

Taking into account the latest results, the current consensus from Core & Main's eleven analysts is for revenues of US$7.50b in 2025. This would reflect a meaningful 9.2% increase on its revenue over the past 12 months. Per-share earnings are expected to swell 19% to US$2.34. In the lead-up to this report, the analysts had been modelling revenues of US$7.46b and earnings per share (EPS) of US$2.43 in 2025. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

The consensus price target held steady at US$58.75, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Core & Main, with the most bullish analyst valuing it at US$75.00 and the most bearish at US$38.00 per share. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that Core & Main's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 12% growth on an annualised basis. This is compared to a historical growth rate of 18% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 5.7% per year. So it's pretty clear that, while Core & Main's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Core & Main. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Core & Main analysts - going out to 2027, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Core & Main that you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives